- United States

- /

- Real Estate

- /

- NasdaqCM:UOKA

Should MDJM (NASDAQ:MDJH) Be Disappointed With Their 74% Profit?

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But if you pick the right individual stocks, you could make more than that. For example, the MDJM Ltd. (NASDAQ:MDJH) share price is up 74% in the last year, clearly besting the market return of around 27% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

Check out our latest analysis for MDJM

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year MDJM grew its earnings per share, moving from a loss to a profit.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

We think that the revenue growth of 55% could have some investors interested. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

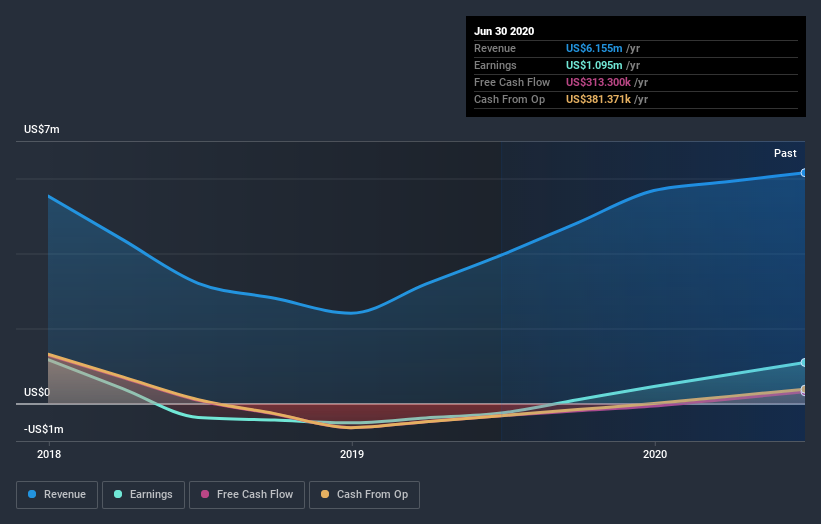

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on MDJM's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

MDJM boasts a total shareholder return of 74% for the last year. A substantial portion of that gain has come in the last three months, with the stock up 41% in that time. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 4 warning signs we've spotted with MDJM (including 2 which are significant) .

But note: MDJM may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you’re looking to trade MDJM, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:UOKA

MDJM

Engages in the hotel and rental management business in the United Kingdom.

Flawless balance sheet moderate.

Similar Companies

Market Insights

Community Narratives