- United States

- /

- REITS

- /

- NYSE:EPRT

Do Essential Properties Realty Trust's (NYSE:EPRT) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Essential Properties Realty Trust (NYSE:EPRT). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Essential Properties Realty Trust

Essential Properties Realty Trust's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Essential Properties Realty Trust managed to grow EPS by 16% per year, over three years. That's a good rate of growth, if it can be sustained.

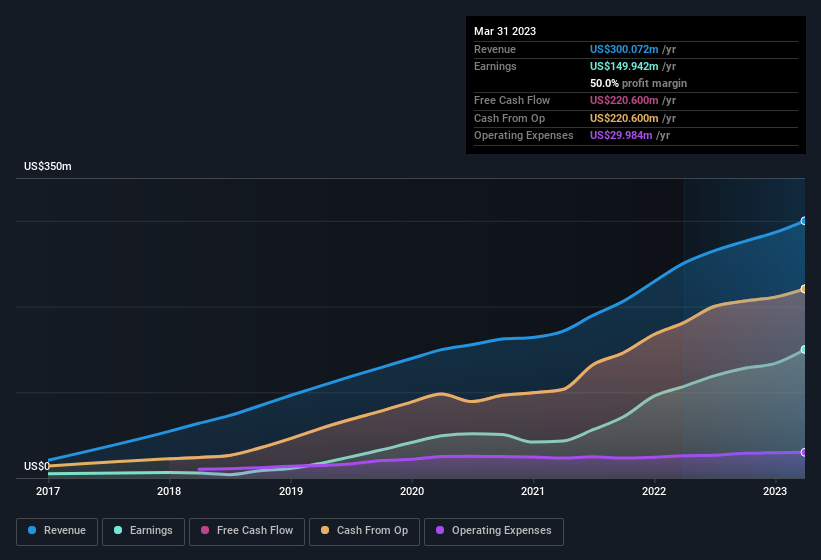

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It's noted that Essential Properties Realty Trust's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. While we note Essential Properties Realty Trust achieved similar EBIT margins to last year, revenue grew by a solid 20% to US$300m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Essential Properties Realty Trust's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Essential Properties Realty Trust Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Shareholders in Essential Properties Realty Trust will be more than happy to see insiders committing themselves to the company, spending US$434k on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to be brimming with joyful expectancy. It is also worth noting that it was President Peter Mavoides who made the biggest single purchase, worth US$414k, paying US$20.68 per share.

Along with the insider buying, another encouraging sign for Essential Properties Realty Trust is that insiders, as a group, have a considerable shareholding. Indeed, they hold US$20m worth of its stock. This considerable investment should help drive long-term value in the business. Despite being just 0.6% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add Essential Properties Realty Trust To Your Watchlist?

One positive for Essential Properties Realty Trust is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. That makes the company a prime candidate for your watchlist - and arguably a research priority. Still, you should learn about the 3 warning signs we've spotted with Essential Properties Realty Trust (including 1 which is a bit concerning).

The good news is that Essential Properties Realty Trust is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Essential Properties Realty Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:EPRT

Essential Properties Realty Trust

A real estate company, acquires, owns, and manages single-tenant properties in the United States.

Good value with acceptable track record.