- United States

- /

- Real Estate

- /

- NYSE:MMI

Marcus & Millichap (MMI): Assessing Valuation After Ongoing Growth Challenges and Weak Shareholder Returns

Reviewed by Kshitija Bhandaru

If you’ve been tracking Marcus & Millichap (MMI) lately, there’s a good chance the recent headlines have you weighing your next move. The company’s stock has been in the spotlight after continued flat revenue growth and a sharp decline in return on invested capital, raising questions about how much value management can deliver going forward. With ongoing difficulties turning revenue into free cash flow, the story has become less about earnings growth and more about what comes next for shareholders looking for a clearer signal.

It’s not just the past month’s performance that has caught attention. Over the past year, Marcus & Millichap shares have slipped 21%, running counter to broader market momentum and echoing a multiyear stretch of underwhelming returns. Even over the past three years, the stock has barely budged, despite a quick bump in annual revenue. A lack of meaningful capital returns and fading market confidence have kept any rallies in check, leaving investors watching for a catalyst.

So, after a year of steady declines and cautious sentiment, is this current price a true value, or are markets still adjusting for weaker prospects and pricing in further downside?

Most Popular Narrative: 2.5% Overvalued

The stock is currently viewed as trading just above fair value, with analysts pricing in a modest premium based on future earnings growth and margin expansion. Market expectations focus on several substantial catalysts, with technology and business model shifts appearing front and center in these forecasts.

Ongoing investments in technology, including AI and centralized production support, are expected to enhance operational efficiency, lower costs, and increase productivity over time, supporting expansion in net margins. Expansion of the agent network and recruiting experienced market leaders strengthen the platform's scalability, promoting higher transaction throughput and supporting organic revenue growth.

Curious about why analysts believe the future could be much brighter than the recent numbers suggest? What hidden levers are they betting will unlock new value for shareholders? Find out how bold expansion plans and aggressive efficiency targets are fueling the price target. Explore what surprising assumptions support this forecast. The mechanics behind this calculation may just redefine your view of Marcus & Millichap’s upside.

Result: Fair Value of $30 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent reliance on commission-driven revenue and increasing competition in transaction fees could quickly undermine the optimistic outlook if market conditions weaken.

Find out about the key risks to this Marcus & Millichap narrative.Another View: Is the Value Story So Clear?

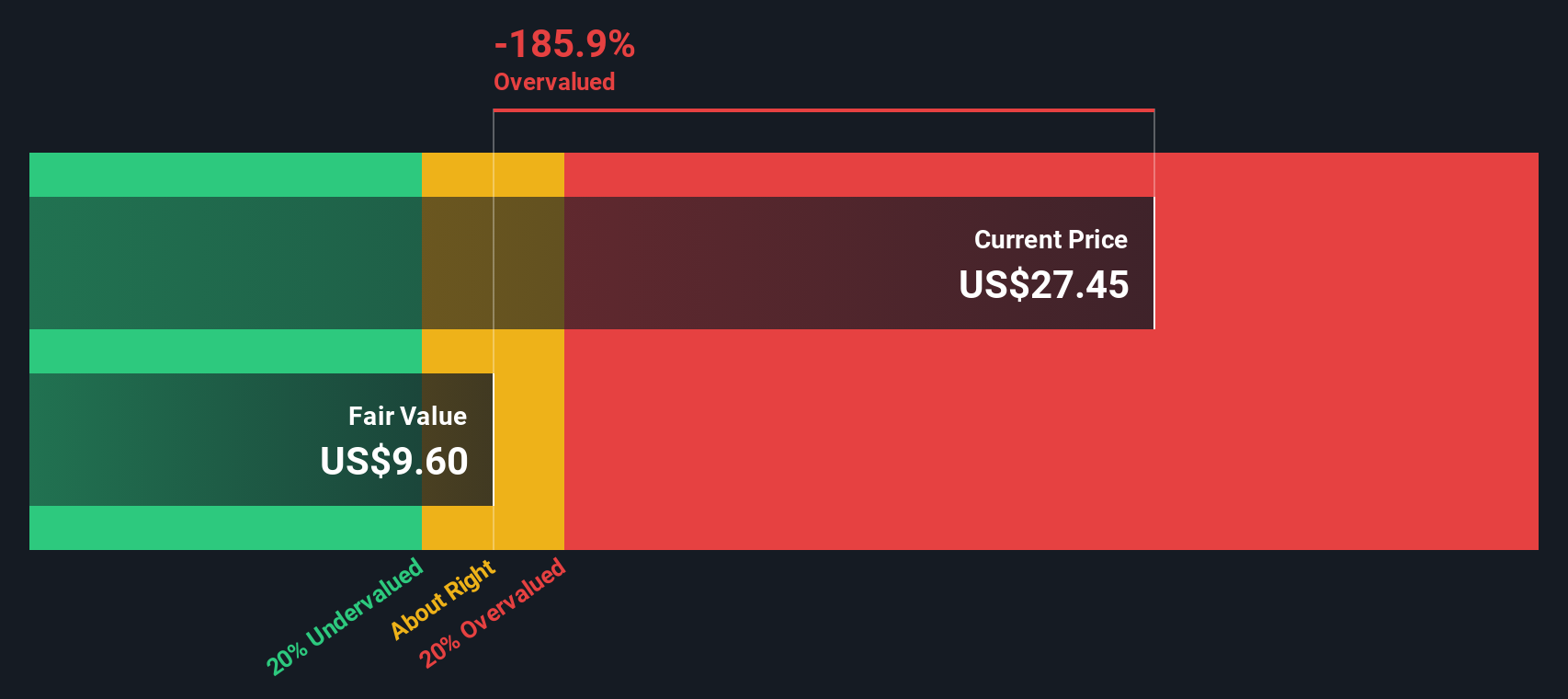

Our DCF model paints a very different picture. It suggests Marcus & Millichap could be overvalued when considering the business’s future cash flows instead of relying solely on industry multiples. Does this highlight deeper risks or expose hidden opportunity?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Marcus & Millichap to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Marcus & Millichap Narrative

If you see the story differently or want to dig deeper into the numbers yourself, it takes just a few minutes to craft your own perspective. Do it your way.

A great starting point for your Marcus & Millichap research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t miss the chance to build your edge. Now is the time to scan for standout stocks with unique potential using these hand-picked strategies from Simply Wall St:

- Snap up early movers in artificial intelligence by jumpstarting your research with AI penny stocks.

- Unlock tomorrow’s high achievers by targeting companies trading below their true value through undervalued stocks based on cash flows.

- Secure stronger portfolio income by pinpointing firms with above-average yields thanks to dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MMI

Marcus & Millichap

An investment brokerage company, provides real estate investment brokerage and financing services to sellers and buyers of commercial real estate in the United States and Canada.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives