- United States

- /

- Specialized REITs

- /

- NYSE:FCPT

Four Corners Property Trust (FCPT): Assessing Valuation After a Recent Share Price Slide and Weak Total Returns

Reviewed by Simply Wall St

Four Corners Property Trust (FCPT) has quietly drifted lower this year, even as its rental income and net income keep growing at a healthy clip. This sets up an interesting risk reward trade off for income focused investors.

See our latest analysis for Four Corners Property Trust.

That recent slide to a share price of $23.08, with a year to date share price return of negative 13.91 percent and a one year total shareholder return of negative 16.54 percent, suggests momentum has been fading even as the long term three and five year total shareholder returns hover just above flat.

If FCPT has you thinking about where else reliable cash flows and steady growth might show up, this could be a good moment to scan healthcare stocks for your next idea.

With rental and net income still rising and the share price now trading at a sizable discount to analyst targets, investors face a familiar dilemma: is FCPT now undervalued, or is the market already discounting future growth?

Most Popular Narrative: 19% Undervalued

With Four Corners Property Trust last closing at $23.08 against a narrative fair value of $28.50, the gap hinges on how durable its cash flows really are.

The company's focus on acquiring and expanding high quality, e commerce resistant retail and essential service properties (such as quick service restaurants, automotive services, and medical retail) positions FCPT's tenant base to benefit from long term growth in physical service retail, supporting future rental income and revenue stability.

Curious how steady expansion, rising margins and a richer future earnings multiple all fit together? The popular narrative connects these levers in a very specific way. Want to see which assumptions really power that target valuation and how a modest growth profile still supports a higher price? Dive in and decide if the story stacks up.

Result: Fair Value of $28.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, even this steady story could wobble if restaurant traffic weakens further or higher for longer inflation keeps pressuring margins and acquisition spreads.

Find out about the key risks to this Four Corners Property Trust narrative.

Another Take on Value

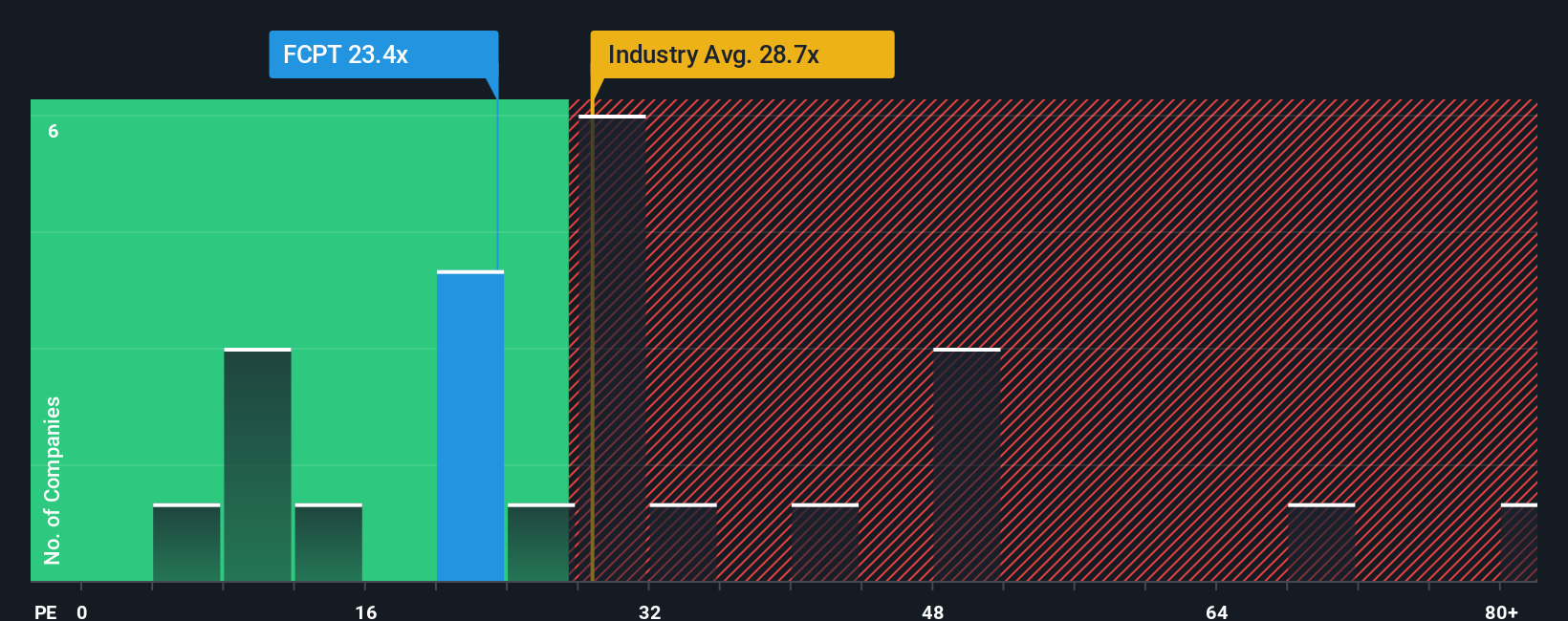

On earnings, FCPT trades at 22.4 times profits, cheaper than the US Specialized REITs average of 28.3 times but below a fair ratio of 33.3 times that our work suggests the market could move toward. If sentiment normalizes, is today’s discount mispricing or caution well placed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Four Corners Property Trust Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a fresh narrative in minutes: Do it your way.

A great starting point for your Four Corners Property Trust research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop at FCPT, you could miss stronger opportunities. Put Simply Wall St’s powerful screener to work and line up your next smart move today.

- Capture potential bargains by scanning these 907 undervalued stocks based on cash flows that the market may be mispricing based on their future cash flows and underlying fundamentals.

- Ride powerful innovation trends by targeting these 26 AI penny stocks that could reshape entire industries and fuel long term portfolio growth.

- Strengthen your income stream by reviewing these 15 dividend stocks with yields > 3% that combine attractive yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCPT

Four Corners Property Trust

FCPT is a real estate investment trust primarily engaged in the ownership, acquisition and leasing of restaurant and retail properties.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026