- United States

- /

- Real Estate

- /

- NYSE:JLL

How WestJet’s Facility Management Deal Could Shape JLL’s Aviation Growth and Revenue Outlook

Reviewed by Sasha Jovanovic

- WestJet recently announced that it has chosen Jones Lang LaSalle (JLL) to provide facilities management services for its 1.9-million-square-foot Canadian portfolio, spanning corporate headquarters and 17 airport locations.

- This contract win highlights JLL's expanding presence in the aviation sector and its push to deliver comprehensive solutions that address evolving client needs.

- We'll examine how JLL’s addition of WestJet as a client impacts the company's growth story and future revenue visibility.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Jones Lang LaSalle Investment Narrative Recap

At its core, Jones Lang LaSalle appeals to those who believe in the company's ability to accelerate growth in recurring revenue streams through new outsourcing contracts and workplace management. The recent WestJet win adds a visible contract to JLL’s annuity-like business, but the impact on near-term revenue and margins is not expected to move the needle substantially given the company's much larger global portfolio. Risks tied to transaction activity in capital markets and leasing remain the main short-term focus for investors.

The appointment of Sam Schaefer as CEO of Property Management is particularly relevant, signaling a push for better execution, talent development, and client value in JLL’s recurring businesses. With Schaefer tasked to oversee global property management, the integration of large new clients like WestJet will be closely watched as a catalyst for growth in recurring revenues and improved margin stability for JLL.

Yet, despite these new wins, investors should not overlook the potential earnings volatility that can emerge if...

Read the full narrative on Jones Lang LaSalle (it's free!)

Jones Lang LaSalle's narrative projects $31.5 billion revenue and $1.0 billion earnings by 2028. This requires 8.4% yearly revenue growth and a $436 million earnings increase from current earnings of $563.9 million.

Uncover how Jones Lang LaSalle's forecasts yield a $341.11 fair value, a 20% upside to its current price.

Exploring Other Perspectives

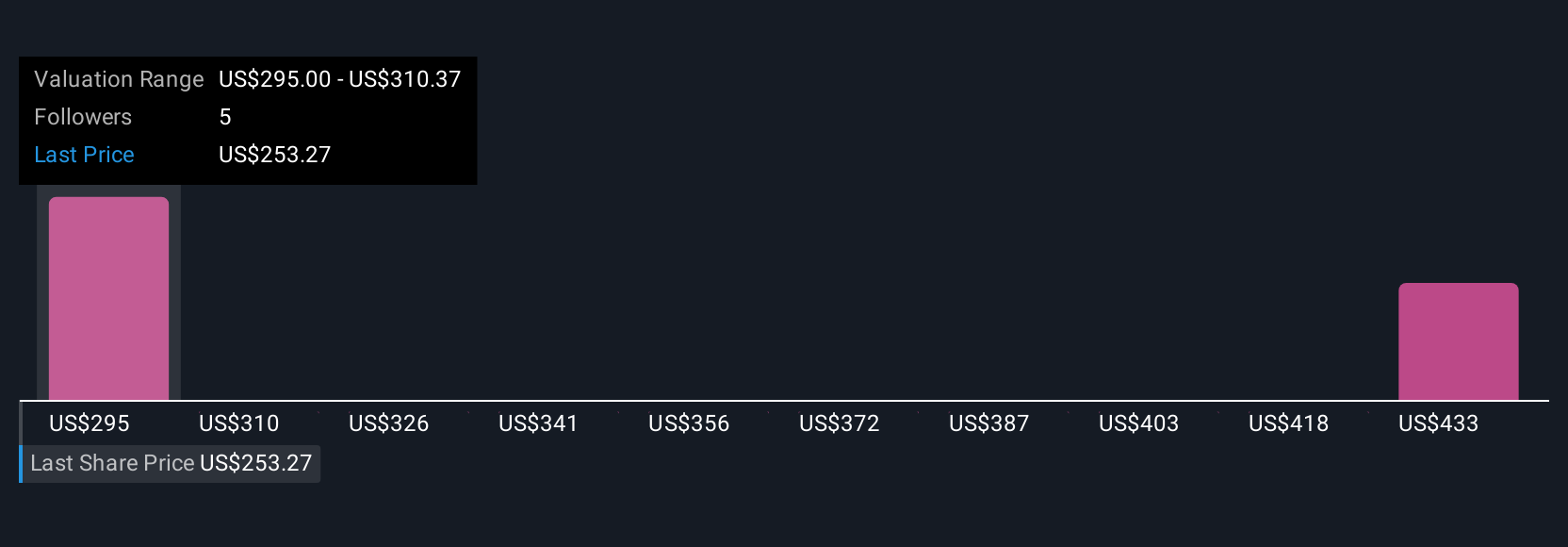

Simply Wall St Community members have published two fair value estimates for JLL in a US$341 to US$405 range. While contract wins support revenue visibility, persistent risks to transaction-driven fee income may weigh on overall performance, so consider the range of views on future growth.

Explore 2 other fair value estimates on Jones Lang LaSalle - why the stock might be worth just $341.11!

Build Your Own Jones Lang LaSalle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jones Lang LaSalle research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Jones Lang LaSalle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jones Lang LaSalle's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JLL

Jones Lang LaSalle

A commercial real estate and investment management company, engages in the buying, building, occupying, managing, and investing in commercial, industrial, hotel, residential, and retail properties in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives