- United States

- /

- Retail REITs

- /

- NasdaqGS:REG

Regency Centers (REG): Is There More Value Left After Steady Long-Term Gains?

Reviewed by Simply Wall St

Regency Centers (REG) shares have recently caught investors’ attention, sparking fresh conversations about the company’s current value and its place within the real estate investment trust landscape. Investors are now weighing how its recent performance compares with sector peers.

See our latest analysis for Regency Centers.

Regency Centers’ share price has edged up over the past month, and while recent news has been relatively quiet, the main focus comes from its solid three- and five-year total shareholder returns of 22% and 77% respectively. This kind of track record may interest patient investors who are looking at long-term opportunities.

If you’re looking to broaden your search beyond REITs, it’s a great time to discover fast growing stocks with high insider ownership and see which fast-moving companies are also capturing insider interest.

With recent gains and a strong long-term performance, the question for investors now is whether Regency Centers is trading below its true value or if the market has already accounted for the company’s future growth prospects.

Most Popular Narrative: 11% Undervalued

With Regency Centers closing at $71.16 and the most popular narrative fair value anchored at $80.05, the narrative signals the stock remains meaningfully below this valuation. This sets the stage for the underlying drivers shaping the positive outlook.

Demographic-driven suburban population growth and continued household formation are boosting demand for well-located, necessity-based retail in Regency's predominantly suburban, grocery-anchored centers. This positions the company for stronger occupancy, above-average rental rate growth, and increased long-term revenue.

Want to know which key financial levers push Regency’s fair value well above its current price? There is a surprising interplay of rising profit margins, slow yet steady revenue expansion, and a future valuation multiple that would turn heads in any sector. Hungry for the details baked into these projections? Click for the behind-the-scenes math powering this bullish narrative.

Result: Fair Value of $80.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tenant concentration risk and shifts in consumer preferences could pressure Regency’s revenue growth if market conditions or anchor demand changes unexpectedly.

Find out about the key risks to this Regency Centers narrative.

Another View: Market Ratios Paint a Different Picture

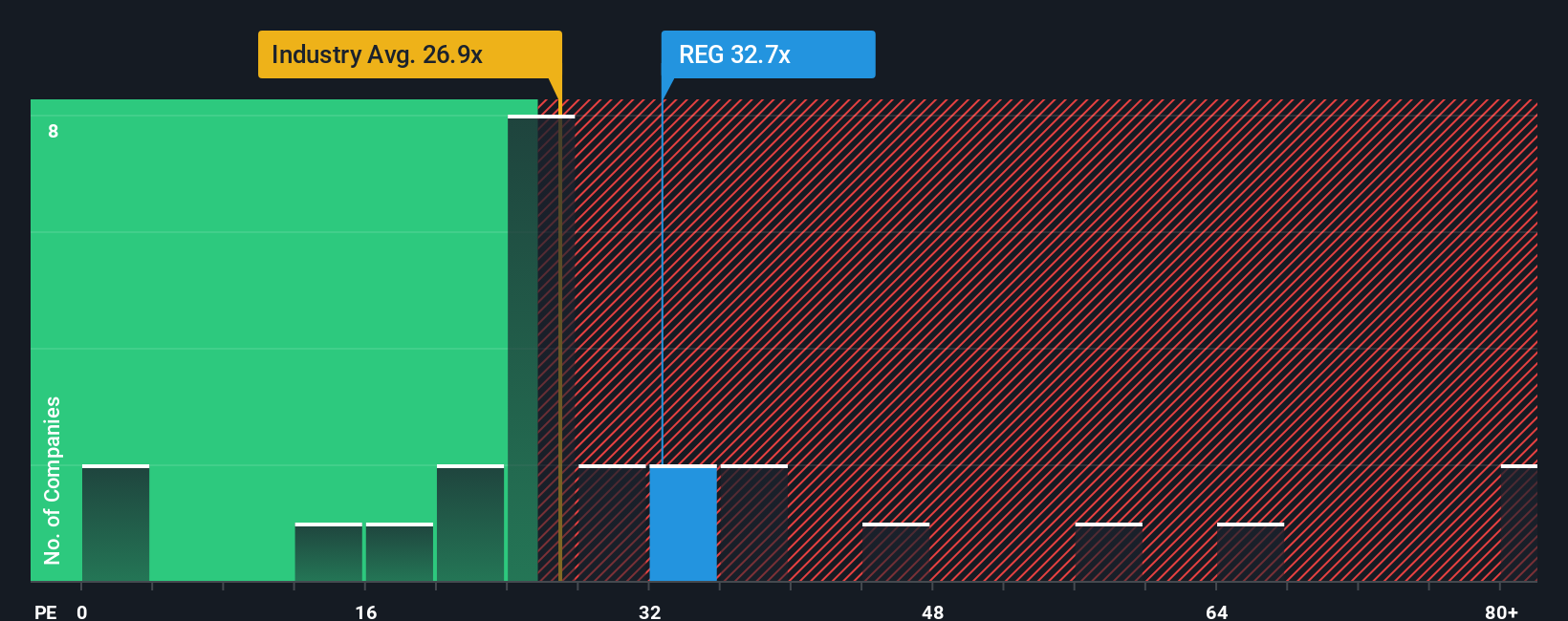

Looking at valuation through the lens of the price-to-earnings ratio reveals a more expensive story. Regency Centers trades at 32.6 times earnings, which is above the US Retail REITs industry average of 27.1 and its peers at 23.5. Even when compared to the fair ratio of 33.9, current levels suggest limited upside and potential valuation risk. Will the market continue to pay a premium for Regency’s steady track record, or could expectations reset?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Regency Centers Narrative

If you see the story differently or want to chart your own course, it’s quick and easy to build your own perspective using the underlying data. Take just a few minutes to get started with Do it your way.

A great starting point for your Regency Centers research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Ideas?

Why settle for one opportunity when the market is filled with bold new frontiers? Take charge with these unique screens that can help you spot tomorrow’s standouts before the crowd.

- Tap into innovation and get ahead by checking out these 25 AI penny stocks, where leading-edge companies are advancing artificial intelligence breakthroughs.

- Explore your earning potential with these 15 dividend stocks with yields > 3% that reward investors with consistent, above-average yields exceeding 3%.

- Ride the next wave of financial technology by reviewing these 81 cryptocurrency and blockchain stocks, with businesses pioneering major shifts in blockchain and the digital asset space.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REG

Regency Centers

Regency Centers is a preeminent national owner, operator, and developer of shopping centers located in suburban trade areas with compelling demographics.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.