- United States

- /

- Biotech

- /

- NasdaqGS:PRLD

Penny Stocks To Consider In December 2025

Reviewed by Simply Wall St

As December 2025 begins, U.S. stock indexes have slipped, with major tech and cryptocurrency-tied shares experiencing declines amid a broader risk-off sentiment in the market. Despite this cautious atmosphere, investors continue to explore opportunities beyond the well-known large-cap stocks. Penny stocks, though often considered a relic of past market eras, remain relevant for those seeking affordable entry points into companies with growth potential and strong financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.72 | $368.6M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.795 | $650.99M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.847 | $144.85M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $3.285 | $553.59M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.25 | $1.36B | ✅ 5 ⚠️ 1 View Analysis > |

| FinVolution Group (FINV) | $4.99 | $1.26B | ✅ 3 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.50 | $584.17M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 1 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.837 | $6.08M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.81 | $86.32M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 345 stocks from our US Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Nautilus Biotechnology (NAUT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nautilus Biotechnology, Inc. is a development stage life sciences company focused on creating a platform technology to analyze the complexity of the proteome, with a market cap of approximately $284.19 million.

Operations: Currently, there are no reported revenue segments for this development stage life sciences company.

Market Cap: $284.19M

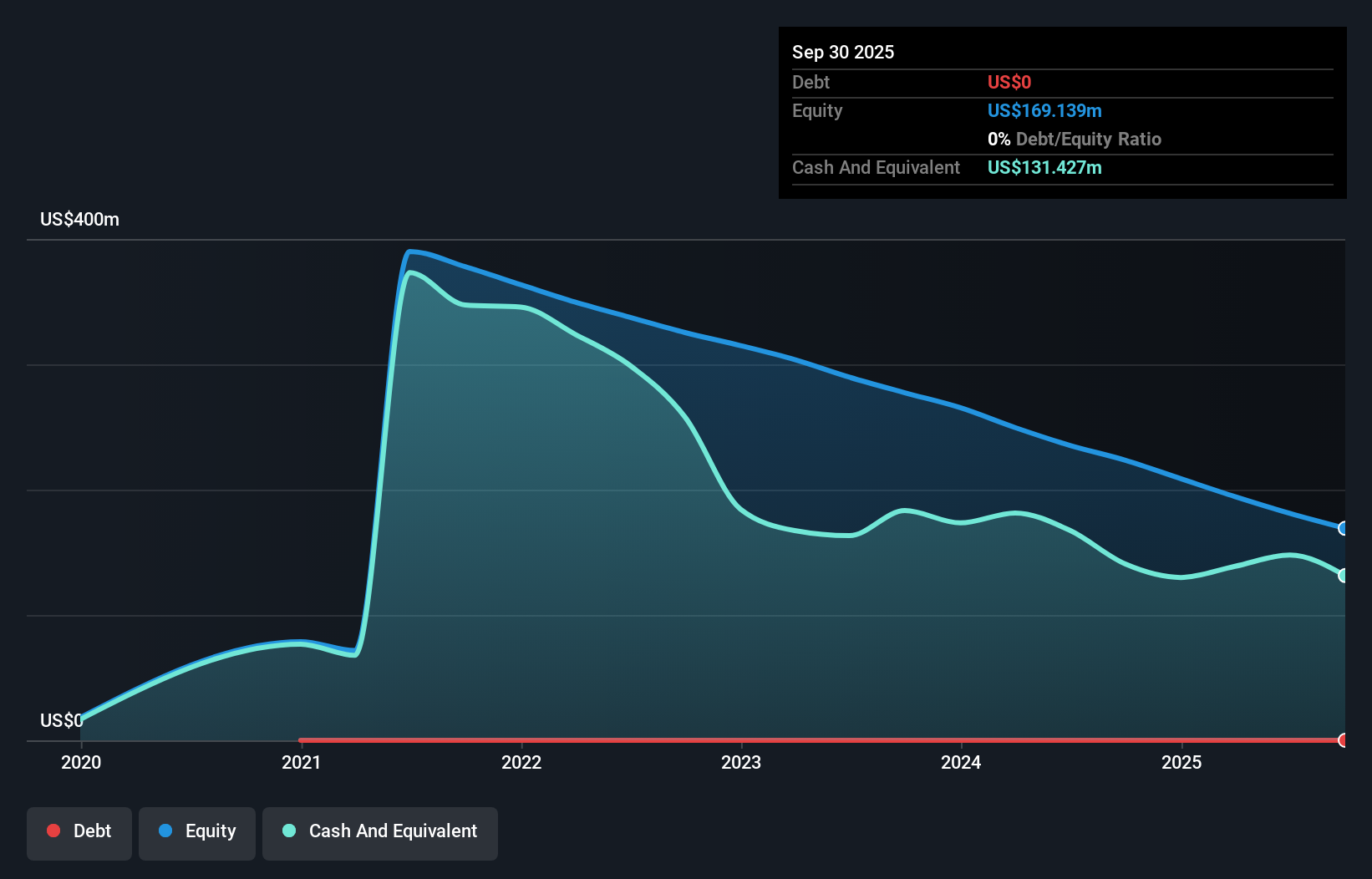

Nautilus Biotechnology, Inc., a pre-revenue company with a market cap of US$284.19 million, has recently achieved a significant milestone by installing its first external field evaluation unit at the Buck Institute for Research on Aging. This development showcases Nautilus' potential in single-molecule proteomics, particularly in neurodegenerative research. Despite being unprofitable and experiencing volatility, Nautilus maintains strong short-term assets (US$134.3M) exceeding liabilities and is debt-free. While earnings are forecast to decline over the next three years, the company has sufficient cash runway for over two years based on current free cash flow trends.

- Take a closer look at Nautilus Biotechnology's potential here in our financial health report.

- Explore Nautilus Biotechnology's analyst forecasts in our growth report.

Prelude Therapeutics (PRLD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Prelude Therapeutics Incorporated is a clinical-stage precision oncology company dedicated to discovering and developing novel cancer medicines for underserved patients, with a market cap of $138.43 million.

Operations: Prelude Therapeutics generates its revenue from the biotechnology (startups) segment, totaling $10.5 million.

Market Cap: $138.43M

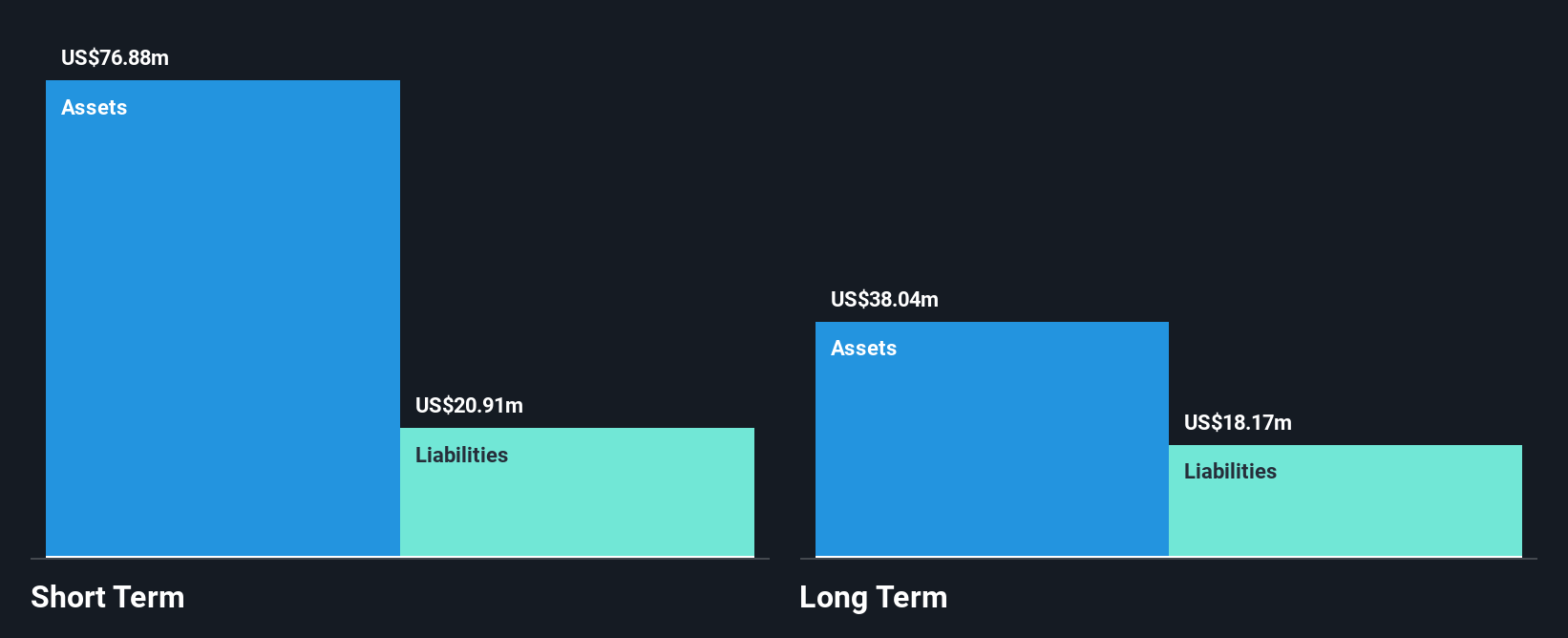

Prelude Therapeutics, with a market cap of US$138.43 million, is navigating the challenges typical of penny stocks in the biotech sector. The company reported third-quarter sales of US$6.5 million, up from US$3 million a year ago, yet remains unprofitable with significant net losses. Despite this, Prelude's short-term assets (US$58.3M) comfortably cover both its short and long-term liabilities and it remains debt-free. Recent strategic moves include a private placement raising US$25 million and leadership changes to strengthen clinical development as they advance key oncology programs towards human trials. However, volatility persists with increased weekly fluctuations in share price.

- Dive into the specifics of Prelude Therapeutics here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Prelude Therapeutics' future.

Douglas Elliman (DOUG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Douglas Elliman Inc. operates in the United States, focusing on real estate services and property technology investments, with a market cap of approximately $235.37 million.

Operations: The company's revenue is primarily generated from its real estate brokerage segment, which accounts for $1.03 billion.

Market Cap: $235.37M

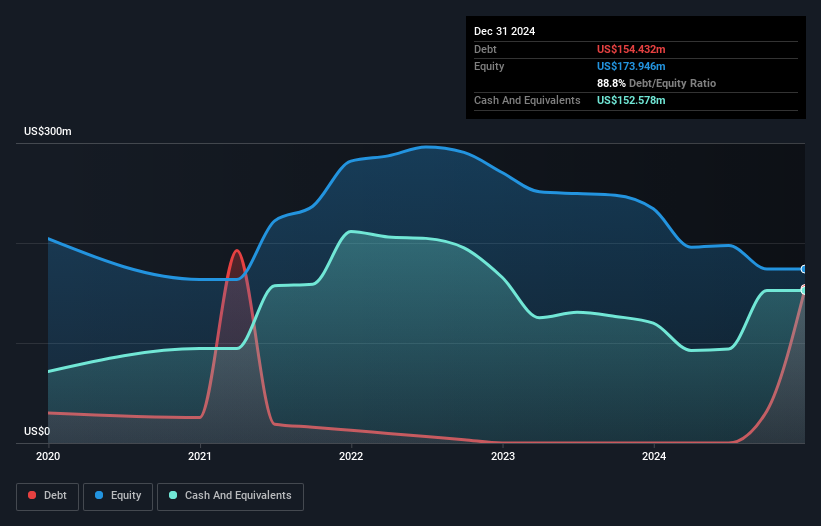

Douglas Elliman Inc., with a market cap of US$235.37 million, is navigating the complexities of the real estate sector amidst ongoing losses. Recent third-quarter revenues stood at US$262.84 million, slightly down from last year, while net losses narrowed to US$24.69 million. The company has launched innovative tools like Elli AI and expanded its Estate, Trust & Probate Division to enhance service offerings and market reach. Despite having more cash than debt and stable weekly volatility, Douglas Elliman remains unprofitable with negative return on equity and insufficient short-term assets to cover long-term liabilities.

- Jump into the full analysis health report here for a deeper understanding of Douglas Elliman.

- Learn about Douglas Elliman's historical performance here.

Next Steps

- Click here to access our complete index of 345 US Penny Stocks.

- Looking For Alternative Opportunities? Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PRLD

Prelude Therapeutics

A clinical-stage precision oncology company, focuses on the discovery and development of novel precision cancer medicines to underserved patients.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026