- United States

- /

- Specialized REITs

- /

- NYSE:AMT

American Tower (NYSE:AMT) Announces Quarterly Dividend Increase To US$1.70 Per Share

Reviewed by Simply Wall St

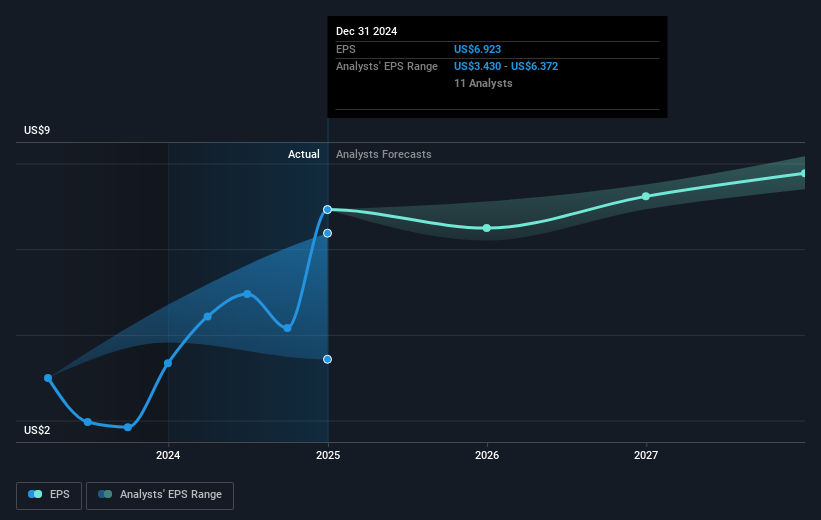

American Tower (NYSE:AMT) experienced a notable price move of 12% over the past month, a period marked by significant corporate events and broader market turmoil. On March 6, the company declared a quarterly cash distribution of $1.70 per share, reflecting its solid dividend strategy, which may have bolstered investor confidence. Earlier, American Tower reported strong Q4 earnings with sharp increases in net income and revenue, which likely supported investor sentiment. Additionally, the company announced its intent to pursue acquisition opportunities, signaling strategic growth plans. These positive developments occurred amidst a challenging market landscape, with major indexes experiencing declines due to economic concerns and ongoing tariff impacts. While the Dow Jones and S&P 500 were on track for their worst weekly losses in two years, AMT's robust financial performance and strategic announcements may have provided relative resilience and optimism, explaining the impressive stock performance compared to broader market trends.

See the full analysis report here for a deeper understanding of American Tower.

American Tower's shares achieved a total return of 8.30% over the last five years. Despite a steady dividend strategy, its performance trailed the broader market in the past year, reflecting underlying challenges. Notably, the company's earnings growth accelerated significantly last year, with profits rising much faster than the industry average. The stock's market valuation remains attractive, trading at 33.7% below its estimated fair value of US$312.34, supported by a robust price-to-earnings ratio compared to peers.

Corporate developments have also been significant, including the January 2025 appointment of a new director experienced in IT and finance, which may bolster governance and strategic direction. However, ongoing debt restructuring efforts, like the January 28 extension of credit facility maturities, underscore the company's focus on optimizing its capital structure amidst competitive pressures in the specialized REITs industry. These elements shape the distinctive trajectory of AMT’s long-term shareholder returns.

- Understand the fair market value of American Tower with insights from our valuation analysis—click here to learn more.

- Understand the uncertainties surrounding American Tower's market positioning with our detailed risk analysis report.

- Is American Tower part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMT

American Tower

American Tower, one of the largest global REITs, is a leading independent owner, operator and developer of multitenant communications real estate with a portfolio of over 148,000 communications sites and a highly interconnected footprint of U.S.

Solid track record established dividend payer.