- United States

- /

- Specialized REITs

- /

- NYSE:DLR

Evaluating Digital Realty (DLR) Valuation After Launch of Innovation Lab for AI and Hybrid Cloud Testing

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 55.8% Overvalued

According to the most widely followed narrative, Digital Realty Trust is considered significantly overvalued relative to its fair value estimate. The projected future growth, profitability, and sector dynamics are at the center of this valuation perspective.

AI workloads require more power-hungry data centers, which leads to higher leasing rates and increased revenue per MW. International expansion, portfolio optimization, as well as the adoption of edge computing and hybrid cloud models are seen as drivers of mid- and long-term growth.

Curious what justifies such a steep premium? The narrative is built on rapid changes in AI and hybrid cloud, expanding margins, and an aggressive growth outlook, but only those who dig deeper will see the quantitative forecasts that truly move the needle on this valuation. Are these bold assumptions realistic? You will have to explore the underlying drivers yourself.

Result: Fair Value of $110.45 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising interest rates and competitive pressures from hyperscalers could quickly challenge Digital Realty's bullish growth expectations. As a result, this narrative is far from guaranteed.

Find out about the key risks to this Digital Realty Trust narrative.Another View: SWS DCF Model Paints a Different Picture

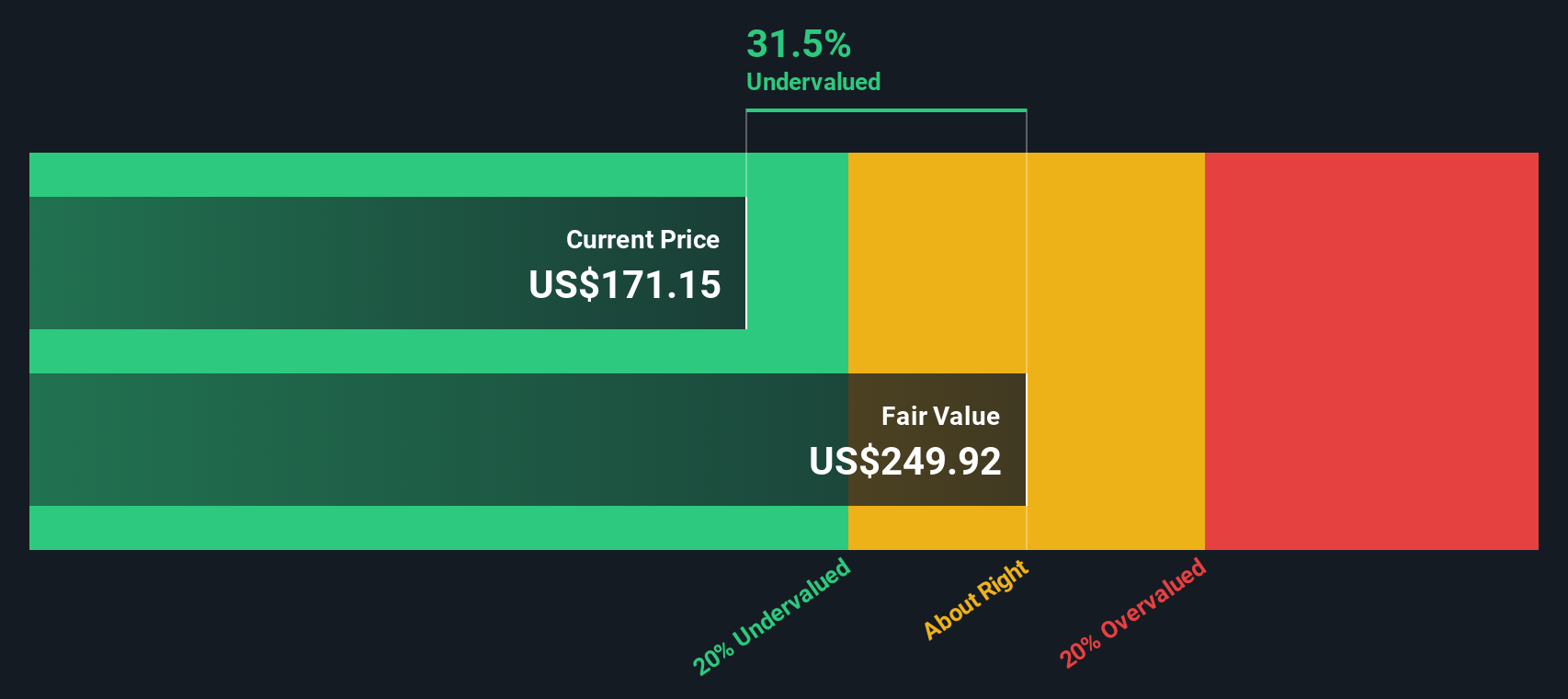

While the most popular view says the stock looks expensive, our SWS DCF model tells a different story. This approach actually suggests Digital Realty might be undervalued. It raises the question of whether the truth lies somewhere in between.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Digital Realty Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Digital Realty Trust Narrative

If you want to dive deeper or challenge the crowd, it is quick and easy to shape your own take in under three minutes. Do it your way

A great starting point for your Digital Realty Trust research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Opportunities?

Seize your chance to get ahead of the crowd: the Simply Wall Street Screener points you straight to stocks with winning potential you might otherwise miss.

- Kickstart your hunt for untapped market gems by tapping into penny stocks with strong financials. Uncover small companies with big ambitions and financial muscle.

- Ride the next tech wave as you target future-shaping disruptors with AI penny stocks. These feature AI powerhouses with strong growth potential.

- Lock in lasting income by selecting dividend stocks with yields > 3%. This highlights companies offering attractive yields above 3% to bolster your portfolio’s returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DLR

Digital Realty Trust

Digital Realty Trust, Inc. (“Digital Realty” or the “company”) owns, acquires, develops, and operates data centers through its operating partnership subsidiary, Digital Realty Trust, L.P.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives