- United States

- /

- Office REITs

- /

- NYSE:DEA

Most Shareholders Will Probably Find That The CEO Compensation For Easterly Government Properties, Inc. (NYSE:DEA) Is Reasonable

Under the guidance of CEO Bill Trimble, Easterly Government Properties, Inc. (NYSE:DEA) has performed reasonably well recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 18 May 2021. We present our case of why we think CEO compensation looks fair.

Check out our latest analysis for Easterly Government Properties

Comparing Easterly Government Properties, Inc.'s CEO Compensation With the industry

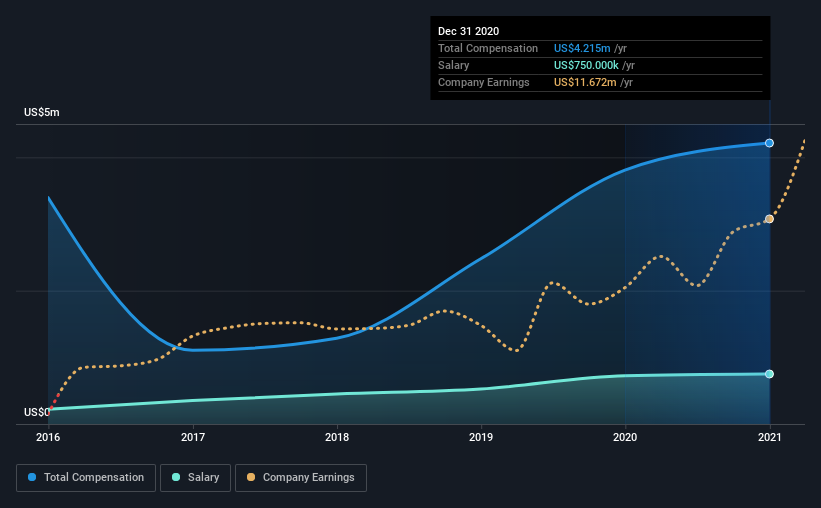

At the time of writing, our data shows that Easterly Government Properties, Inc. has a market capitalization of US$1.9b, and reported total annual CEO compensation of US$4.2m for the year to December 2020. We note that's an increase of 11% above last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$750k.

On comparing similar companies from the same industry with market caps ranging from US$1.0b to US$3.2b, we found that the median CEO total compensation was US$4.2m. This suggests that Easterly Government Properties remunerates its CEO largely in line with the industry average. Furthermore, Bill Trimble directly owns US$1.9m worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$750k | US$725k | 18% |

| Other | US$3.5m | US$3.1m | 82% |

| Total Compensation | US$4.2m | US$3.8m | 100% |

Talking in terms of the industry, salary represented approximately 15% of total compensation out of all the companies we analyzed, while other remuneration made up 85% of the pie. Easterly Government Properties is paying a higher share of its remuneration through a salary in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Easterly Government Properties, Inc.'s Growth

Easterly Government Properties, Inc. has seen its funds from operations (FFO) increase by 23% per year over the past three years. In the last year, its revenue is up 9.8%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Easterly Government Properties, Inc. Been A Good Investment?

Easterly Government Properties, Inc. has generated a total shareholder return of 18% over three years, so most shareholders would be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We did our research and identified 4 warning signs (and 1 which makes us a bit uncomfortable) in Easterly Government Properties we think you should know about.

Switching gears from Easterly Government Properties, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Easterly Government Properties, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Easterly Government Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:DEA

Easterly Government Properties

Easterly Government Properties, Inc. (NYSE: DEA) is based in Washington, D.C., and focuses primarily on the acquisition, development and management of Class A commercial properties that are leased to the U.S.

Established dividend payer and slightly overvalued.

Similar Companies

Market Insights

Community Narratives