- United States

- /

- Medical Equipment

- /

- NYSE:GKOS

Discovering GeneDx Holdings And Two Stocks Possibly Priced Below Estimated Value

Reviewed by Simply Wall St

As the Dow Jones, S&P 500, and Nasdaq continue to set new records despite the ongoing U.S. government shutdown, investors are keenly observing market dynamics for opportunities that may be flying under the radar. In this context of record-setting indices and economic uncertainty, identifying stocks that are potentially priced below their estimated value can provide a strategic advantage for investors seeking to optimize their portfolios amidst fluctuating market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Udemy (UDMY) | $6.84 | $13.44 | 49.1% |

| SLM (SLM) | $27.23 | $53.64 | 49.2% |

| Phibro Animal Health (PAHC) | $39.01 | $77.67 | 49.8% |

| Northwest Bancshares (NWBI) | $12.33 | $24.41 | 49.5% |

| Investar Holding (ISTR) | $22.70 | $45.37 | 50% |

| Hess Midstream (HESM) | $34.34 | $66.83 | 48.6% |

| HCI Group (HCI) | $189.77 | $376.13 | 49.5% |

| First Commonwealth Financial (FCF) | $16.75 | $32.97 | 49.2% |

| First Busey (BUSE) | $23.06 | $45.30 | 49.1% |

| Alnylam Pharmaceuticals (ALNY) | $460.99 | $889.36 | 48.2% |

We'll examine a selection from our screener results.

GeneDx Holdings (WGS)

Overview: GeneDx Holdings Corp. is a genomics company that provides genetic testing services and has a market cap of approximately $3.26 billion.

Operations: The company's revenue primarily comes from its Gene Dx segment, which generated $360.81 million.

Estimated Discount To Fair Value: 45.4%

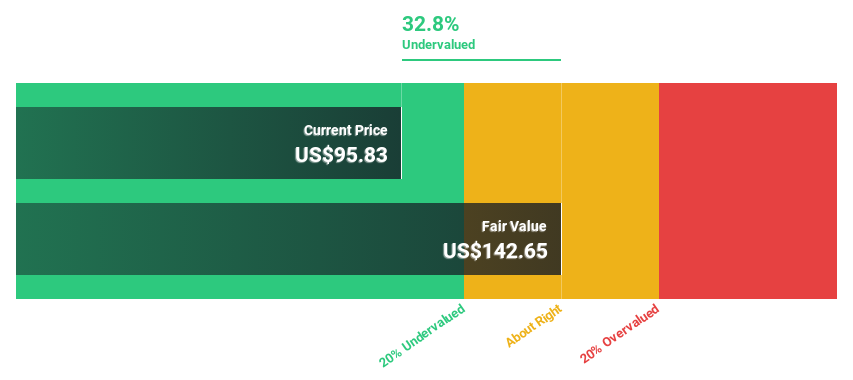

GeneDx Holdings is trading at 45.4% below its estimated fair value of US$214.8, with the current price at US$117.37, suggesting it may be undervalued based on discounted cash flow analysis. Despite significant insider selling recently, GeneDx's earnings are forecast to grow substantially at 46.86% annually, outpacing the broader U.S. market average growth rate of 15.4%. Recent initiatives like BEACONS highlight their strategic focus and potential for long-term revenue growth in genomic screening technologies.

- The growth report we've compiled suggests that GeneDx Holdings' future prospects could be on the up.

- Take a closer look at GeneDx Holdings' balance sheet health here in our report.

Glaukos (GKOS)

Overview: Glaukos Corporation is an ophthalmic pharmaceutical and medical technology company that develops therapies for glaucoma, corneal disorders, and retinal diseases globally, with a market cap of approximately $4.77 billion.

Operations: The company's revenue is derived from the development and commercialization of ophthalmic therapies, totaling $432.95 million.

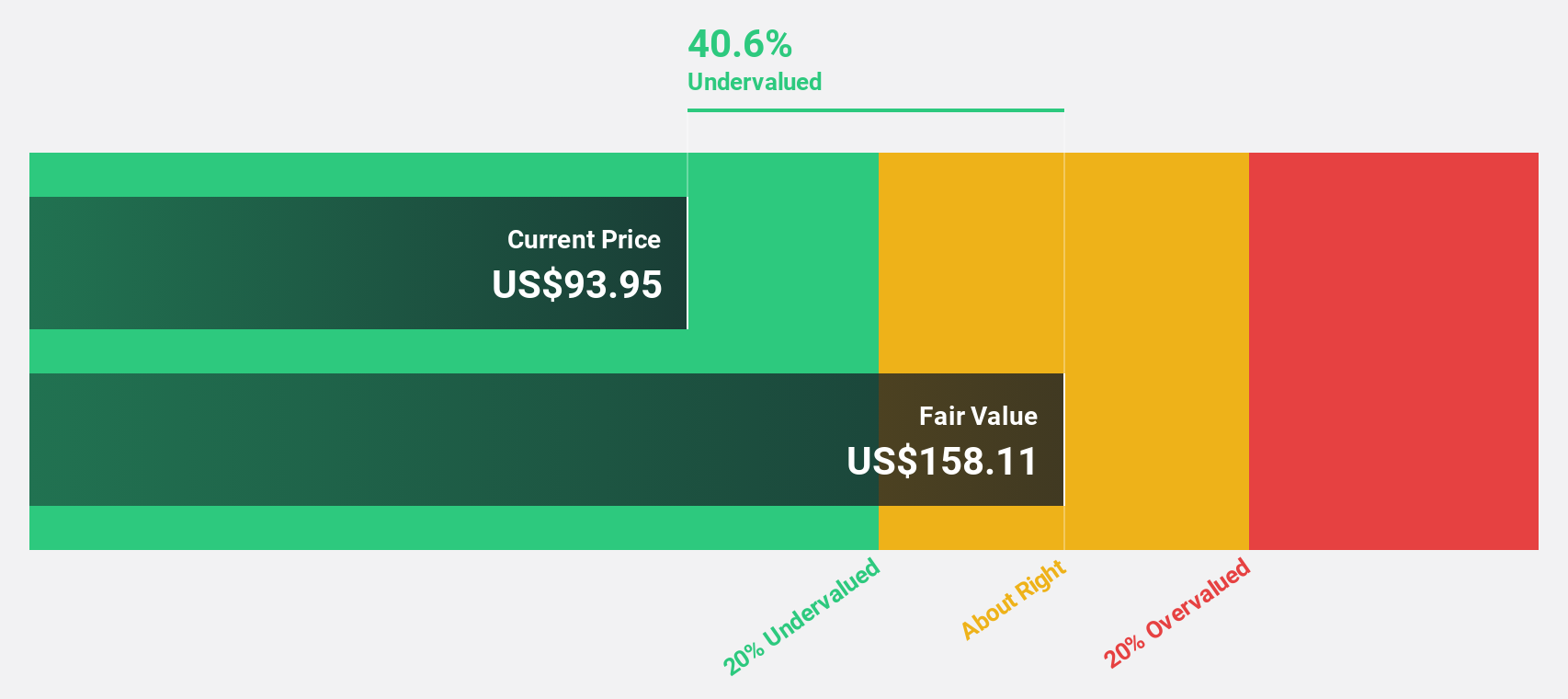

Estimated Discount To Fair Value: 47.8%

Glaukos, currently priced at US$84.49, is trading significantly below its estimated fair value of US$162, indicating potential undervaluation based on discounted cash flow analysis. The company's revenue is projected to grow at 19.2% annually, outpacing the broader U.S. market's growth rate of 9.8%. Although Glaukos has yet to achieve profitability, it is expected to do so within three years as earnings are forecasted to rise by 70.95% annually. Recent expansions and increased guidance underscore its strategic growth initiatives despite current losses.

- Our comprehensive growth report raises the possibility that Glaukos is poised for substantial financial growth.

- Get an in-depth perspective on Glaukos' balance sheet by reading our health report here.

Howard Hughes Holdings (HHH)

Overview: Howard Hughes Holdings Inc. develops and operates master planned communities in the United States, with a market cap of $5.07 billion.

Operations: The company's revenue segments include Strategic Developments at $783.86 million and Master Planned Communities (MPC) at $530.02 million.

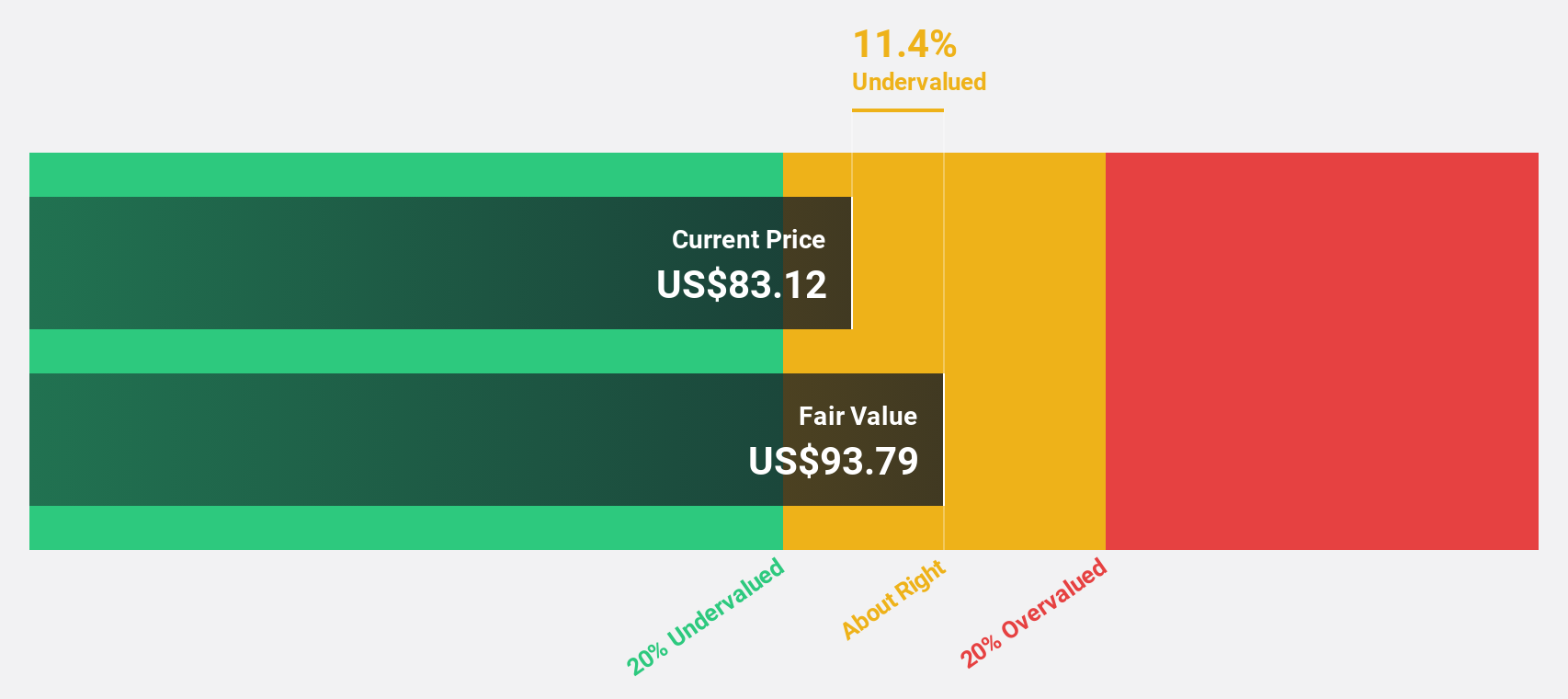

Estimated Discount To Fair Value: 10.9%

Howard Hughes Holdings, trading at US$84.31, is slightly undervalued compared to its fair value of US$94.64 based on discounted cash flow analysis. Despite recent losses and shareholder dilution, earnings are projected to grow significantly at 23.2% annually, surpassing the U.S. market's growth rate of 15.4%. However, debt coverage by operating cash flow remains a concern. Recent board changes with experienced leaders could positively influence strategic direction and financial performance improvements.

- According our earnings growth report, there's an indication that Howard Hughes Holdings might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Howard Hughes Holdings.

Taking Advantage

- Unlock more gems! Our Undervalued US Stocks Based On Cash Flows screener has unearthed 200 more companies for you to explore.Click here to unveil our expertly curated list of 203 Undervalued US Stocks Based On Cash Flows.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GKOS

Glaukos

An ophthalmic pharmaceutical and medical technology company, develops therapies for the treatment of glaucoma, corneal disorders, and retinal diseases in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives