- United States

- /

- Specialized REITs

- /

- NYSE:DLR

Digital Realty Trust (DLR): Assessing Valuation After New AI Partnership With Dell and DXC

Reviewed by Kshitija Bhandaru

Digital Realty Trust, a leading data center provider, has teamed up with Dell Technologies and DXC to offer tailored AI solutions for enterprises. This new collaboration brings together infrastructure, implementation know-how, and advanced AI technology.

See our latest analysis for Digital Realty Trust.

Digital Realty Trust’s share price has pulled back around 4% so far this year, despite upbeat news such as its collaboration with Dell and DXC, a raised full-year outlook, and ongoing expansions into new data center projects. However, the stock’s 1-year total shareholder return of nearly 8% and its significant 106% three-year total return both signal strong underlying momentum fueled by surging data center and AI demand.

If the latest AI-driven moves have you thinking bigger, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

But with shares lagging year to date and analyst targets pointing to upside, is Digital Realty Trust trading at a discount after recent pullbacks, or is the company’s future AI-driven growth already priced in?

Most Popular Narrative: 13.8% Undervalued

Digital Realty Trust's most widely followed valuation narrative pegs fair value at $195.44, a notable premium to the last close of $168.49. With analysts factoring in future growth and AI demand, the narrative sets the stage for ambitious financial expectations supported by robust leasing and expansion signals.

The successful formation of Digital Realty's first U.S. hyperscale fund is expected to fuel future growth with up to $10 billion in investments, leading to enhanced revenue and returns through fees. This highlights its significant potential impact on long-term earnings sustainability.

Curious how a company with recent earnings declines can still command a soaring price target? The narrative hinges on extraordinary assumptions, including future revenue, lofty profit projections, and a multiple that would catch any investor’s eye. Tap in to discover how these bold expectations stack up against Digital Realty’s real momentum.

Result: Fair Value of $195.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a supply glut in key U.S. markets or rising interest rates could quickly challenge Digital Realty’s ambitious outlook and put pressure on future profits.

Find out about the key risks to this Digital Realty Trust narrative.

Another View: Market Ratios Tell a Different Story

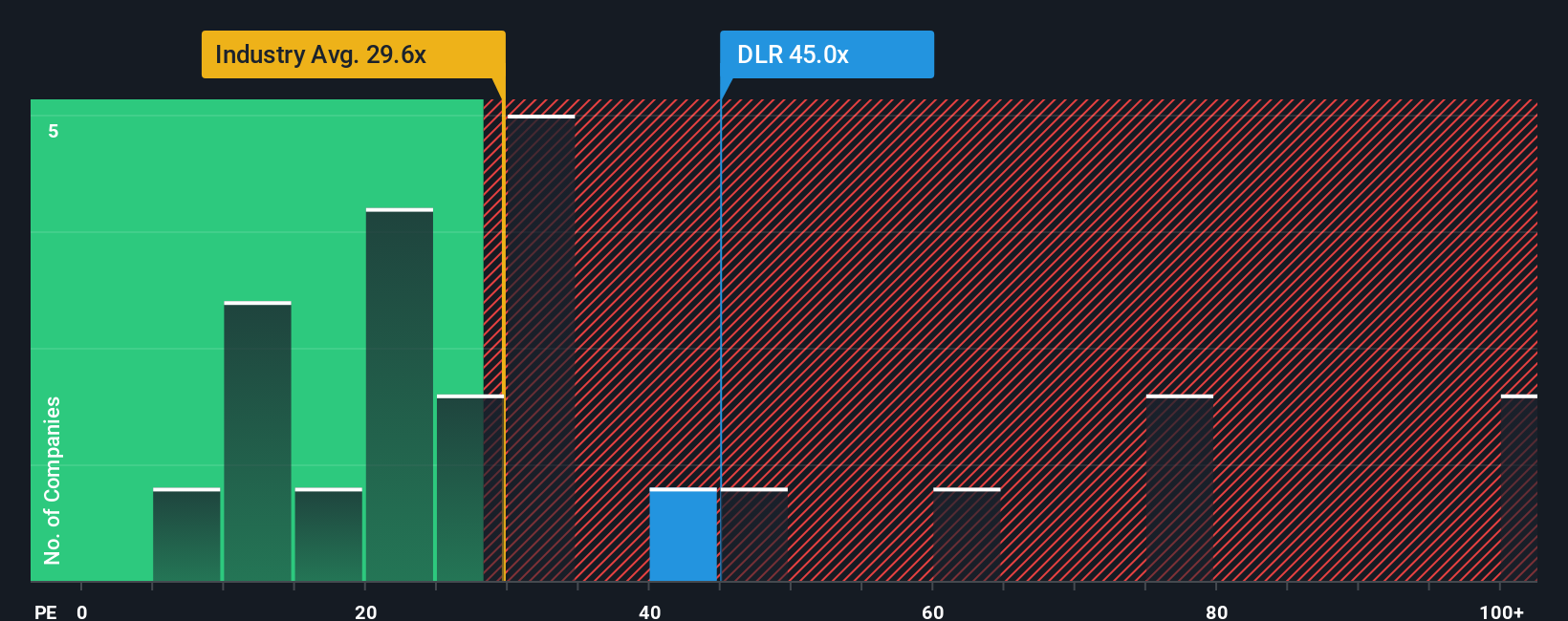

Looking at the company’s price-to-earnings ratio, Digital Realty Trust appears expensive compared to US Specialized REITs and its peers. The current multiple stands at 42.8x, well above the industry average of 28.4x and a peer average of 39.4x. The fair ratio is estimated at 30.4x, which suggests the market is building in high expectations for future growth. Could this premium be a sign of over-optimism, or is there more upside left?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Digital Realty Trust Narrative

If you have a different perspective or want to see the numbers for yourself, you can piece together your own view in just a few minutes, or Do it your way

A great starting point for your Digital Realty Trust research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why settle for just one opportunity? Take charge of your portfolio and get ahead of the crowd by finding stocks that match your goals and risk appetite.

- Tap into outsized growth potential by targeting these 3582 penny stocks with strong financials, which combine strong fundamentals with compelling market momentum.

- Accelerate your search for the next tech disruptor by scanning these 24 AI penny stocks, driving breakthroughs across industries with artificial intelligence.

- Boost your returns with consistent payouts by checking out these 19 dividend stocks with yields > 3%, offering attractive yields and steady income.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DLR

Digital Realty Trust

Digital Realty Trust, Inc. (“Digital Realty” or the “company”) owns, acquires, develops, and operates data centers through its operating partnership subsidiary, Digital Realty Trust, L.P.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives