- United States

- /

- REITS

- /

- NYSE:AHH

If EPS Growth Is Important To You, Armada Hoffler Properties (NYSE:AHH) Presents An Opportunity

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Armada Hoffler Properties (NYSE:AHH). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Armada Hoffler Properties

Armada Hoffler Properties' Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that Armada Hoffler Properties' EPS has grown 27% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

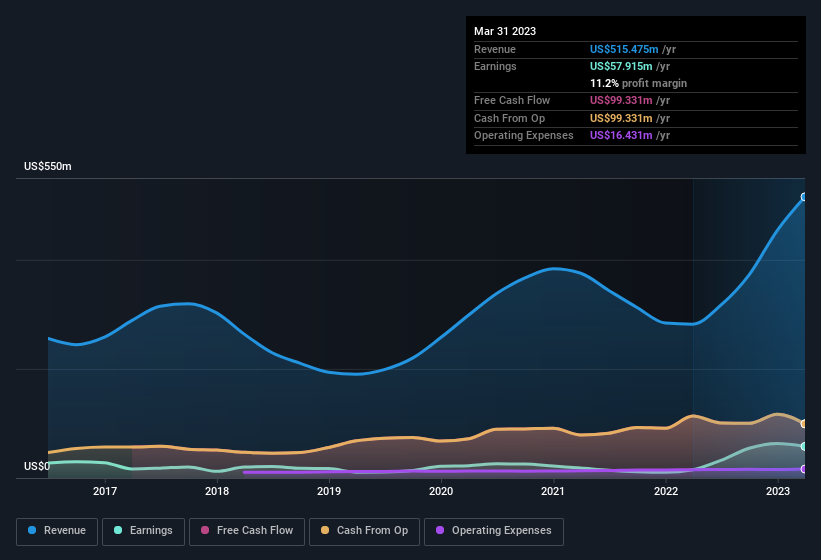

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. It's noted that Armada Hoffler Properties' revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. On the revenue front, Armada Hoffler Properties has done well over the past year, growing revenue by 83% to US$515m but EBIT margin figures were less stellar, seeing a decline over the last 12 months. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Armada Hoffler Properties' future profits.

Are Armada Hoffler Properties Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Not only did Armada Hoffler Properties insiders refrain from selling stock during the year, but they also spent US$120k buying it. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading. Zooming in, we can see that the biggest insider purchase was by President of Construction & Development Eric Apperson for US$44k worth of shares, at about US$14.32 per share.

Along with the insider buying, another encouraging sign for Armada Hoffler Properties is that insiders, as a group, have a considerable shareholding. To be specific, they have US$16m worth of shares. This considerable investment should help drive long-term value in the business. Even though that's only about 1.6% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, Lou Haddad is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalisations between US$400m and US$1.6b, like Armada Hoffler Properties, the median CEO pay is around US$3.8m.

The Armada Hoffler Properties CEO received US$2.7m in compensation for the year ending December 2022. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Armada Hoffler Properties Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Armada Hoffler Properties' strong EPS growth. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. These things considered, this is one stock worth watching. We don't want to rain on the parade too much, but we did also find 4 warning signs for Armada Hoffler Properties (2 are potentially serious!) that you need to be mindful of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Armada Hoffler Properties, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AHH

Armada Hoffler Properties

Armada Hoffler (NYSE: AHH) is a vertically integrated, self-managed real estate investment trust with over four decades of experience developing, building, acquiring, and managing high-quality retail, office, and multifamily properties located primarily in the Mid-Atlantic and Southeastern United States.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives