- United States

- /

- Retail REITs

- /

- NYSE:BRX

Can Brixmor’s Stable Cash Flow Support Its Value After a 4.6% Monthly Dip in 2025?

Reviewed by Bailey Pemberton

If you own shares of Brixmor Property Group or are thinking about adding it to your watchlist, you might be feeling a bit uncertain about the next move. The stock has seen some mild turbulence recently, slipping 2.0% in the past week and down 4.6% over the last month. Year-to-date, it’s off by 2.3%, but zoom out and the picture looks much more optimistic. The stock has gained 2.9% over the past year and 66.6% over three years. Looking back even further, the five-year return sits at a robust 173.3%. These results are a reminder that, for patient investors, long-term trends may matter more than short-term dips.

Some of these price swings can be traced back to market-wide shifts in how investors perceive the risks and growth prospects for shopping center real estate, especially as consumer and retail trends keep evolving. Even with the latest market jitters, Brixmor is catching the attention of value-focused analysts. In fact, based on a set of six standard valuation checks, Brixmor earns a value score of 5, meaning it's been identified as undervalued in five out of six key areas. That is not something you see every day, and it raises an interesting question: Are investors missing something here, or is the market identifying risks that have not surfaced yet?

We will examine the different valuation methods that produced this score, so you can see what is driving Brixmor’s perceived edge. At the end, I’ll share what might be an even more insightful way to think about its true value.

Why Brixmor Property Group is lagging behind its peers

Approach 1: Brixmor Property Group Discounted Cash Flow (DCF) Analysis

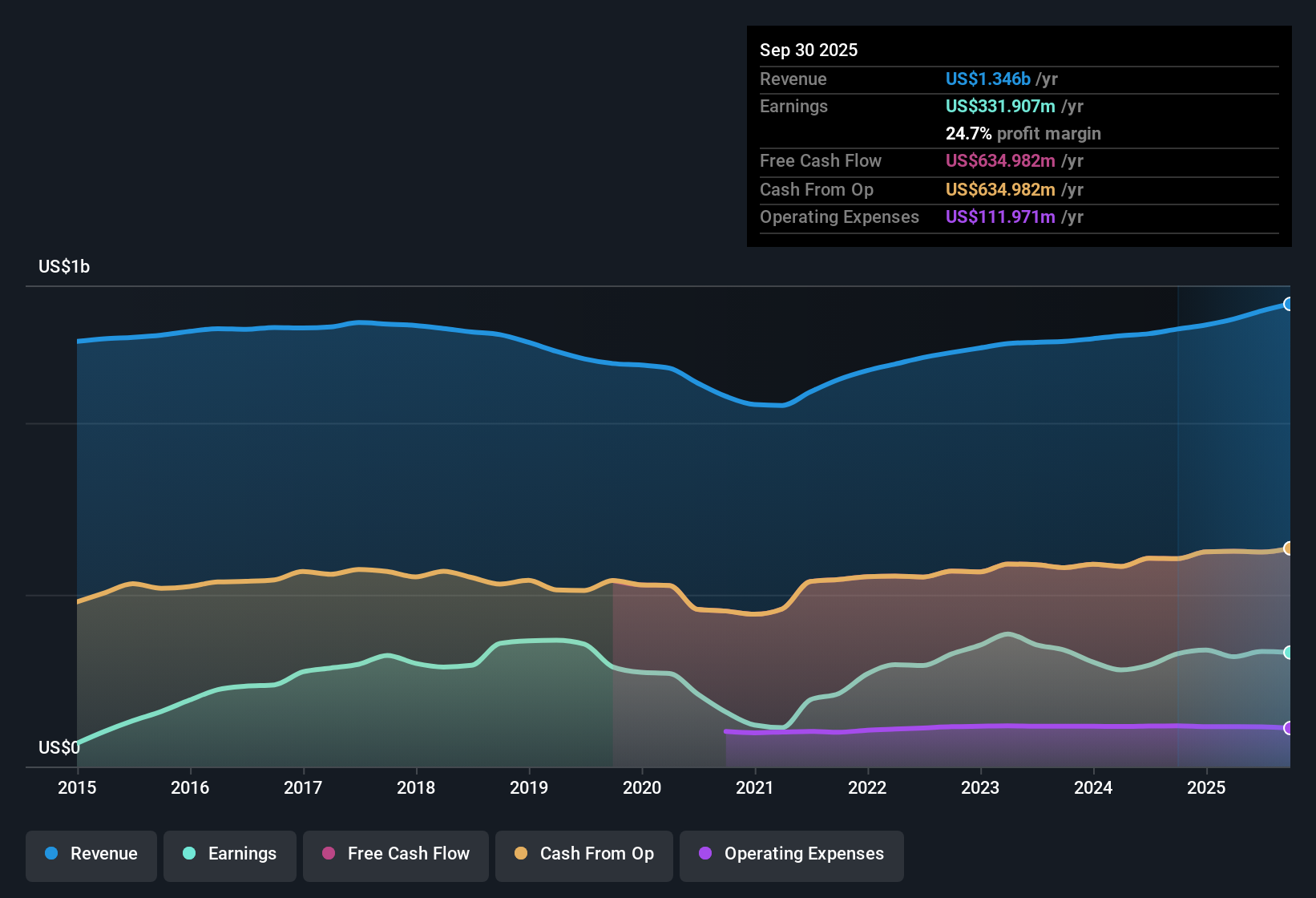

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future adjusted funds from operations, then discounting those cash flows back to today in order to estimate what the stock should be worth now. For Brixmor Property Group, this method focuses on its ability to generate consistent cash returns over time. This is a practical approach given the company’s stable, recurring rental income from shopping centers.

Brixmor’s latest reported Free Cash Flow stands at $647.9 million. Over the next few years, analysts forecast modest annual growth, reaching an estimated $608.1 million by the end of 2029. Projections beyond this period are extrapolated to maintain a realistic long-term trajectory. All figures are presented in US dollars, and, since the annual values are well under $1 billion, they are in millions.

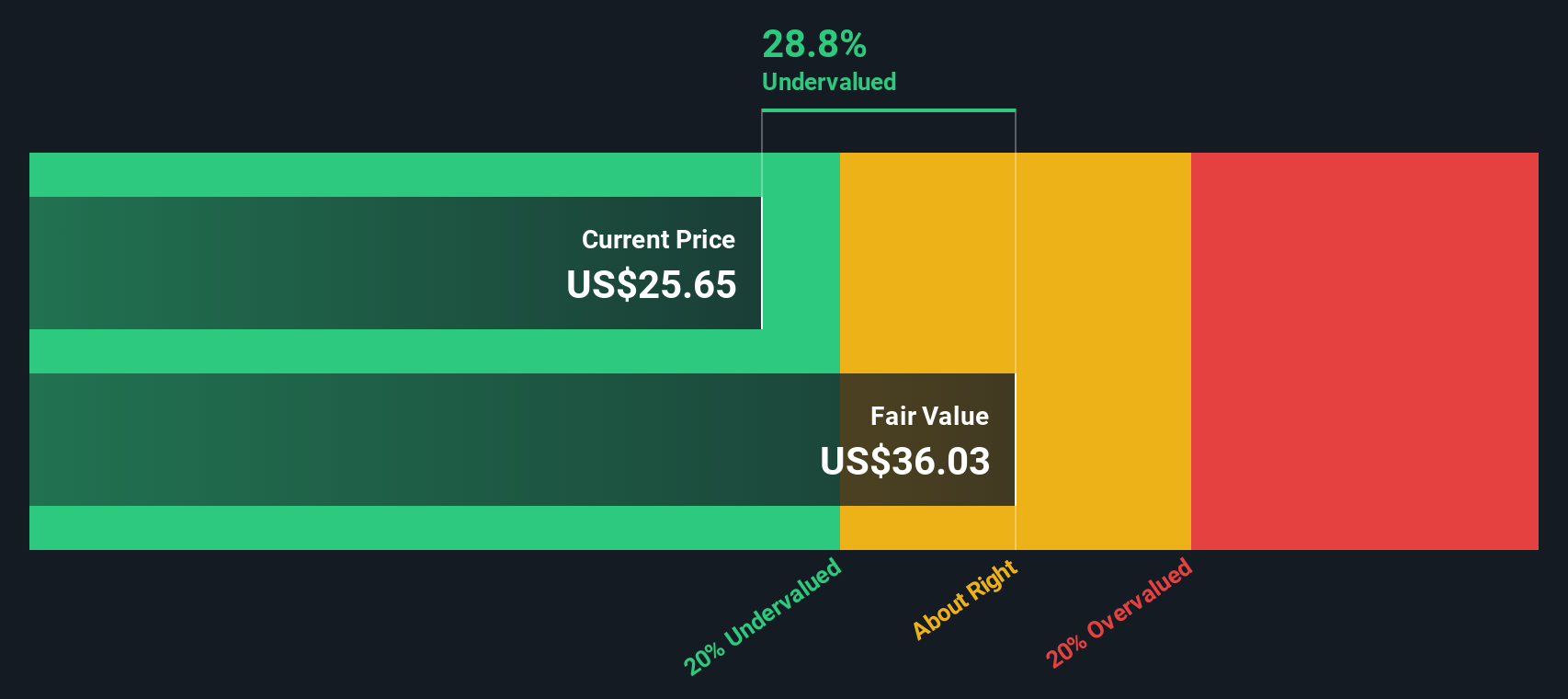

After discounting these projected future cash flows to reflect their value in today’s dollars, the DCF model arrives at an intrinsic value of $34.97 per share. This is approximately 23.1% above the current market price, which may indicate the stock is notably undervalued based on its fundamental earning power and growth prospects.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Brixmor Property Group is undervalued by 23.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Brixmor Property Group Price vs Earnings

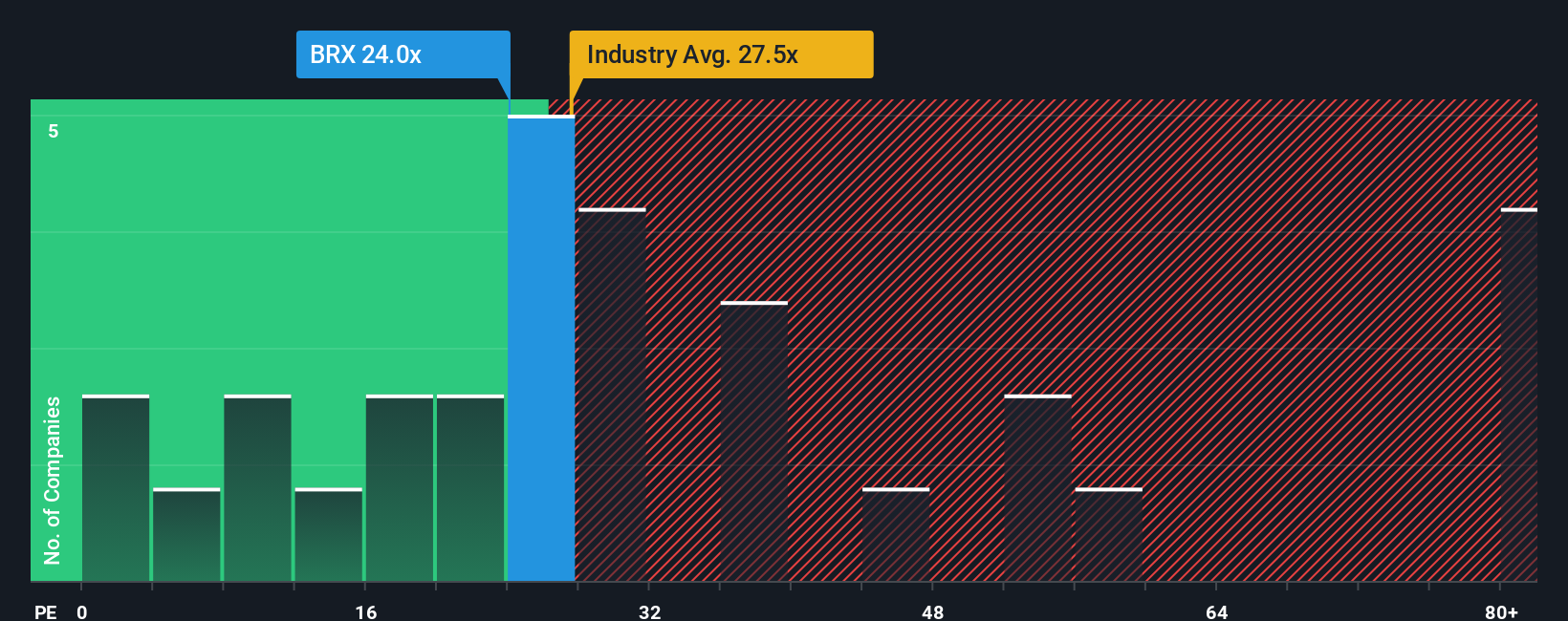

The Price-to-Earnings (PE) ratio is often favored as a valuation metric for profitable companies because it reflects how much investors are willing to pay for each dollar of earnings. More stable and profitable firms, like Brixmor Property Group, tend to be analyzed with PE because earnings visibility is relatively high and supports reliable comparison across the sector.

Growth expectations and perceived risk both weigh heavily on what a “normal” or “fair” PE ratio should be. High-growth, lower-risk companies will often command a premium, while slower growth or heightened risk warrants a discount. In Brixmor’s case, the current PE ratio stands at 24.6x, which is just below the retail REIT industry average of 26.0x and under the peer group average of 29.5x. This suggests that, on the surface, the stock looks attractively priced compared to its immediate competition.

However, it is important to look beyond simple benchmarks. This is where Simply Wall St’s proprietary “Fair Ratio” helps, aiming to calculate what a reasonable PE should be for Brixmor based on more than just industry averages or peer activity. The Fair Ratio of 31.1x takes into account growth prospects, risk profile, profit margins, its place within the industry, and market cap. This makes it a more comprehensive yardstick. By weighing the actual PE of 24.6x against this Fair Ratio, we see that Brixmor appears noticeably undervalued on this basis as well.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Brixmor Property Group Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, yet powerful tool that lets investors craft their own story for a company by bringing together personal expectations about Brixmor's growth, earnings, and margins, and connecting those assumptions directly to a Fair Value calculation.

Unlike traditional methods that rely only on snapshots or static benchmarks, Narratives weave together what you believe about a company's future and reflect how new developments might change its prospects or risks. On Simply Wall St's Community page, millions of investors are already using Narratives to create and compare forecasts, making it easy to see how different viewpoints stack up as new earnings or news emerges.

This means you can update your Narrative as events unfold, and immediately see whether the current share price offers value compared to your personalized Fair Value, helping you decide if it's time to buy, sell, or wait.

For example, on Brixmor Property Group, one Narrative projects aggressive rent growth and sees fair value above $35, while another cautious perspective sees sluggish margins and sets fair value near $26. This gives you a clear, real-time sense of where your expectations fit within the wider investment community.

Do you think there's more to the story for Brixmor Property Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Brixmor Property Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRX

Brixmor Property Group

Brixmor (NYSE: BRX) is a real estate investment trust (REIT) that owns and operates a high-quality, national portfolio of open-air shopping centers.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)