- United States

- /

- Specialized REITs

- /

- NYSE:EXR

Will Extra Space Storage’s (EXR) Expanded $4.5 Billion Credit Facility Drive Urban Growth Strategy?

Reviewed by Simply Wall St

- On August 21, 2025, Extra Space Storage Inc. announced that its board declared a third quarter dividend of US$1.62 per share, payable on September 30, 2025, to shareholders of record as of September 15, 2025, and entered into a fourth amended and restated credit agreement allowing for aggregate borrowings of up to US$4.5 billion.

- The expanded credit facility substantially enhances the company's financial flexibility, providing new capacity to pursue growth initiatives and adjust to changing market conditions.

- We’ll now assess how Extra Space Storage’s expanded US$4.5 billion credit facility may influence its ability to capitalize on urbanization trends.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Extra Space Storage Investment Narrative Recap

To own shares of Extra Space Storage, I believe you need confidence in the company’s ability to convert ongoing demand for urban storage into steady income―even as muted same-store revenue growth challenges near-term performance and competitive pressures persist. The recently expanded US$4.5 billion credit facility, while meaningfully improving financial flexibility, does not appear to fundamentally change the biggest immediate catalyst, unlocking higher occupancy and rental rate growth in key urban markets, or the most pressing risk, which remains margin pressure from rising property tax expenses and supply overhang in certain regions.

Among recent developments, the Q2 2025 earnings release stands out, with higher sales and net income year-over-year providing context for the board’s continued US$1.62 per share quarterly dividend. This consistency underlines management’s commitment to shareholder returns, yet also reflects a business environment where revenue growth remains modest and margin risks, especially from properties acquired through the Life Storage deal, are still very much alive.

In contrast, investors should not overlook the potential for persistently high property tax expense growth in legacy Life Storage properties to ...

Read the full narrative on Extra Space Storage (it's free!)

Extra Space Storage is projected to reach $3.2 billion in revenue and $1.1 billion in earnings by 2028. This outlook assumes an annual revenue decline of 1.5% and an earnings increase of about $125 million from the current $974.7 million.

Uncover how Extra Space Storage's forecasts yield a $157.80 fair value, a 10% upside to its current price.

Exploring Other Perspectives

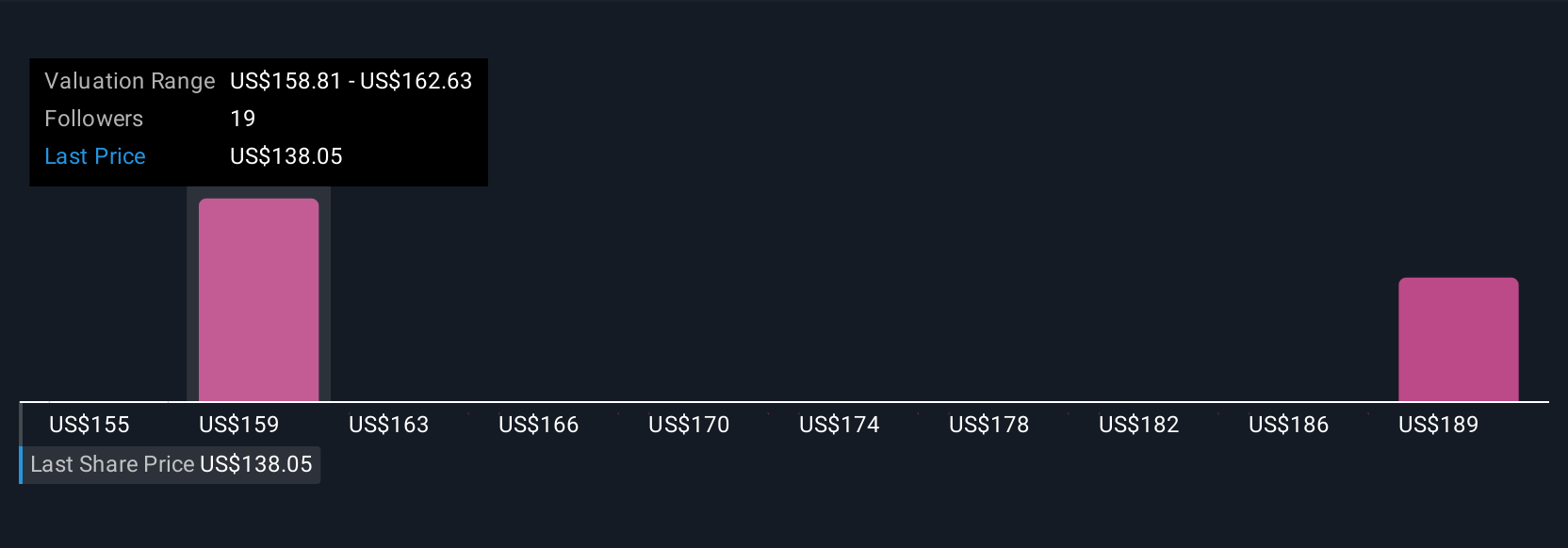

Three Simply Wall St Community members estimate Extra Space Storage’s fair value between US$155 and US$189.61 per share. While opinions range widely, muted revenue growth guidance may weigh on future expectations and invites readers to compare these viewpoints for themselves.

Explore 3 other fair value estimates on Extra Space Storage - why the stock might be worth as much as 32% more than the current price!

Build Your Own Extra Space Storage Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Extra Space Storage research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Extra Space Storage research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Extra Space Storage's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Extra Space Storage might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EXR

Extra Space Storage

Extra Space Storage Inc., headquartered in Salt Lake City, Utah, is a self-administered and self-managed REIT and a member of the S&P 500.

6 star dividend payer with solid track record.

Similar Companies

Market Insights

Community Narratives