- United States

- /

- Retail REITs

- /

- NYSE:ALX

Assessing Alexander’s (ALX) Valuation Following Analyst Downgrade and Lowered Earnings Expectations

Reviewed by Kshitija Bhandaru

Price-to-Earnings of 32.8x: Is it justified?

Alexander’s currently trades at a Price-to-Earnings (P/E) ratio of 32.8x, which is significantly higher than both the estimated fair P/E ratio of 20.4x and the peer average of 20.6x. This indicates that shares look expensive compared to what investors are paying for similar companies in the market and industry.

The P/E ratio measures the market price of a company’s shares relative to its earnings. For real estate investment trusts like Alexander’s, the P/E ratio is an important indicator for comparing relative valuation within the sector because it reflects both investor sentiment and expectations for future growth or stability.

The premium in Alexander’s P/E suggests that the market is pricing in higher future earnings or stability than industry peers, even though there have been recent declines in both profits and revenue growth outlook. Investors should consider whether this optimism is warranted in light of the company’s fundamentals.

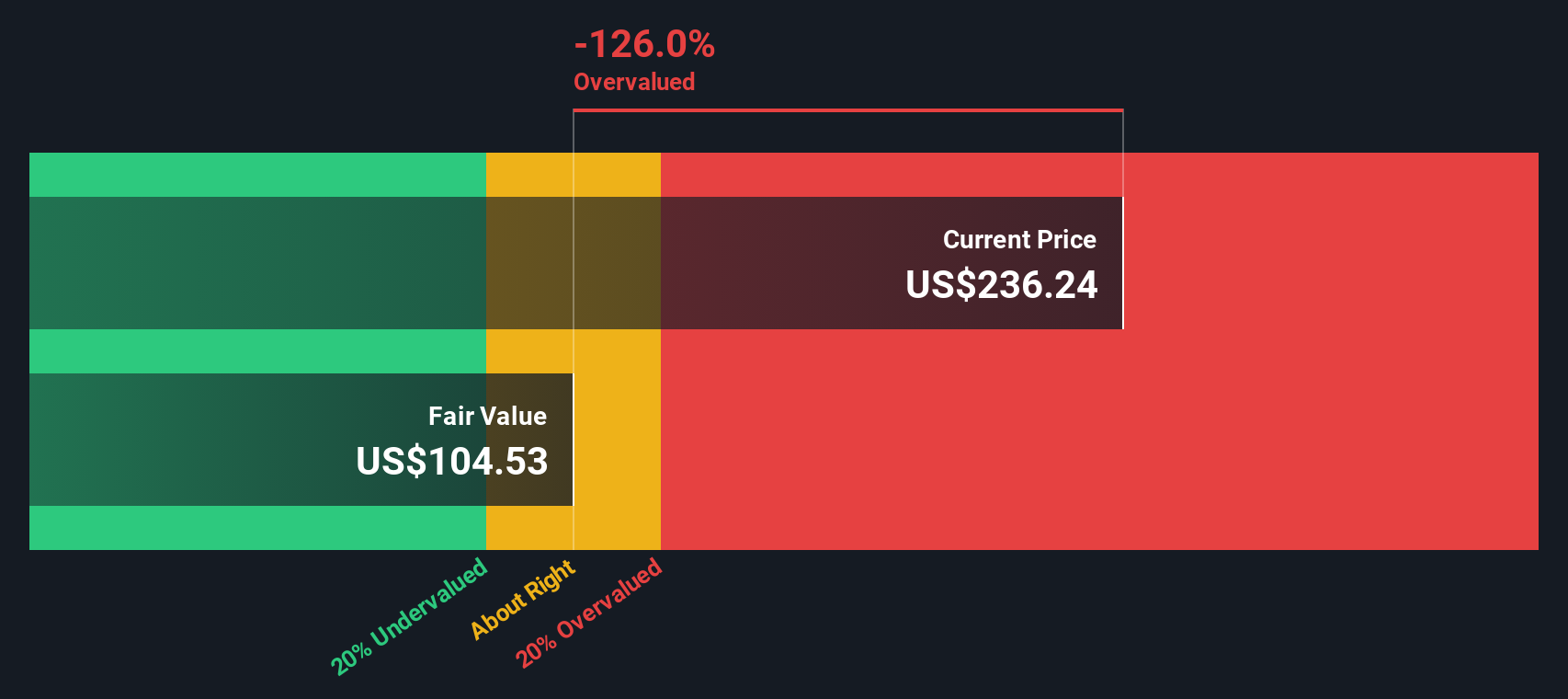

Result: Fair Value of $104.68 (OVERVALUED)

See our latest analysis for Alexander's.However, slowing annual revenue growth and sharply declining net income remain significant risks. These factors could quickly shift investor sentiment and challenge the current valuation.

Find out about the key risks to this Alexander's narrative.Another View: What Does Our DCF Model Say?

While the market price suggests optimism, our SWS DCF model offers a more grounded perspective and indicates the shares may be overvalued. Could this gap signal that investors are too hopeful, or is something being overlooked?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Alexander's to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Alexander's Narrative

If you would rather reach your own conclusions or take a different view, you can easily craft a personalized story in just a few minutes with Do it your way.

A great starting point for your Alexander's research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Smart investors keep an eye out for new opportunities every day. With the Simply Wall St Screener, you can take control and act on fresh, promising investment ideas that match your strategy before others catch on.

- Power your portfolio with steady income growth by uncovering companies offering dividend stocks with yields > 3% to investors seeking yields above 3%.

- Tap into surging industries and spot potential early winners by checking out the latest AI penny stocks making headlines in artificial intelligence.

- Target compelling value plays by searching for undervalued stocks based on cash flows that could be set for a market re-rating based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALX

Alexander's

Alexander’s, Inc. is a real estate investment trust (REIT) engaged in leasing, managing, developing and redeveloping properties.

Average dividend payer with low risk.

Market Insights

Community Narratives