- United States

- /

- Specialized REITs

- /

- NasdaqGS:PCH

Assessing PotlatchDeltic (PCH) Valuation After Recent Unexplained Share Price Movement

Reviewed by Simply Wall St

PotlatchDeltic (PCH) has caught the attention of investors recently, as price moves without an obvious catalyst often raise questions. When a company’s shares shift direction without a clear headline or event, it can be a challenge to figure out if this is the start of a bigger trend or just noise in the market. For those considering a move, times like this can open the door to a valuation reset or a momentary mispricing, making it worth a closer look.

Looking at PotlatchDeltic’s performance, there have been some modest ups and downs over the past year. The stock has gained just under 2% in the last year, but it has climbed over 6% since the start of this year and even more in the last three months. That steady, albeit unspectacular, momentum comes as PotlatchDeltic reported annual revenue growth of 4% and a significant jump in net income, suggesting their core business may be turning a corner despite near-term price fluctuations.

The big question now is whether this low-key price action is a buying opportunity hiding in plain sight or if the market is already factoring in PotlatchDeltic’s future growth prospects.

Most Popular Narrative: 17.9% Undervalued

The prevailing narrative points to PotlatchDeltic being significantly undervalued relative to its fair value estimate, according to widely followed analyst projections. This thesis suggests the market is not fully accounting for the company’s forward earnings potential and asset optimization.

The market is not fully valuing the premium pricing achieved on land sales, for example, conservation transactions and solar/lithium options. The company's positioning to capitalize further on strong institutional demand for rural real assets translates to improved net asset value realization and potential meaningful earnings accretion.

Curious why analysts see something others don't? The narrative relies on bold growth assumptions, a major margin leap, and earnings power projected well beyond recent trends. Want to uncover the specific financial forecasts that drive this upbeat outlook? Explore the quantitative story behind the headline valuation to see whether the math stacks up.

Result: Fair Value of $50.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weakness in housing demand or adverse regulatory changes could derail earnings expectations and challenge the case for PotlatchDeltic’s undervaluation.

Find out about the key risks to this PotlatchDeltic narrative.Another View: Market-Based Comparison Tells a Different Story

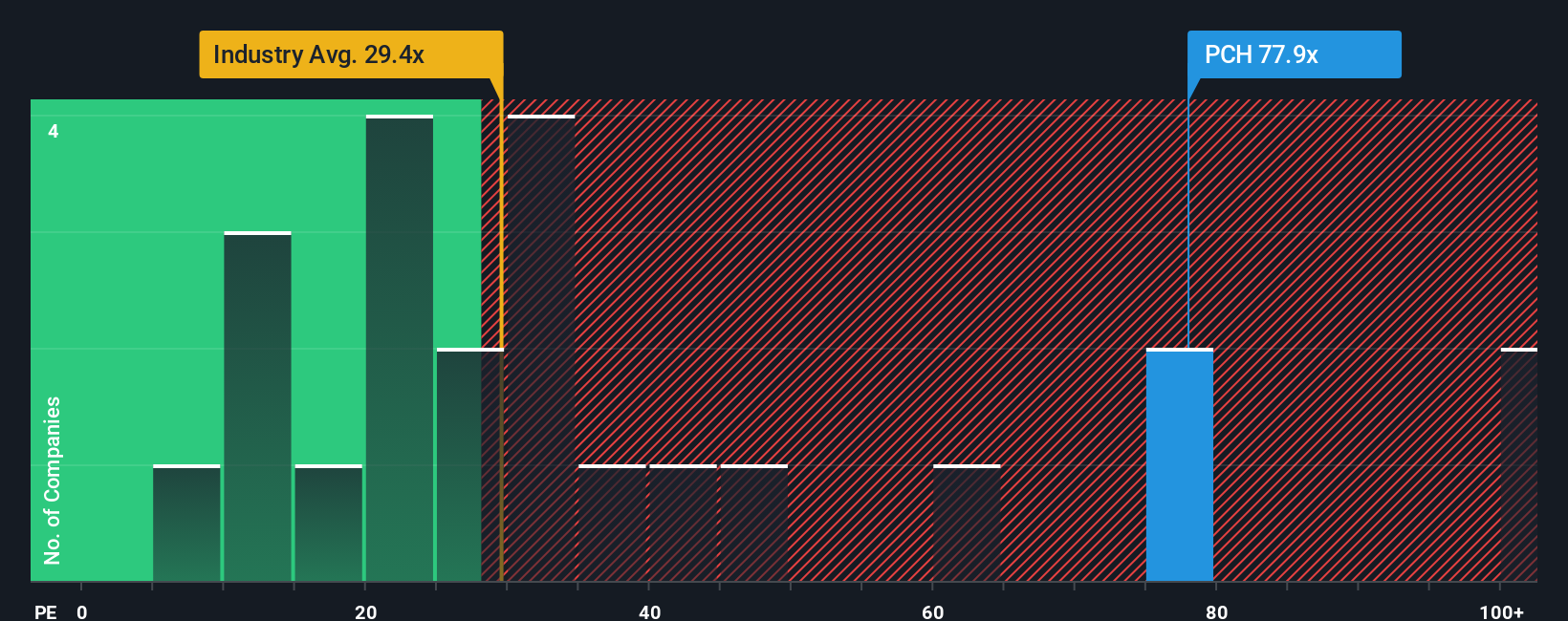

Looking from a traditional valuation angle, PotlatchDeltic appears expensive compared to the industry average. This challenges the notion that the shares are a bargain and suggests the market might be seeing risks analysts overlook. Could this be a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding PotlatchDeltic to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own PotlatchDeltic Narrative

If you look at these numbers and feel a different story emerging or want to run your own analysis, you can do that quickly and confidently. Do it your way

A great starting point for your PotlatchDeltic research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Compelling Investment Opportunities?

Broaden your perspective and take charge of your investing journey. Don’t miss the chance to find companies with unique advantages not currently on your radar. The right screen can reveal stocks with the edge you need.

- Embrace powerful trends shaping tomorrow by tapping into AI-driven companies making breakthroughs in technology: AI penny stocks

- Unlock income potential and stability for your portfolio through stocks offering generous yields above 3%: dividend stocks with yields > 3%

- Power up your returns with undervalued picks supported by robust cash flows: undervalued stocks based on cash flows

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PCH

PotlatchDeltic

PotlatchDeltic Corporation (Nasdaq: PCH) is a leading Real Estate Investment Trust (REIT) with ownership of 2.1 million acres of timberlands in Alabama, Arkansas, Georgia, Idaho, Louisiana, Mississippi and South Carolina.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives