- United States

- /

- Real Estate

- /

- NYSE:MMI

Marcus & Millichap (MMI) Valuation: Is There Hidden Value After Recent Share Price Declines?

Reviewed by Kshitija Bhandaru

Marcus & Millichap (MMI) shares have seen some movement lately, with a nearly 10% decline over the past month and a drop of 22% so far this year. Investors may be wondering if current valuations reflect opportunity as the market digests recent performance.

See our latest analysis for Marcus & Millichap.

The share price has lost momentum in recent months, reflecting some investor caution following a tough year for Marcus & Millichap. While recent events have been relatively quiet, the sizeable drop in this year’s share price, supported by a 1-year total shareholder return of -22%, suggests the market is looking for clearer signs of improvement before confidence returns.

If you’re watching MMI’s moves and want to diversify your watchlist, now is the perfect chance to broaden your search and discover fast growing stocks with high insider ownership

With shares pulling back and recent results now in the rearview mirror, investors must ask whether current prices offer a bargain entry point or if the market is already factoring in any future growth for Marcus & Millichap.

Most Popular Narrative: 3.9% Undervalued

The current last close for Marcus & Millichap stands at $28.83, just below the narrative’s fair value calculation of $30. According to the narrative widely followed by analysts, there is a slight margin of undervaluation in the market, which could signal the potential for upside if projections are met.

The company is benefiting from renewed institutional investor activity and an improving lending environment. This is fueling larger transaction volumes and a stronger capital markets pipeline, both factors that are likely to boost future revenue and earnings growth.

Want to know what is powering this verdict? The narrative’s fair value rests on bold assumptions about growth rates, margin expansion and a profit turnaround. Curious how these projected leaps stack up against industry trends? The full story lays out the drivers behind that price. Find out what is beneath the surface.

Result: Fair Value of $30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, skeptics point out that Marcus & Millichap’s heavy reliance on transaction commissions and fee compression could quickly undermine the undervalued narrative if market conditions worsen.

Find out about the key risks to this Marcus & Millichap narrative.

Another View: Multiples Tell a Different Story

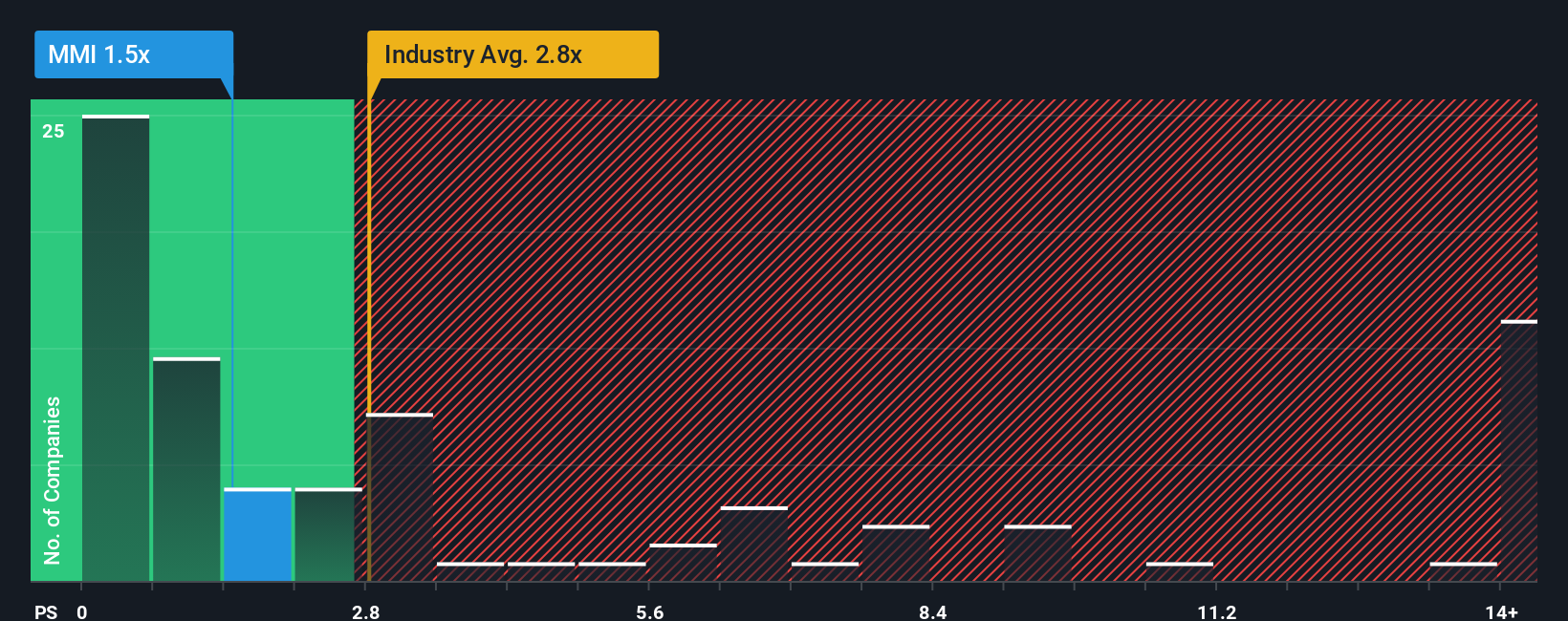

While the analyst narrative points to upside, looking at price-to-sales ratios reveals some caution. Marcus & Millichap is valued at 1.5x sales. This is a better deal than the industry average of 3x, but more expensive than peers at 0.4x. Notably, the fair ratio stands at just 1x. This suggests the current market price could still be above where fundamental value may settle. Does this mean the stock’s risk of further downside is higher than it appears?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Marcus & Millichap for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Marcus & Millichap Narrative

If you see things differently or want to dig into the details yourself, building your own narrative for Marcus & Millichap is both quick and straightforward. Do it your way

A great starting point for your Marcus & Millichap research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t wait on the sidelines while opportunities move fast. Simply Wall St's tailored screeners can show you a fresh set of high-potential investment possibilities.

- Catch companies redefining healthcare by checking out these 31 healthcare AI stocks, which is driving breakthroughs in medical AI and digital transformation.

- Unearth value by tapping into these 904 undervalued stocks based on cash flows and find overlooked gems primed for growth based on strong fundamentals.

- Jump into the future of finance with these 78 cryptocurrency and blockchain stocks, shaping new pathways in digital assets and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MMI

Marcus & Millichap

An investment brokerage company, provides real estate investment brokerage and financing services to sellers and buyers of commercial real estate in the United States and Canada.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives