- United States

- /

- Insurance

- /

- NYSE:HMN

Exploring 3 Undervalued Small Caps With Notable Insider Buying

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of volatility with the S&P 500 and Nasdaq experiencing declines, small-cap stocks present intriguing opportunities amidst broader economic uncertainties. In such a dynamic environment, identifying promising small-cap companies can be challenging but rewarding, especially when insider buying suggests confidence in the company's future prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Angel Oak Mortgage REIT | 6.2x | 4.0x | 33.92% | ★★★★★★ |

| Peoples Bancorp | 10.0x | 1.9x | 45.74% | ★★★★★☆ |

| Industrial Logistics Properties Trust | NA | 0.9x | 20.19% | ★★★★★☆ |

| Citizens & Northern | 11.2x | 2.8x | 43.40% | ★★★★☆☆ |

| Southside Bancshares | 10.6x | 3.5x | 37.76% | ★★★★☆☆ |

| S&T Bancorp | 10.9x | 3.7x | 40.35% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.8x | 26.88% | ★★★★☆☆ |

| GEN Restaurant Group | NA | 0.1x | -614.34% | ★★★★☆☆ |

| Shore Bancshares | 9.9x | 2.6x | -73.80% | ★★★☆☆☆ |

| Citizens Community Bancorp | 12.5x | 2.7x | 20.75% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

Helen of Troy (HELE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Helen of Troy is a consumer products company specializing in home, outdoor, beauty, and wellness segments with a market cap of approximately $2.54 billion.

Operations: The company generates revenue primarily from its Home & Outdoor and Beauty & Wellness segments, with the latter contributing $976.62 million. Over recent periods, the gross profit margin has shown an upward trend, reaching 48.08% in May 2024. Operating expenses are significant, with sales and marketing being a notable component at $345.5 million as of February 2025.

PE: -1.7x

Helen of Troy, a company recently added to the Russell 2000 Dynamic Index, has faced challenges with a volatile share price and reliance on external borrowing. Despite reporting a net loss of US$450.72 million for Q1 2025 compared to a previous net income, insider confidence is evident with no insider buying activity reported recently. The appointment of Scott Uzzell as CEO could bring fresh leadership insights from his experience at Nike and Coca-Cola, potentially steering future growth strategies amidst current financial hurdles.

- Delve into the full analysis valuation report here for a deeper understanding of Helen of Troy.

Assess Helen of Troy's past performance with our detailed historical performance reports.

Centerspace (CSR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Centerspace operates as a real estate investment trust focusing on the ownership, management, and development of multifamily apartment communities, with a market capitalization of approximately $1.06 billion.

Operations: The primary revenue stream is derived from the multifamily segment, contributing $263.50 million. The company's cost of goods sold (COGS) and operating expenses significantly impact its financial performance, with recent figures showing COGS at $112.55 million and operating expenses at $129.88 million as of June 2025. Notably, the gross profit margin has shown some fluctuations over time, reaching 57.86% in June 2025 after peaking at 58.31% in September 2024.

PE: -32.1x

Centerspace, a smaller company in the U.S., recently reported increased sales of US$68.55 million for Q2 2025, though it faced a net loss of US$14.36 million. Despite this, the company raised its earnings guidance for 2025 to a potential net profit per share between $2.50 and $2.76, signaling optimism about future performance. Insider confidence is evident with recent buyback announcements up to US$100 million and strategic acquisitions expanding their Mountain West presence, particularly in Salt Lake City and Fort Collins.

- Get an in-depth perspective on Centerspace's performance by reading our valuation report here.

Gain insights into Centerspace's past trends and performance with our Past report.

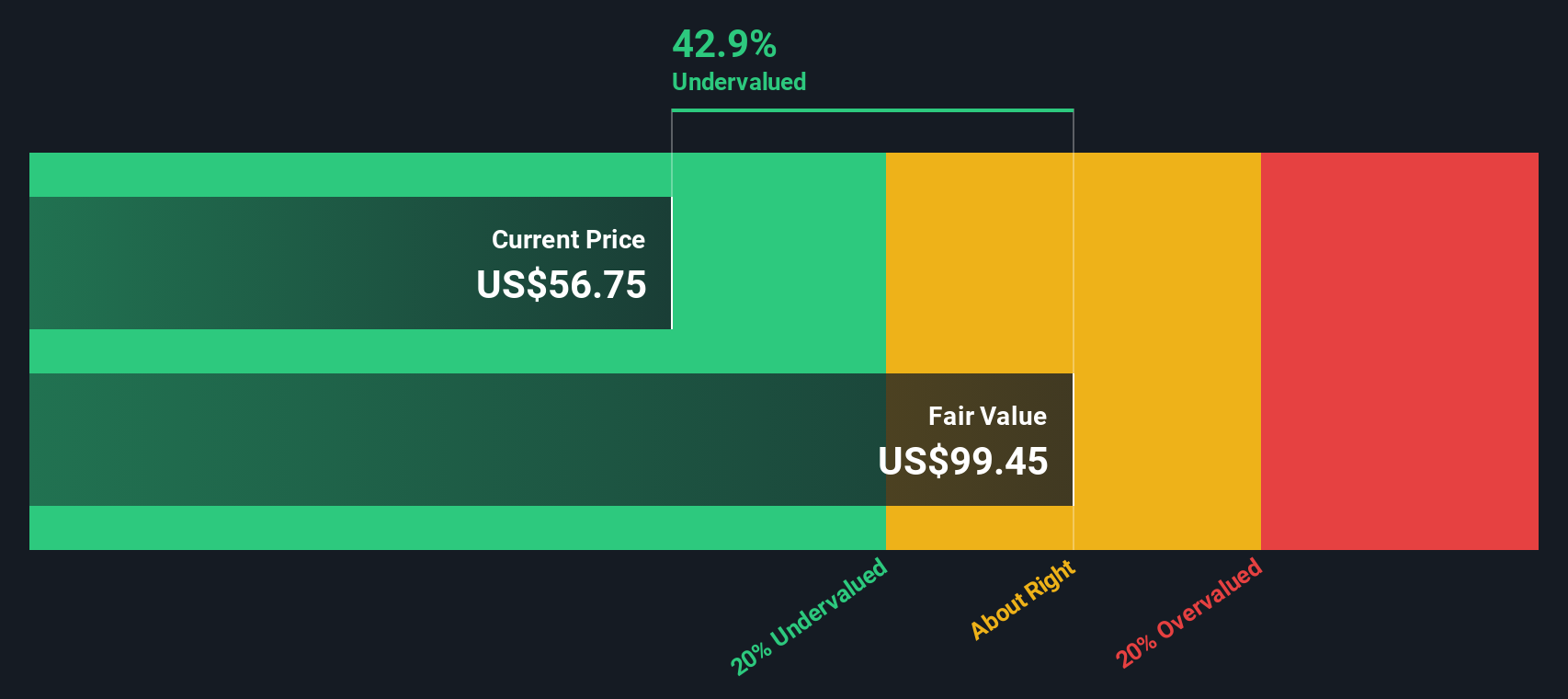

Horace Mann Educators (HMN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Horace Mann Educators is an insurance holding company that provides a range of financial solutions, including life and retirement products, property and casualty insurance, and supplemental group benefits, with a market cap of approximately $1.46 billion.

Operations: The company generates revenue primarily from its Property & Casualty and Life & Retirement segments, with significant contributions from Supplemental & Group Benefits. Over recent periods, the gross profit margin has shown variability, reaching 35.76% in mid-2025 after experiencing fluctuations in earlier years. Operating expenses have consistently impacted profitability, with general and administrative expenses being a major component of these costs.

PE: 13.1x

Horace Mann Educators, a smaller player in the insurance sector, recently reported a significant increase in net income for Q2 2025 to US$29.4 million from US$3.8 million the previous year, with earnings per share rising to US$0.71 from US$0.09. The company raised its full-year EPS guidance to between US$4.15 and US$4.45, indicating strong future prospects despite recent executive changes and reliance on external borrowing for funding without customer deposits as a safety net.

Make It Happen

- Unlock more gems! Our Undervalued US Small Caps With Insider Buying screener has unearthed 80 more companies for you to explore.Click here to unveil our expertly curated list of 83 Undervalued US Small Caps With Insider Buying.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Horace Mann Educators might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HMN

Horace Mann Educators

Operates as an insurance holding company in the United States.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion