- United States

- /

- REITS

- /

- NYSE:ALEX

Alexander & Baldwin (ALEX): Assessing Valuation After a 34% One-Month Share Price Surge

Reviewed by Simply Wall St

Alexander & Baldwin (ALEX) has quietly delivered a strong run lately, with the stock up roughly 34% over the past month and about 12% in the past 3 months, catching investors attention.

See our latest analysis for Alexander & Baldwin.

That surge caps an 18.8% year to date share price return and a 22.6% total shareholder return over the past year, suggesting momentum is building as investors reassess Alexander & Baldwin's Hawaii focused REIT story and valuation.

If Alexander & Baldwin's recent move has you thinking about where else capital is quietly lining up, now is a good time to explore fast growing stocks with high insider ownership

Yet with revenue and earnings slipping even as the share price surges toward analyst targets, investors now face a crucial question: is Alexander & Baldwin still undervalued, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 4.1% Overvalued

With the narrative fair value sitting just below the last close at $20.94, the story hinges on how durable Hawaii driven cash flows really are.

The fair value estimate has fallen slightly from about $21.25 to roughly $20.12 per share, implying a modestly lower intrinsic value assessment.

The future P/E multiple has compressed from roughly 47.0x to about 40.8x, pointing to a lower valuation multiple being applied to projected earnings.

Curious why a slower revenue path and thinning margins still support a premium earnings multiple more common in high growth sectors than REITs? The narrative’s valuation hinges on a specific blend of declining earnings, adjusted profitability, and a surprisingly rich future multiple that could reset expectations for this stock. Want to see exactly which earnings and margin assumptions are doing the heavy lifting in that fair value? Read on to unpack the full playbook.

Result: Fair Value of $20.12 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sharper Hawaiian tourism slowdown or persistently rising redevelopment costs could undermine cash flows, compress margins, and challenge the rich earnings multiple baked into today’s price.

Find out about the key risks to this Alexander & Baldwin narrative.

Another View: Cash Flows Tell a Different Story

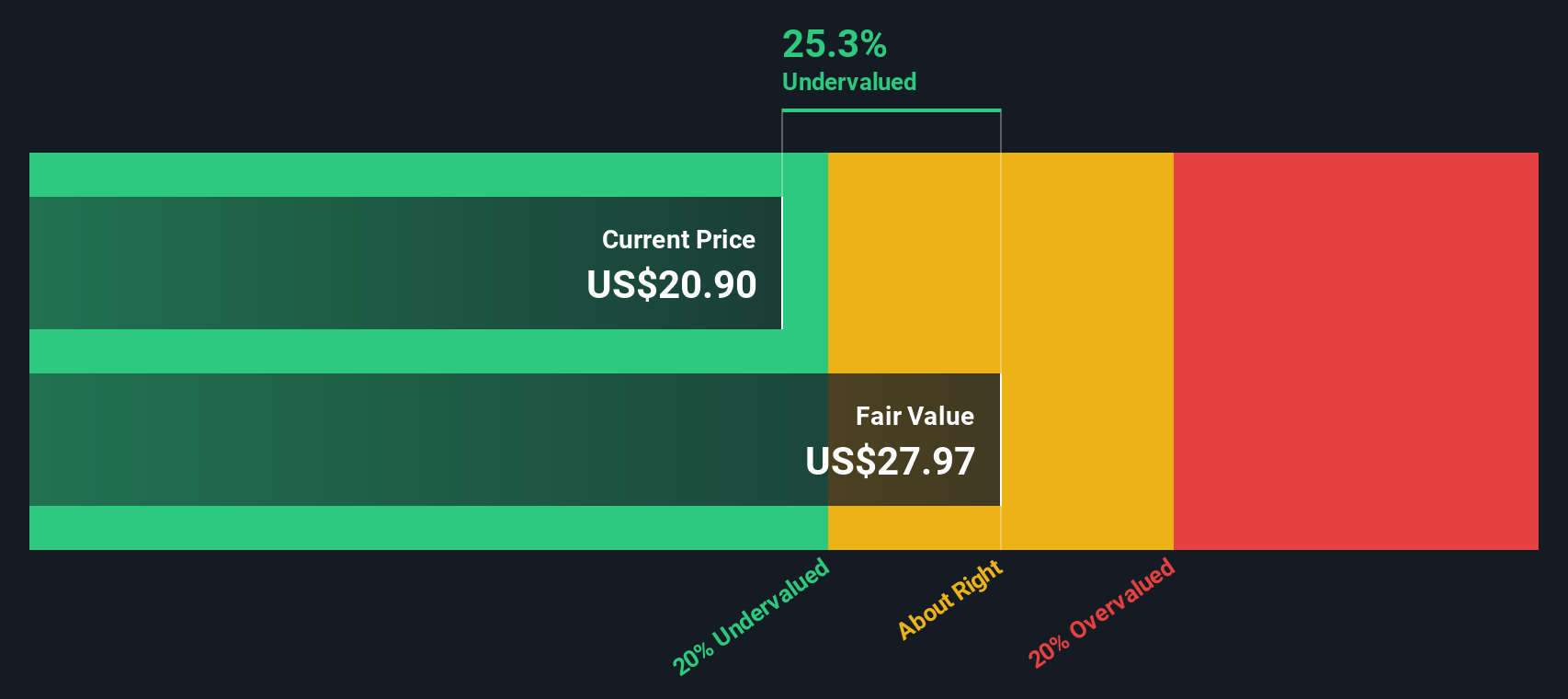

While the narrative model suggests Alexander & Baldwin is modestly overvalued, our DCF model points the other way, with a fair value of $27.95 versus a market price of $20.94. That 25% gap hints at hidden value, but are the long term cash flow assumptions too generous?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Alexander & Baldwin for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 912 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Alexander & Baldwin Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized narrative in just a few minutes: Do it your way

A great starting point for your Alexander & Baldwin research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for your next investment move?

Right now, serious investors are scanning fresh opportunities using the Simply Wall St Screener, and you may miss high conviction ideas if you stay put.

- Capture potential mispricings early by targeting these 912 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has overlooked.

- Turn volatility into an advantage by focusing on these 3642 penny stocks with strong financials that already show robust financial foundations.

- Strengthen your income stream by zeroing in on these 13 dividend stocks with yields > 3% that can support reliable, long term payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALEX

Alexander & Baldwin

Alexander & Baldwin, Inc. (NYSE: ALEX) (A&B) is the only publicly-traded real estate investment trust to focus exclusively on Hawai'i commercial real estate and is the state's largest owner of grocery-anchored, neighborhood shopping centers.

Moderate risk, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)