- United States

- /

- Real Estate

- /

- NYSE:COMP

Compass, Inc. (NYSE:COMP) Soars 55% But It's A Story Of Risk Vs Reward

Compass, Inc. (NYSE:COMP) shareholders would be excited to see that the share price has had a great month, posting a 55% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 61% in the last year.

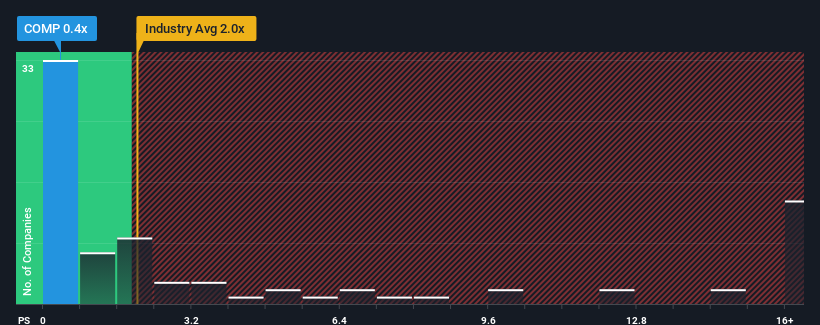

Although its price has surged higher, Compass' price-to-sales (or "P/S") ratio of 0.4x might still make it look like a buy right now compared to the Real Estate industry in the United States, where around half of the companies have P/S ratios above 2x and even P/S above 10x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Compass

What Does Compass' Recent Performance Look Like?

Compass could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Compass.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Compass would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 25% decrease to the company's top line. Still, the latest three year period has seen an excellent 32% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 11% per annum over the next three years. That's shaping up to be similar to the 11% each year growth forecast for the broader industry.

In light of this, it's peculiar that Compass' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From Compass' P/S?

The latest share price surge wasn't enough to lift Compass' P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It looks to us like the P/S figures for Compass remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

Having said that, be aware Compass is showing 3 warning signs in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:COMP

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives