- United States

- /

- Retail REITs

- /

- NasdaqGS:REG

Should Weakness in Regency Centers Corporation's (NASDAQ:REG) Stock Be Seen As A Sign That Market Will Correct The Share Price Given Decent Financials?

It is hard to get excited after looking at Regency Centers' (NASDAQ:REG) recent performance, when its stock has declined 5.7% over the past three months. However, stock prices are usually driven by a company’s financials over the long term, which in this case look pretty respectable. Specifically, we decided to study Regency Centers' ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Put another way, it reveals the company's success at turning shareholder investments into profits.

View our latest analysis for Regency Centers

How Do You Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Regency Centers is:

6.0% = US$366m ÷ US$6.1b (Based on the trailing twelve months to December 2021).

The 'return' is the profit over the last twelve months. So, this means that for every $1 of its shareholder's investments, the company generates a profit of $0.06.

What Is The Relationship Between ROE And Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Regency Centers' Earnings Growth And 6.0% ROE

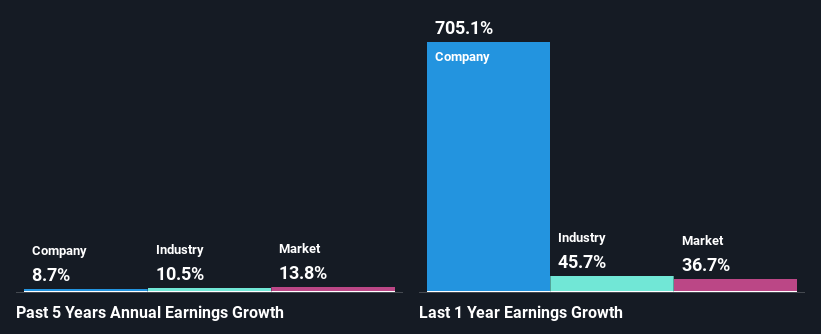

On the face of it, Regency Centers' ROE is not much to talk about. However, given that the company's ROE is similar to the average industry ROE of 6.9%, we may spare it some thought. Having said that, Regency Centers has shown a modest net income growth of 8.7% over the past five years. Taking into consideration that the ROE is not particularly high, we reckon that there could also be other factors at play which could be influencing the company's growth. Such as - high earnings retention or an efficient management in place.

Next, on comparing Regency Centers' net income growth with the industry, we found that the company's reported growth is similar to the industry average growth rate of 10% in the same period.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. What is REG worth today? The intrinsic value infographic in our free research report helps visualize whether REG is currently mispriced by the market.

Is Regency Centers Using Its Retained Earnings Effectively?

Regency Centers has a high three-year median payout ratio of 59%. This means that it has only 41% of its income left to reinvest into its business. However, it's not unusual to see a REIT with such a high payout ratio mainly due to statutory requirements. In spite of this, the company was able to grow its earnings by a fair bit, as we saw above.

Moreover, Regency Centers is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 62%. As a result, Regency Centers' ROE is not expected to change by much either, which we inferred from the analyst estimate of 6.3% for future ROE.

Conclusion

Overall, we feel that Regency Centers certainly does have some positive factors to consider. Namely, its high earnings growth. We do however feel that the earnings growth number could have been even higher, had the company been reinvesting more of its earnings and paid out less dividends. With that said, the latest industry analyst forecasts reveal that the company's earnings growth is expected to slow down. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:REG

Regency Centers

Regency Centers is a preeminent national owner, operator, and developer of shopping centers located in suburban trade areas with compelling demographics.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives