- United States

- /

- Health Care REITs

- /

- NYSE:CTRE

CareTrust REIT (CTRE) valuation review as new Texas senior housing platform investment reshapes growth outlook

Reviewed by Simply Wall St

CareTrust REIT (CTRE) just made a strategic move, closing a $40 million acquisition of three Texas senior living communities as the first investment in its new senior housing operating portfolio platform.

See our latest analysis for CareTrust REIT.

The deal lands at a time when momentum in the name is clearly building, with an 8.0% 1 month share price return contributing to a strong 41.1% year to date share price gain and a 5 year total shareholder return of 130.3%.

If this kind of steady compounding in healthcare real estate appeals, it could be worth scanning healthcare stocks to see what other operators are quietly building long term track records.

Yet with the shares hovering just below analyst targets but still trading at an estimated 35% discount to intrinsic value, investors face a key question: Is CTRE still attractively valued at this level, or is future growth already reflected in the current price?

Most Popular Narrative: 5.3% Undervalued

With CareTrust REIT closing at $37.43 against a narrative fair value near $39.55, the valuation story hinges on ambitious growth, margins and a premium multiple.

The expanded investment pipeline of approximately $600 million mainly in skilled nursing, seniors housing, and U.K. care homes gives strong visibility into continued external growth, bolstering FFO and supporting durable, long term dividend increases.

Curious how that pipeline, rising profitability, and a slightly richer future earnings multiple all mesh together into one target price? The full narrative opens the playbook.

Result: Fair Value of $39.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid portfolio expansion and rising regulatory risk across skilled nursing and U.K. care homes could derail growth assumptions and pressure long-term returns.

Find out about the key risks to this CareTrust REIT narrative.

Another Angle on Valuation

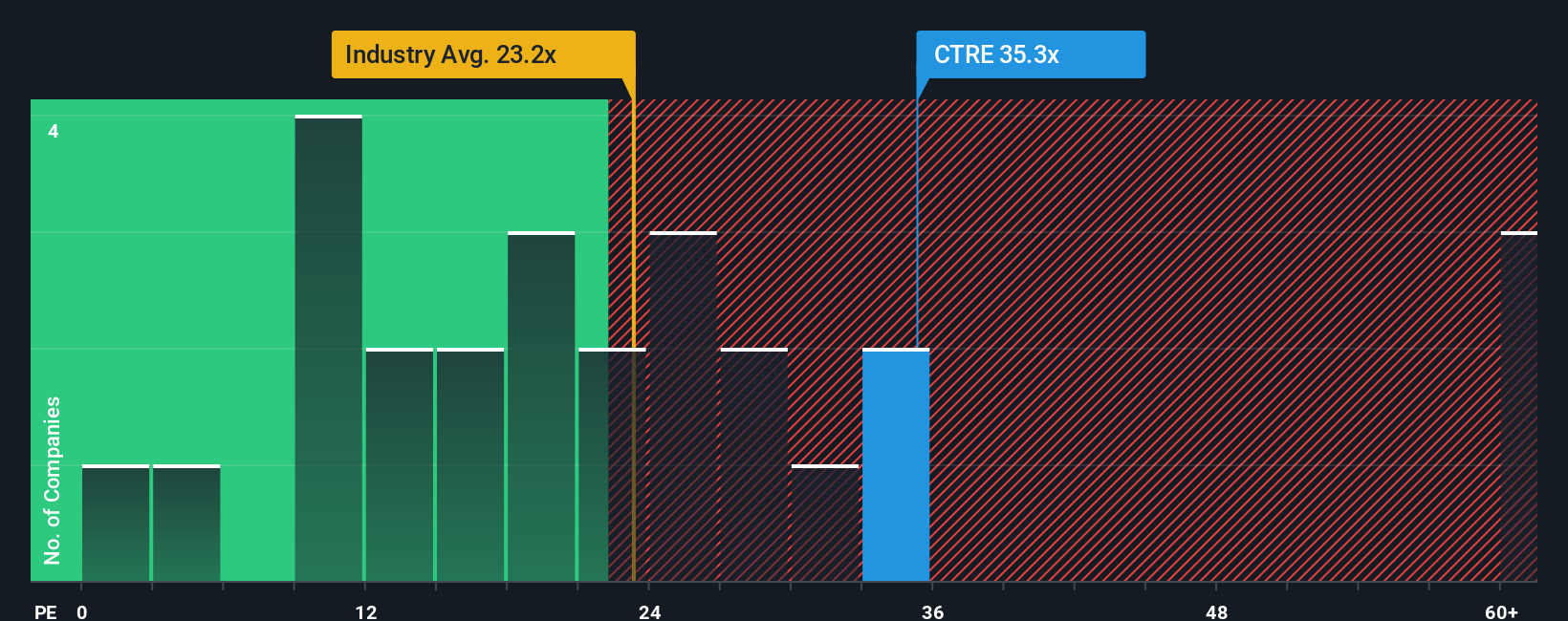

On earnings, the picture looks very different. CTRE trades at about 32.1 times earnings, richer than the global Health Care REIT average of 25.9 times and yet below a fair ratio of 36.4 times. This suggests investors are paying up but not to extremes. Is that premium really justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CareTrust REIT Narrative

And if you see the numbers differently or prefer to dig into the details yourself, you can build a custom view in under three minutes: Do it your way.

A great starting point for your CareTrust REIT research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investing opportunities?

Do not stop your research with one REIT. Use the Simply Wall St screener to uncover fresh, data driven ideas that others are still overlooking.

- Capture potential market mispricings early by scanning these 925 undervalued stocks based on cash flows built around discounted cash flows and fundamentals, not hype.

- Position yourself ahead of the next tech wave by reviewing these 24 AI penny stocks targeting businesses harnessing artificial intelligence for real revenue growth.

- Lock in income that works while you sleep with these 14 dividend stocks with yields > 3% focused on yields above 3 percent plus financial strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTRE

CareTrust REIT

CareTrust REIT is a self-administered, publicly-traded real estate investment trust engaged in the ownership, acquisition, development and leasing of skilled nursing, senior housing and other healthcare-related properties located in the United States and the United Kingdom.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026