- United States

- /

- Real Estate

- /

- NYSE:JLL

The Bull Case For Jones Lang LaSalle (JLL) Could Change Following Major Facilities Win With WestJet – Learn Why

Reviewed by Sasha Jovanovic

- WestJet, Canada’s leading low-cost airline, recently announced it selected Jones Lang LaSalle (JLL) to provide facilities management services for its 1.9-million-square-foot portfolio, covering its Calgary headquarters and 17 airport locations nationwide.

- This contract not only expands JLL's recurring revenue in the aviation sector but also highlights the growing demand for outsourced, integrated property management solutions among large corporate clients.

- We'll explore how winning the WestJet mandate strengthens JLL's recurring revenue profile and influences its future investment outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

Jones Lang LaSalle Investment Narrative Recap

To be a shareholder in Jones Lang LaSalle, you need to believe in the company’s ability to grow recurring revenue through integrated property management and outsourcing mandates, while navigating cyclical transactional markets. The WestJet contract meaningfully supports the most important near-term catalyst, expanding annuity-like revenue streams, but does not fully offset exposure to volatility in capital markets and leasing. However, the main risk remains that ongoing weakness in transactional segments could weigh on overall results if market conditions do not improve.

One relevant recent announcement is the appointment of Sam Schaefer as CEO of Property Management. His mandate to globalize and modernize JLL’s property management business comes at a time when large clients like WestJet seek integrated, efficient real estate solutions, supporting JLL’s push for higher margin, recurring revenue.

In contrast, investors should be aware of ongoing exposure to unpredictable revenue swings in JLL's Capital Markets and Leasing divisions if macroeconomic headwinds persist and...

Read the full narrative on Jones Lang LaSalle (it's free!)

Jones Lang LaSalle is forecast to reach $31.5 billion in revenue and $1.0 billion in earnings by 2028. This outlook assumes revenue grows at an annual rate of 8.4%, with earnings rising by about $436 million from the current $563.9 million.

Uncover how Jones Lang LaSalle's forecasts yield a $335.00 fair value, a 13% upside to its current price.

Exploring Other Perspectives

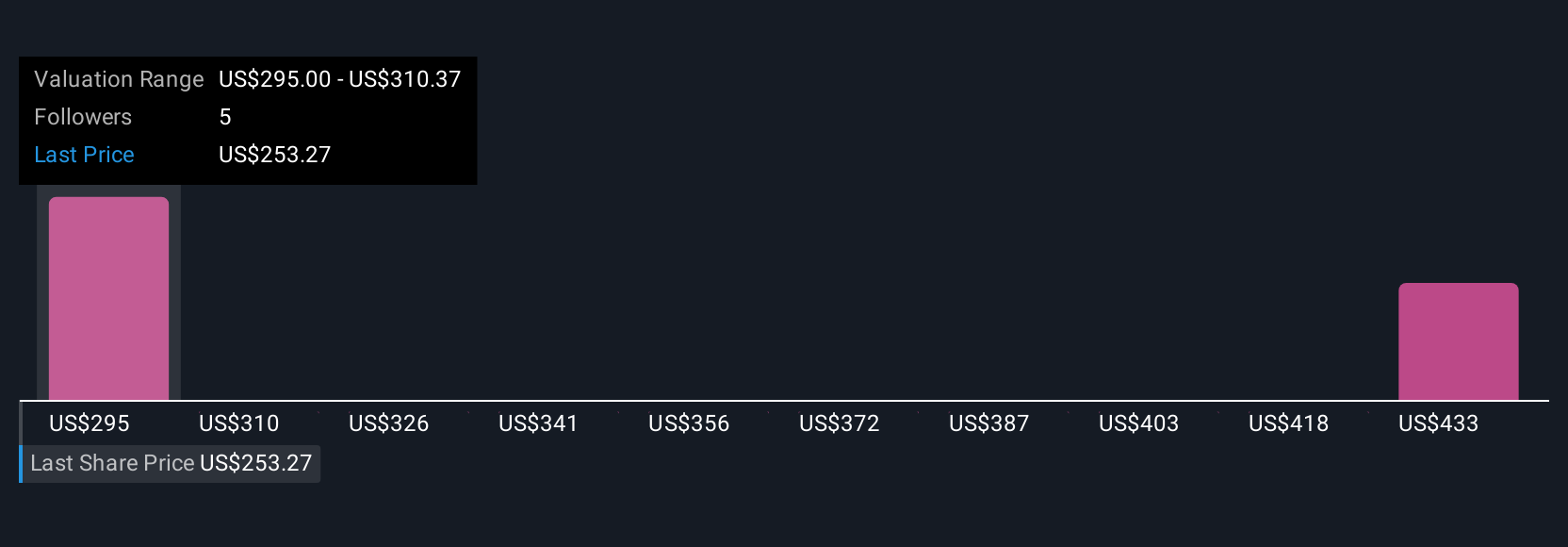

Fair value estimates from two Simply Wall St Community members range from US$335 to US$404.59 per share. Many see potential in the company's growing base of recurring contracts, but opinions vary widely on how this will impact overall returns and risk profiles.

Explore 2 other fair value estimates on Jones Lang LaSalle - why the stock might be worth just $335.00!

Build Your Own Jones Lang LaSalle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jones Lang LaSalle research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Jones Lang LaSalle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jones Lang LaSalle's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JLL

Jones Lang LaSalle

A commercial real estate and investment management company, engages in the buying, building, occupying, managing, and investing in commercial, industrial, hotel, residential, and retail properties in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives