- United States

- /

- Health Care REITs

- /

- NYSE:DOC

Is Healthpeak Properties Now a Value Opportunity After a Tough 2025 Share Price Slide?

Reviewed by Bailey Pemberton

- Wondering if Healthpeak Properties is starting to look like a bargain after a tough run, or if the market sees trouble that is not obvious yet? Let us walk through what the numbers are really saying about its value.

- The stock is trading around $16.36, with returns of about -0.8% over the last week, -5.7% over the last month, and a much steeper -18.8% year to date, which has clearly tested investors' patience.

- Recently, the stock has been in focus as investors reassess listed healthcare REITs in light of shifting demand for medical office, senior housing, and life science properties, as well as the impact of higher interest rates on funding costs. At the same time, portfolio updates and asset recycling across the sector have prompted some investors to reconsider whether current prices fairly reflect the long term cash flow potential of these properties.

- Despite the weak share price performance, Healthpeak scores a solid 6/6 on our valuation checks. This suggests it screens as undervalued across all of them. Next, we will unpack those different valuation approaches, and then finish by looking at a more complete way to think about what the stock might really be worth.

Find out why Healthpeak Properties's -16.7% return over the last year is lagging behind its peers.

Approach 1: Healthpeak Properties Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by extrapolating its future adjusted funds from operations and discounting those cash flows back to their present value in $.

For Healthpeak Properties, the latest twelve month free cash flow is about $1.23 Billion. Analysts provide detailed forecasts for the next few years, and beyond that Simply Wall St extrapolates growth, projecting free cash flow to remain around $1.2 Billion to $1.5 Billion over the coming decade. For example, projections for the 2026 to 2030 period range from roughly $1.14 Billion to $1.26 Billion, with similar gradual increases assumed thereafter.

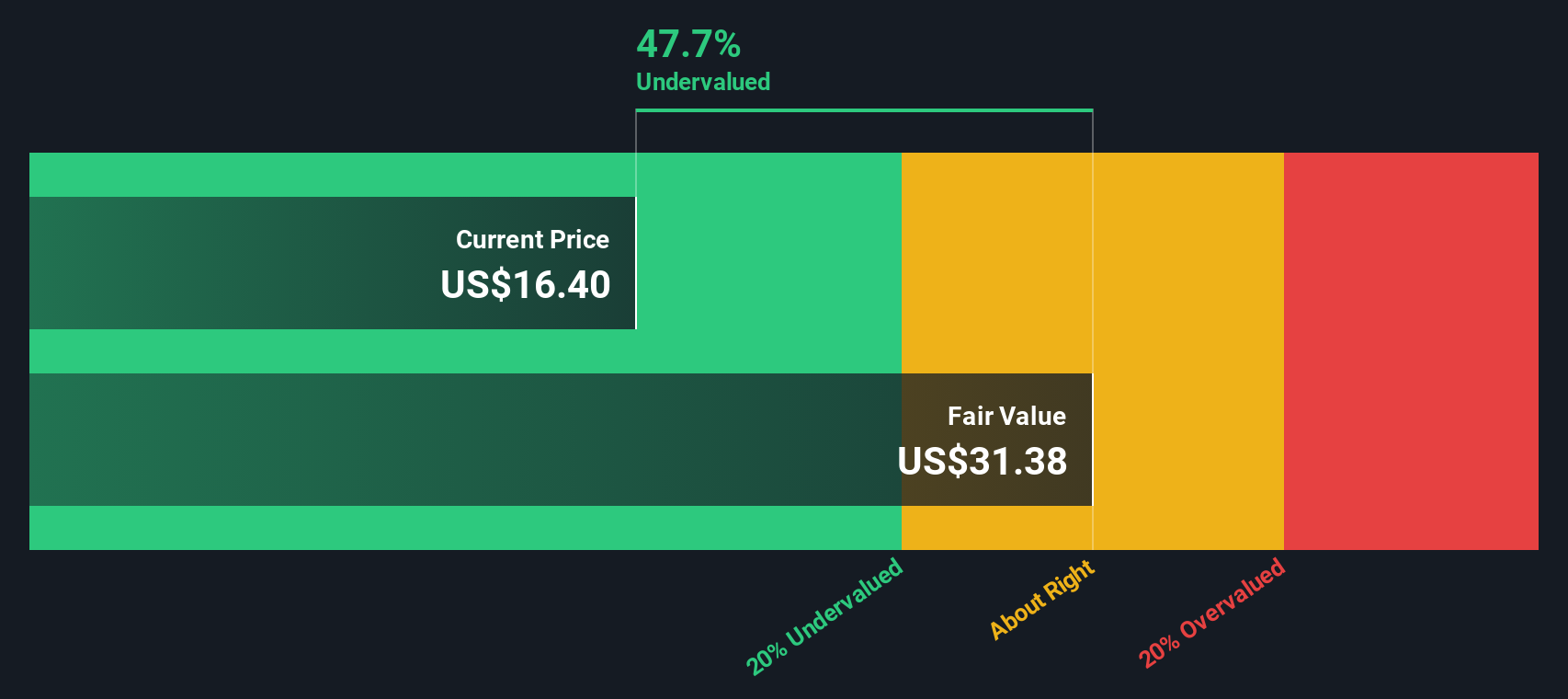

When all those future cash flows are discounted back, the model arrives at an intrinsic value of about $31.52 per share. Against a current share price near $16.36, the DCF indicates that Healthpeak is trading at roughly a 48.1% discount. This suggests a substantial margin of safety if the cash flow assumptions prove broadly correct.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Healthpeak Properties is undervalued by 48.1%. Track this in your watchlist or portfolio, or discover 915 more undervalued stocks based on cash flows.

Approach 2: Healthpeak Properties Price vs Sales

For real estate investment trusts and other asset heavy businesses, the price to sales ratio is often a useful cross check on value, because it looks at how much investors are paying for each dollar of revenue rather than focusing on volatile earnings.

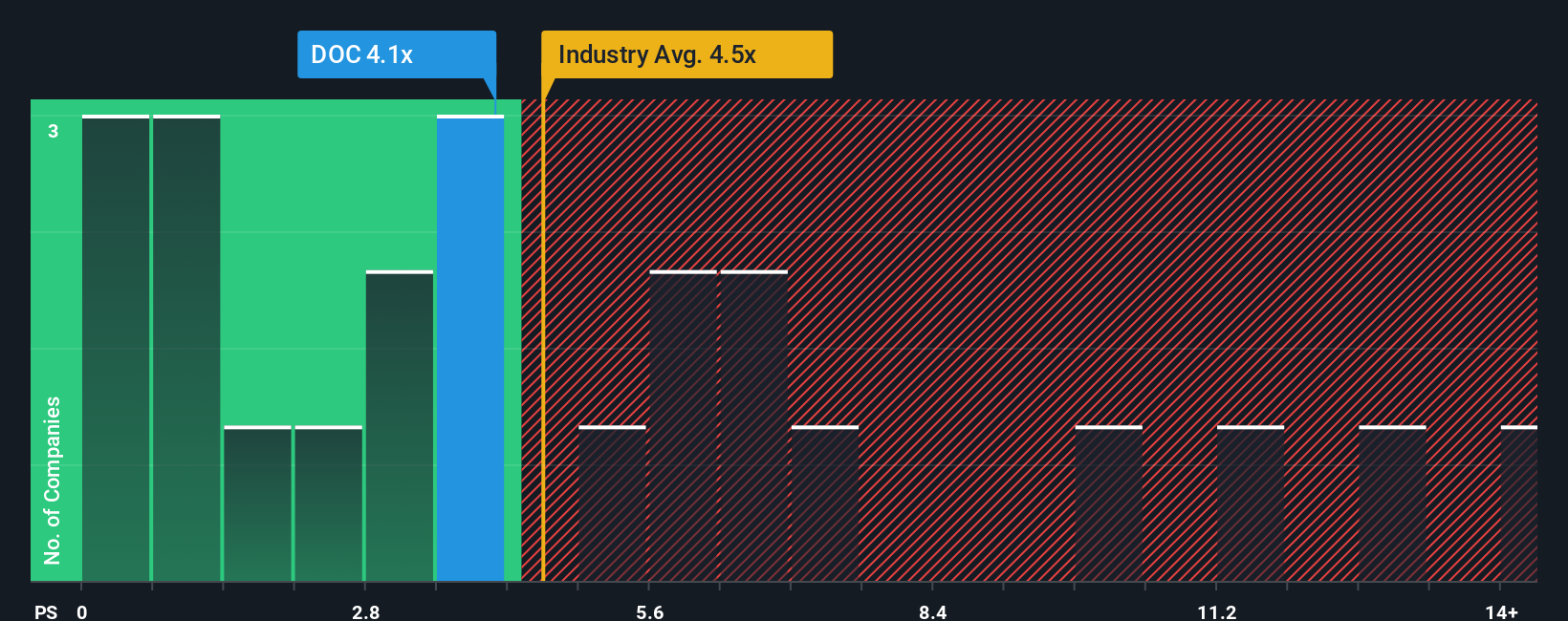

In general, companies with stronger growth prospects and lower perceived risk tend to justify a higher multiple, while slower growing or riskier names should trade on a lower one. Healthpeak currently trades on a price to sales ratio of about 4.06x, which is below both the Health Care REITs industry average of roughly 6.63x and the broader peer group average near 9.20x.

Simply Wall St’s Fair Ratio framework goes a step further by estimating what a reasonable multiple should be for Healthpeak specifically, given its growth outlook, profit margins, risk profile, industry and market cap. On that basis, Healthpeak’s Fair Ratio comes out at around 5.38x, which is meaningfully above the current 4.06x. That gap suggests the shares trade at a discount to what would be expected on fundamentals.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Healthpeak Properties Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Healthpeak Properties’ future with concrete numbers like expected revenue growth, margins, earnings and a fair value estimate, and then compare that fair value to today’s share price to decide whether you see it as a buy, hold or sell. A Narrative is your story about the company, translated into a financial forecast, and on Simply Wall St’s Community page, millions of investors use these Narratives as an accessible tool to build and share scenarios that are automatically updated when new information, such as earnings results or major news like share buybacks or index removals, comes in. For Healthpeak, one investor might build a more optimistic Narrative that leans on strong demographic tailwinds and improving margins to arrive at a fair value closer to the higher analyst target around $29, while another could focus on tenant and funding risks to justify a more cautious view nearer the low target of $18. The platform then lets you see how each story flows through to different valuations in real time.

Do you think there's more to the story for Healthpeak Properties? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Healthpeak Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOC

Healthpeak Properties

A Standard & Poor’s (“S&P”) 500 company that owns, operates, and develops high-quality real estate focused on healthcare discovery and delivery in the United States (“U.S.”).

Very undervalued average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)