- United States

- /

- Office REITs

- /

- NYSE:BXP

BXP (NYSE:BXP) Sees Strong Market Performance and Dividend Amid Strategic Execution and Challenges

Reviewed by Simply Wall St

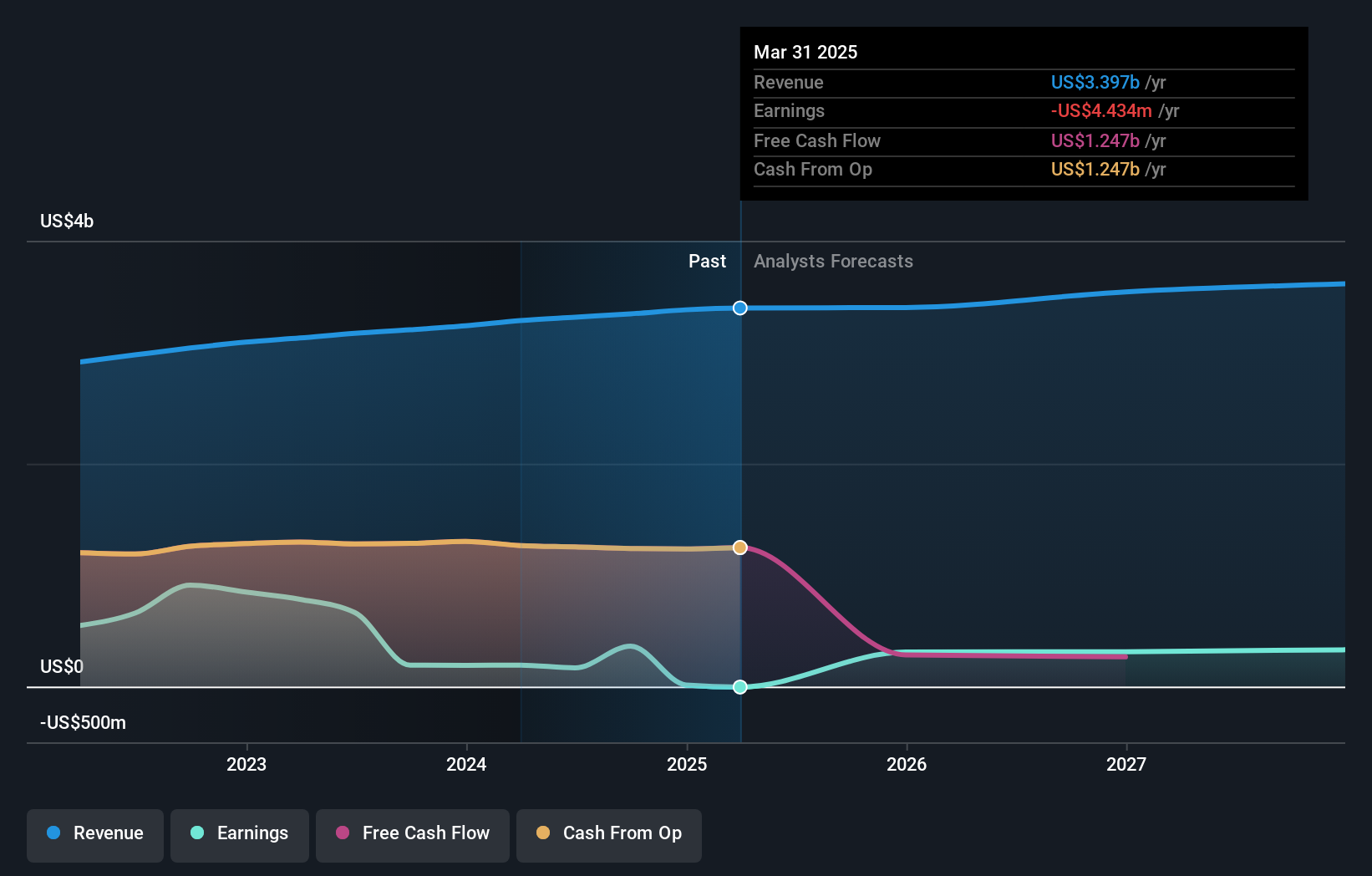

The BXP (NYSE:BXP) is navigating a complex environment marked by both opportunities and challenges. Recent highlights include surpassing FFO per share expectations and being recognized for sustainability efforts, contrasted with declining earnings and occupancy issues. In the discussion that follows, we will explore BXP's unique capabilities, critical performance issues, areas for expansion, and external threats, providing a comprehensive overview of the company's current business situation.

Take a closer look at BXP's potential here.

Unique Capabilities Enhancing BXP's Market Position

BXP has demonstrated resilience and strategic execution in the commercial office industry, as highlighted by Owen Thomas, Chairman and CEO, who noted the company's strong market performance in the second quarter. The company achieved a higher-than-expected FFO per share, surpassing both its forecast and market consensus. BXP's sustainability efforts have also been recognized, with Time Magazine ranking it as the most sustainable property owner in the U.S. Additionally, BXP's strong occupancy rates, with CBD assets 90.4% occupied and 92.2% leased, underscore its market strength. Despite its high Price-To-Earnings Ratio (75.1x) compared to peers and the industry average, BXP is trading at 21.4% below its estimated fair value of $101.37, indicating potential undervaluation.

Critical Issues Affecting BXP's Performance and Areas for Growth

Several challenges are impacting BXP's performance. The company faces occupancy issues, with large known expirations and vacated non-revenue-producing spaces. Market conditions for the broad office asset class remain challenging, as noted by Owen Thomas. Additionally, the life science lab demand in Greater Boston is lackluster, affecting potential new requirements or relocations. BXP's earnings have been declining, with a 74.8% drop in the past year and a 13.6% annual decline over the past five years. The company's high Price-To-Earnings Ratio compared to peers and the industry average further underscores its financial challenges.

Areas for Expansion and Innovation for BXP

BXP has several opportunities to enhance its market position. The company is executing a significant development pipeline with 10 office, lab, retail, and residential projects underway. BXP is also pursuing acquisition opportunities, although these have been limited in the premier workplace segment. Increased office attendance, as indicated by turnstile data, suggests a moderate but steady return of workers to the office. Additionally, BXP aims to establish joint ventures for its pipeline projects, potentially enhancing its market reach and operational capabilities.

External Factors Threatening BXP

Several external factors pose risks to BXP's growth and market share. Economic factors, such as interest rates and corporate earnings growth, continue to impact the company's performance. Competitive pressures remain high, with clients opting for premier properties managed by financially sound property management teams. Regulatory issues, particularly state and local elections, also have a significant impact on BXP's day-to-day operations. Additionally, the limited transaction activity for premier workplaces poses a risk to BXP's market position and growth prospects.

Conclusion

BXP's strong market performance, as evidenced by its higher-than-expected FFO per share and high occupancy rates, highlights its resilience and strategic execution in the commercial office industry. However, the company faces significant challenges, including declining earnings and occupancy issues, which are compounded by broader market conditions and lackluster demand in key sectors. Despite these hurdles, BXP's development pipeline and potential joint ventures offer avenues for growth and innovation. The company is trading 21.4% below its estimated fair value of $101.37, suggesting potential for future appreciation, yet its high Price-To-Earnings Ratio indicates it is currently perceived as expensive compared to peers. This dichotomy underscores the need for BXP to address its operational challenges while leveraging its strategic initiatives to enhance long-term performance.

Summing It All Up

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if BXP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:BXP

BXP

BXP, Inc. (NYSE: BXP) is the largest publicly traded developer, owner, and manager of premier workplaces in the United States, concentrated in six dynamic gateway markets - Boston, Los Angeles, New York, San Francisco, Seattle, and Washington, DC.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives