- United States

- /

- Retail REITs

- /

- NYSE:BFS

Assessing Saul Centers (BFS) Valuation as Recent Short-Term Momentum Shifts

Reviewed by Simply Wall St

Saul Centers (BFS) has experienced shifts in its stock price over the past month, with returns hovering in positive territory. Investors are watching how recent movements might influence the company’s approach in the current real estate market environment.

See our latest analysis for Saul Centers.

Sitting at $30.3, Saul Centers’ share price has seen a modest 2.3% climb over the past month, trimming some of its steeper declines earlier in the year. Still, the 1-year total shareholder return stands at -20.1%, which highlights that recent short-term momentum is only just beginning to shift after a challenging stretch.

If you’re on the lookout for new investment ideas, this could be the right time to broaden your search and discover fast growing stocks with high insider ownership

The question for investors now is whether Saul Centers' current valuation is a sign that the stock is trading below its true worth, or if the recent gains already account for its future growth prospects.

Price-to-Earnings of 26.5x: Is it justified?

Saul Centers’ latest price of $30.3 reflects a price-to-earnings (P/E) ratio of 26.5x, a level that appears undervalued compared to both industry peers and fair value estimates.

The price-to-earnings ratio is a widely used measure for gauging how much investors are paying for each dollar of company earnings. For real estate investment trusts like Saul Centers, it serves as a signal of investor confidence in future income streams and underlying property values.

Right now, Saul Centers is trading at a P/E ratio below industry averages and the computed fair P/E. This suggests investors could be underestimating its revenue stability and potential earnings rebound. If broader market sentiment shifts or the company’s fundamentals improve, there may be room for its valuation multiple to move closer to sector norms or the projected fair level.

Compared to the US Retail REITs industry average of 26.9x and a fair price-to-earnings ratio of 36.3x, Saul Centers stands out as attractively valued. The market could adjust toward this higher fair ratio should financial results improve further.

Explore the SWS fair ratio for Saul Centers

Result: Price-to-Earnings of 26.5x (UNDERVALUED)

However, slow annual revenue growth and recent negative shareholder returns could signal that Saul Centers’ recovery momentum remains fragile for now.

Find out about the key risks to this Saul Centers narrative.

Another View: Discounted Cash Flow Perspective

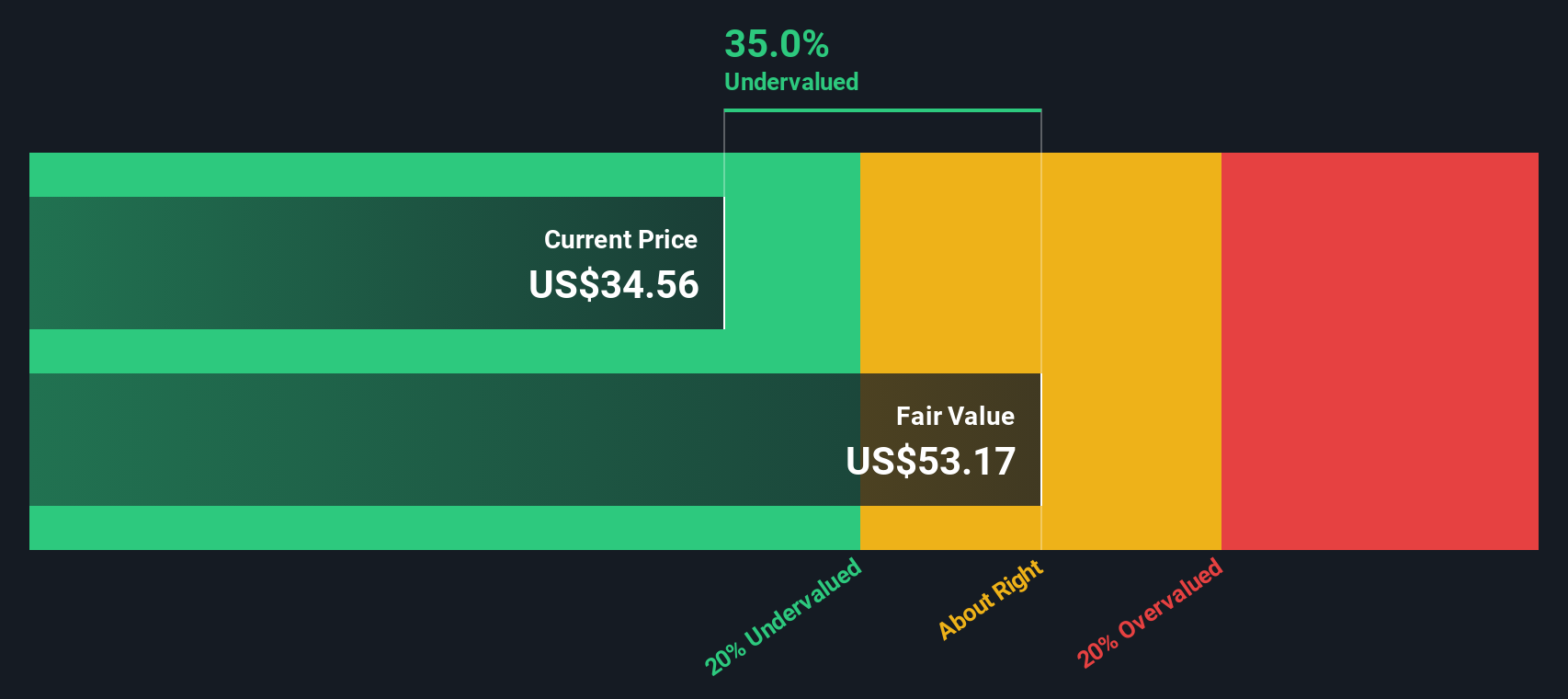

Looking at Saul Centers from the perspective of our DCF model provides a different interpretation. The SWS DCF analysis estimates fair value at $47.59, which suggests the stock may be trading 36.3% below its intrinsic value. This raises the question of whether the market might be overlooking a potential recovery, or if there is simply a degree of caution at play.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Saul Centers for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 930 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Saul Centers Narrative

If you would rather dig into the numbers yourself or think there's a different story to be told, you can build your own perspective in just a few minutes. Do it your way

A great starting point for your Saul Centers research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize the opportunity to expand your portfolio. Simply Wall St’s screens uncover game-changing stocks you could easily miss if you only follow the headlines.

- Access real income potential by targeting these 14 dividend stocks with yields > 3% offering yields above 3% that can strengthen your long-term returns.

- Capitalize on emerging healthcare breakthroughs. Find innovation leaders through these 30 healthcare AI stocks identified for their AI-driven edge in medicine and diagnostics.

- Catch undervalued gems before they surge by reviewing these 930 undervalued stocks based on cash flows selected specifically for solid fundamentals and attractive prices based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BFS

Saul Centers

A self-managed, self-administered equity REIT headquartered in Bethesda, Maryland, which currently operates and manages a real estate portfolio of 62 properties, which includes (a) 50 community and neighborhood shopping centers and eight mixed-use properties with approximately 10.2 million square feet of leasable area and (b) four non-operating land and development properties.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026