- United States

- /

- Specialized REITs

- /

- NYSE:CCI

How Crown Castle’s Fiber Exit and Tower Focus Will Impact CCI Investors

Reviewed by Sasha Jovanovic

- RBC Capital recently upgraded Crown Castle, as the company announced plans to divest its fiber business and operate exclusively as a tower operator following the completion of the transaction expected in 2026.

- This move marks a significant shift in Crown Castle’s business model, signaling renewed focus on core tower operations and a potential transformation for its future operating structure.

- We’ll examine how the planned divestiture of the fiber segment could reshape Crown Castle’s investment narrative and long-term growth outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Crown Castle Investment Narrative Recap

To be a Crown Castle shareholder at this moment, you need confidence in the company's renewed focus on its core tower operations and the broader U.S. wireless infrastructure market. The recently announced plan to divest the fiber business could impact investor sentiment in the short term, but the biggest catalyst, unlocking value and profitability through a tower-only model, remains, while the key risk is the execution and regulatory approval process, which is material and could introduce significant uncertainty before the transaction closes.

Among recent company developments, the appointment of Christian H. Hillabrant as CEO stands out for its relevance. Bringing decades of telecommunications experience, this leadership change aligns with the pivot to a pure-play tower operator, which is now the center of attention as Crown Castle seeks to stabilize performance and address investor concerns about the transition’s complexity.

By contrast, investors should be aware of the added risks if regulatory delays or unexpected challenges...

Read the full narrative on Crown Castle (it's free!)

Crown Castle's narrative projects $4.6 billion in revenue and $1.6 billion in earnings by 2028. This outlook assumes a 10.7% annual revenue decline and a $5.5 billion increase in earnings from current levels of -$3.9 billion.

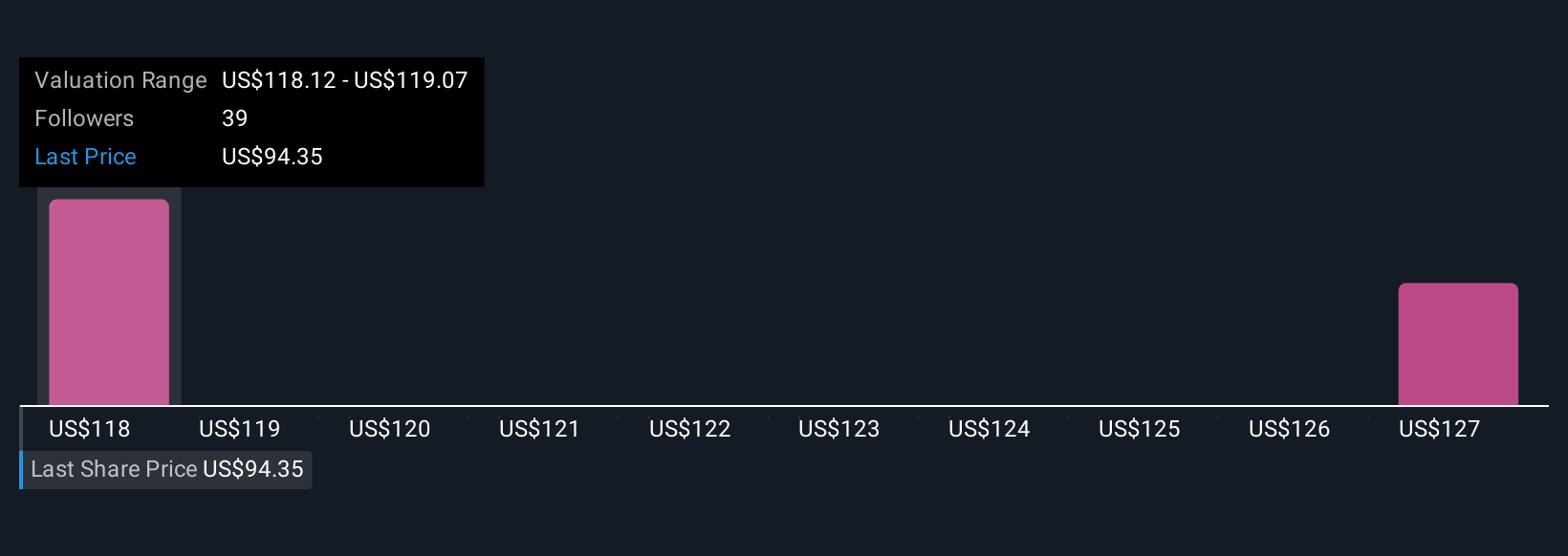

Uncover how Crown Castle's forecasts yield a $118.12 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have shared two fair value estimates for Crown Castle, ranging from US$118.12 to US$127.17 per share. As many weigh the opportunity in a refocused tower business, execution risks tied to the fiber divestiture could influence future outcomes, highlighting why these views can differ widely.

Explore 2 other fair value estimates on Crown Castle - why the stock might be worth as much as 34% more than the current price!

Build Your Own Crown Castle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crown Castle research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Crown Castle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crown Castle's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCI

Crown Castle

Crown Castle owns, operates and leases approximately 40,000 cell towers and approximately 90,000 route miles of fiber supporting small cells and fiber solutions across every major U.S.

Very undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives