- United States

- /

- Specialized REITs

- /

- NYSE:AMT

American Tower (NYSE:AMT) Confirms Deloitte & Declares US$1.70 Dividend

Reviewed by Simply Wall St

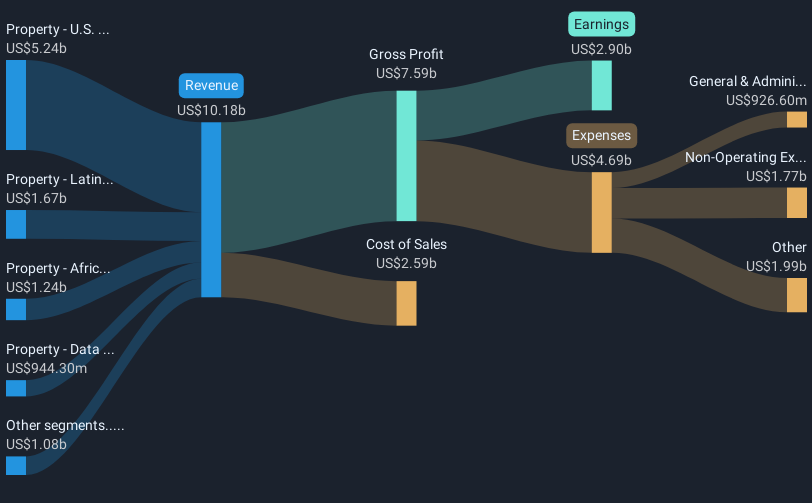

American Tower (NYSE:AMT) recently made headlines with its decision to approve Deloitte & Touche LLP as its independent auditor, while consistently maintaining shareholder value through dividends, recently reaffirmed at $1.70 per share. Over the last quarter, the company's stock achieved an 11.8% rise, aligning with a broader upward market movement, especially given the S&P 500's substantial gains. Additionally, positive earnings presentations, including solid quarterly revenue, demonstrated resilience that would have complemented the broader market rally. The ratified corporate guidance further underscored American Tower's confident outlook amidst an overall positive trading environment.

We've identified 2 weaknesses for American Tower (1 is significant) that you should be aware of.

American Tower's recent decision to appoint Deloitte & Touche LLP as its independent auditor could enhance its transparency, potentially affecting investor confidence and corporate governance. The reaffirmation of a US$1.70 per share dividend signals the company's commitment to maintaining shareholder value, aligning with expectations noted in analyst revenue and earnings forecasts. The S&P 500's broader upward movement in recent months has been mirrored by American Tower's 11.8% quarterly stock rise, highlighting its strong correlation with market dynamics.

Over the past year, the company's total shareholder return, including share price appreciation and dividends, was 12.18%. This performance is particularly significant when compared to the broader US market's 11.2% return and substantially outpaces the 5.2% gain in the US Specialized REITs industry. The company's strong showing against these benchmarks underscores its competitive positioning within its sector.

With respect to future revenue and earnings, the enhanced 5G infrastructure rollout plans and expansion into data centers are anticipated to boost core leasing activity, potentially driving an increase in property revenue and adjusted EBITDA for American Tower. However, refining these forecasts with consideration to macroeconomic variables, such as interest rate fluctuations and market volatility, remains crucial. These elements could challenge the predicted financial outlook.

Currently trading at US$223.81, the company's share price reveals an 8.9% discrepancy from the analyst consensus price target of US$245.75. This close alignment suggests that market participants view American Tower as fairly valued, but with room for moderate potential growth. Investors may find the company's valuation attractive given its alignment with industry trends and strong internal financial strategies.

Click to explore a detailed breakdown of our findings in American Tower's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade American Tower, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMT

American Tower

American Tower, one of the largest global REITs, is a leading independent owner, operator and developer of multitenant communications real estate with a portfolio of over 149,000 communications sites and a highly interconnected footprint of U.S.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives