- United States

- /

- Retail REITs

- /

- NYSE:ALX

Is Alexander's (ALX) Steady Dividend a Sign of Strength Amid Declining Earnings?

Reviewed by Simply Wall St

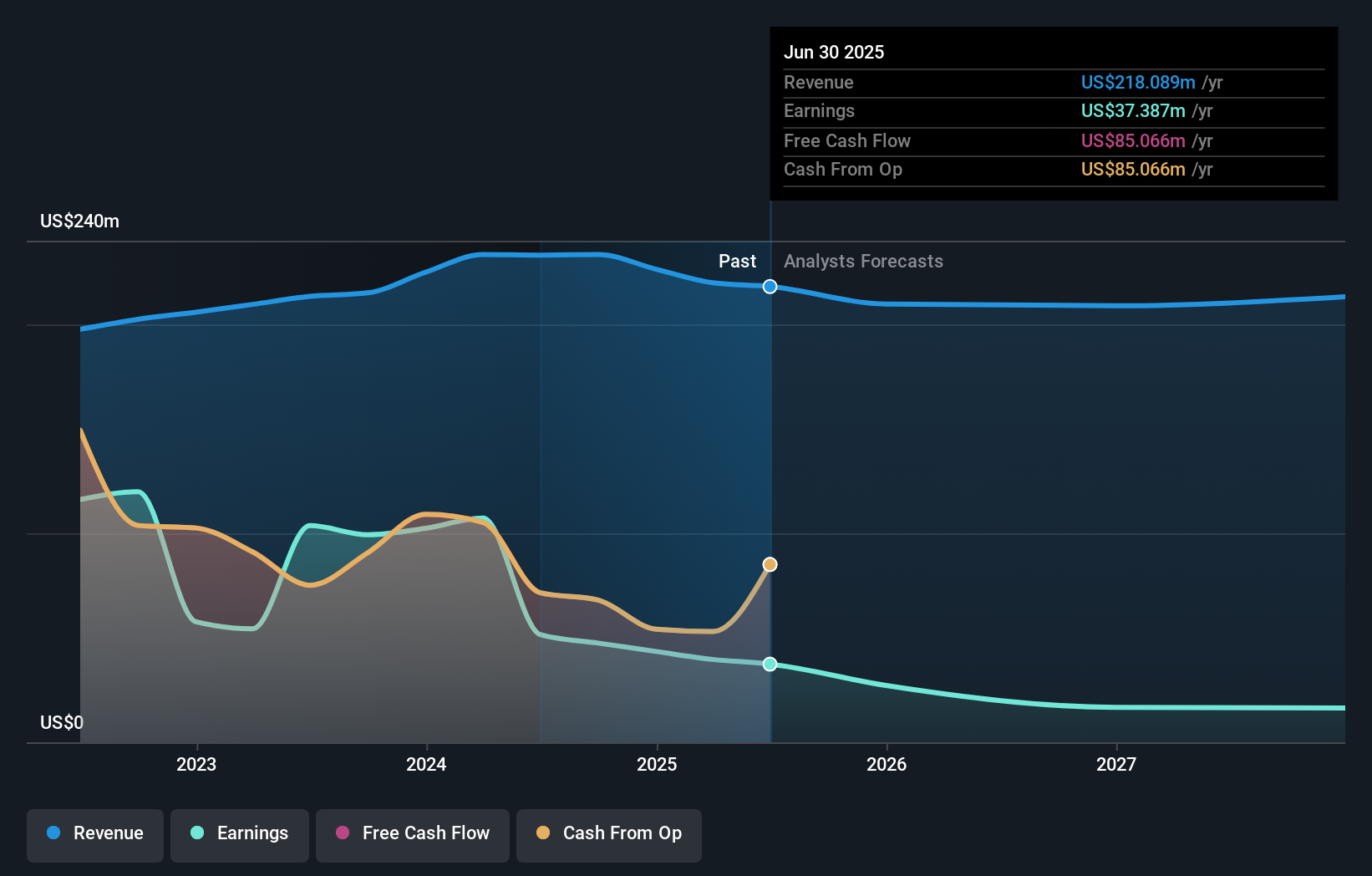

- Alexander's, Inc. recently announced its second quarter and six-month earnings for 2025, showing declines in both sales and net income compared to the same periods in the prior year.

- Despite the decreases in key financial metrics, the company’s Board has continued its practice of declaring a regular quarterly dividend of US$4.50 per share.

- We’ll explore how the year-over-year decrease in sales and earnings could influence Alexander’s investment narrative in light of the latest results.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Alexander's Investment Narrative?

To believe in Alexander’s, Inc. as a shareholder, you have to be convinced by its resilience amid earnings pressure and a long-term justification for premium valuation. The latest earnings release, reflecting year-over-year drops in both sales and net income for the second quarter and first half of 2025, reinforces the company's trend of contracting financial performance, with revenues and profits in steady decline. Yet, the Board’s decision to maintain the regular US$4.50 per share quarterly dividend signals a focus on rewarding income-oriented investors, which might help support near-term sentiment despite the lack of earnings cover. The recent softness in results adds urgency to existing risks: a shrinking profit base and the challenge of sustaining dividends with thinner margins and interest coverage. These issues could now weigh more heavily on short-term catalysts like asset re-leasing, expense management, and the capacity to revisit growth amid sector headwinds. While the news marks a continuation rather than an abrupt deterioration, it does sharpen the company’s risk profile, and weak earnings momentum looks likely to limit any immediate catalyst until there are signs of improvement.

On the other hand, a dwindling earnings base raises questions about dividend sustainability that investors should watch closely.

Exploring Other Perspectives

Explore 2 other fair value estimates on Alexander's - why the stock might be worth as much as $155.00!

Build Your Own Alexander's Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alexander's research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Alexander's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alexander's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 18 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALX

Alexander's

Alexander’s, Inc. is a real estate investment trust (REIT) engaged in leasing, managing, developing and redeveloping properties.

Average dividend payer with low risk.

Market Insights

Community Narratives