- United States

- /

- Residential REITs

- /

- NYSE:AMH

Should You Be Adding American Homes 4 Rent (NYSE:AMH) To Your Watchlist Today?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like American Homes 4 Rent (NYSE:AMH). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for American Homes 4 Rent

American Homes 4 Rent's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. Shareholders will be happy to know that American Homes 4 Rent's EPS has grown 32% each year, compound, over three years. As a result, we can understand why the stock trades on a high multiple of trailing twelve month earnings.

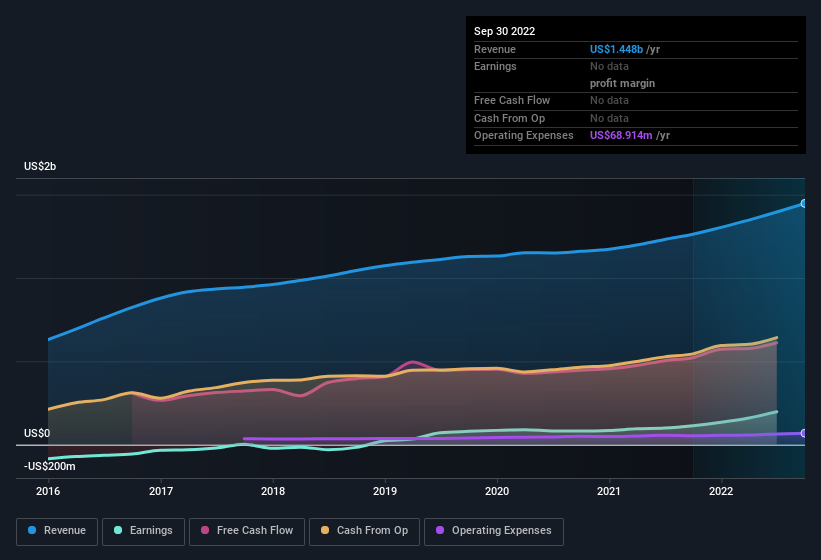

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for American Homes 4 Rent remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 15% to US$1.4b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for American Homes 4 Rent's future profits.

Are American Homes 4 Rent Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Although we did see some insider selling (worth US$1.3m) this was overshadowed by a mountain of buying, totalling US$43m in just one year. We find this encouraging because it suggests they are optimistic about American Homes 4 Rent'sfuture. Zooming in, we can see that the biggest insider purchase was by Independent Trustee Tamara Gustavson for US$28m worth of shares, at about US$37.01 per share.

Along with the insider buying, another encouraging sign for American Homes 4 Rent is that insiders, as a group, have a considerable shareholding. We note that their impressive stake in the company is worth US$887m. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, David Singelyn is paid comparatively modestly to CEOs at similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like American Homes 4 Rent, with market caps over US$8.0b, is about US$13m.

American Homes 4 Rent's CEO took home a total compensation package of US$4.6m in the year prior to December 2021. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add American Homes 4 Rent To Your Watchlist?

For growth investors, American Homes 4 Rent's raw rate of earnings growth is a beacon in the night. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. Astute investors will want to keep this stock on watch. Before you take the next step you should know about the 4 warning signs for American Homes 4 Rent (1 is a bit concerning!) that we have uncovered.

Keen growth investors love to see insider buying. Thankfully, American Homes 4 Rent isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AMH

American Homes 4 Rent

AMH (NYSE: AMH) is a leading large-scale integrated owner, operator and developer of single-family rental homes.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives