- United States

- /

- Healthtech

- /

- NasdaqGS:WAY

3 Stocks Possibly Priced Below Their Estimated Worth In May 2025

Reviewed by Simply Wall St

As the U.S. stock market experiences a notable surge, with the S&P 500 on track for its longest winning streak since 2004 and optimism surrounding trade talks with China, investors are increasingly focused on identifying opportunities amidst fluctuating economic conditions. In this environment, stocks that appear to be priced below their estimated worth can present compelling prospects, offering potential value as the market navigates through complex trade dynamics and strong corporate earnings reports.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| MINISO Group Holding (NYSE:MNSO) | $18.20 | $34.93 | 47.9% |

| ConnectOne Bancorp (NasdaqGS:CNOB) | $22.75 | $45.38 | 49.9% |

| Lantheus Holdings (NasdaqGM:LNTH) | $105.92 | $204.25 | 48.1% |

| Ready Capital (NYSE:RC) | $4.48 | $8.65 | 48.2% |

| Curbline Properties (NYSE:CURB) | $23.18 | $44.84 | 48.3% |

| Tenable Holdings (NasdaqGS:TENB) | $30.74 | $59.71 | 48.5% |

| BigCommerce Holdings (NasdaqGM:BIGC) | $5.22 | $10.35 | 49.6% |

| StoneCo (NasdaqGS:STNE) | $13.89 | $27.47 | 49.4% |

| Verra Mobility (NasdaqCM:VRRM) | $21.71 | $42.94 | 49.4% |

| Viking Holdings (NYSE:VIK) | $40.93 | $80.03 | 48.9% |

Let's review some notable picks from our screened stocks.

Waystar Holding (NasdaqGS:WAY)

Overview: Waystar Holding Corp. develops cloud-based software solutions for healthcare payments and has a market cap of approximately $6.43 billion.

Operations: Waystar Holding Corp. generates revenue through its cloud-based software solutions designed for healthcare payments.

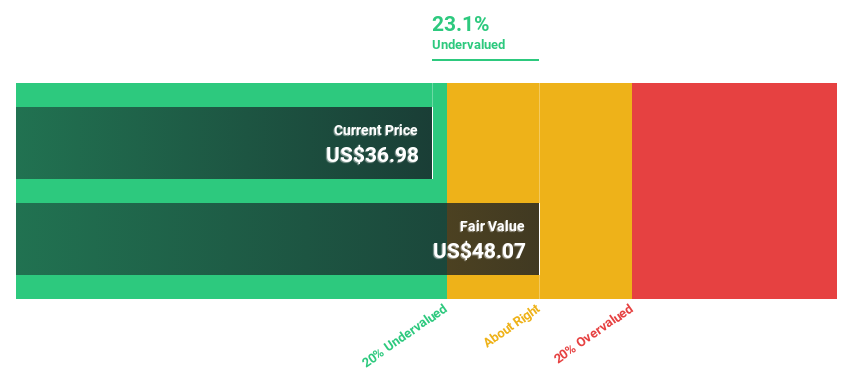

Estimated Discount To Fair Value: 16.8%

Waystar Holding, trading at US$39.46, is undervalued with a fair value estimate of US$47.43, offering potential upside. The company became profitable this year and forecasts indicate significant annual earnings growth of 31.9%, outpacing the market's 13.7%. Recent quarterly results showed a net income of US$29.27 million compared to a loss last year, reflecting strong financial health and improved cash flows driven by innovative AI solutions in healthcare payments.

- Insights from our recent growth report point to a promising forecast for Waystar Holding's business outlook.

- Get an in-depth perspective on Waystar Holding's balance sheet by reading our health report here.

CBIZ (NYSE:CBZ)

Overview: CBIZ, Inc. offers financial, insurance, and advisory services across the United States and Canada with a market cap of approximately $3.64 billion.

Operations: The company generates revenue through its Financial Services segment ($1.70 billion), Benefits and Insurance Services ($405.62 million), and National Practices ($48.00 million).

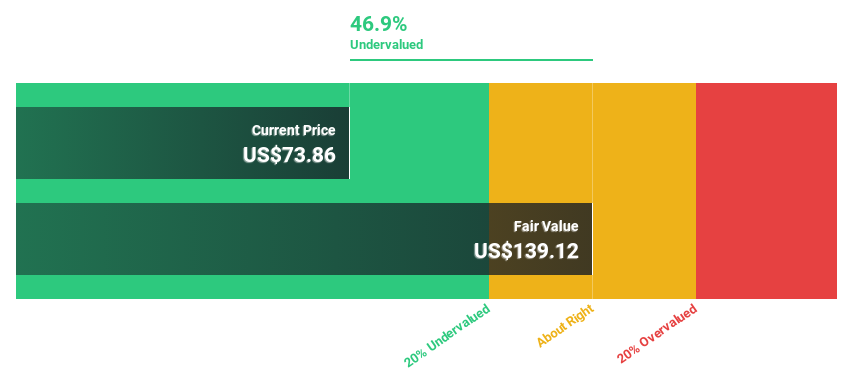

Estimated Discount To Fair Value: 47.8%

CBIZ, trading at US$69.86, is significantly undervalued with a fair value estimate of US$133.87. Despite recent challenges in non-recurring service lines due to economic uncertainties, its first-quarter revenue surged to US$838.01 million from last year's US$494.3 million, and net income rose sharply to US$122.77 million. Forecasted earnings growth of 40.6% annually surpasses market expectations, but insider selling and debt coverage issues present concerns for investors evaluating cash flow strength.

- According our earnings growth report, there's an indication that CBIZ might be ready to expand.

- Click to explore a detailed breakdown of our findings in CBIZ's balance sheet health report.

Compass (NYSE:COMP)

Overview: Compass, Inc. operates as a real estate brokerage service provider in the United States with a market cap of approximately $4 billion.

Operations: The company generates revenue from its Internet Information Providers segment, amounting to $5.63 billion.

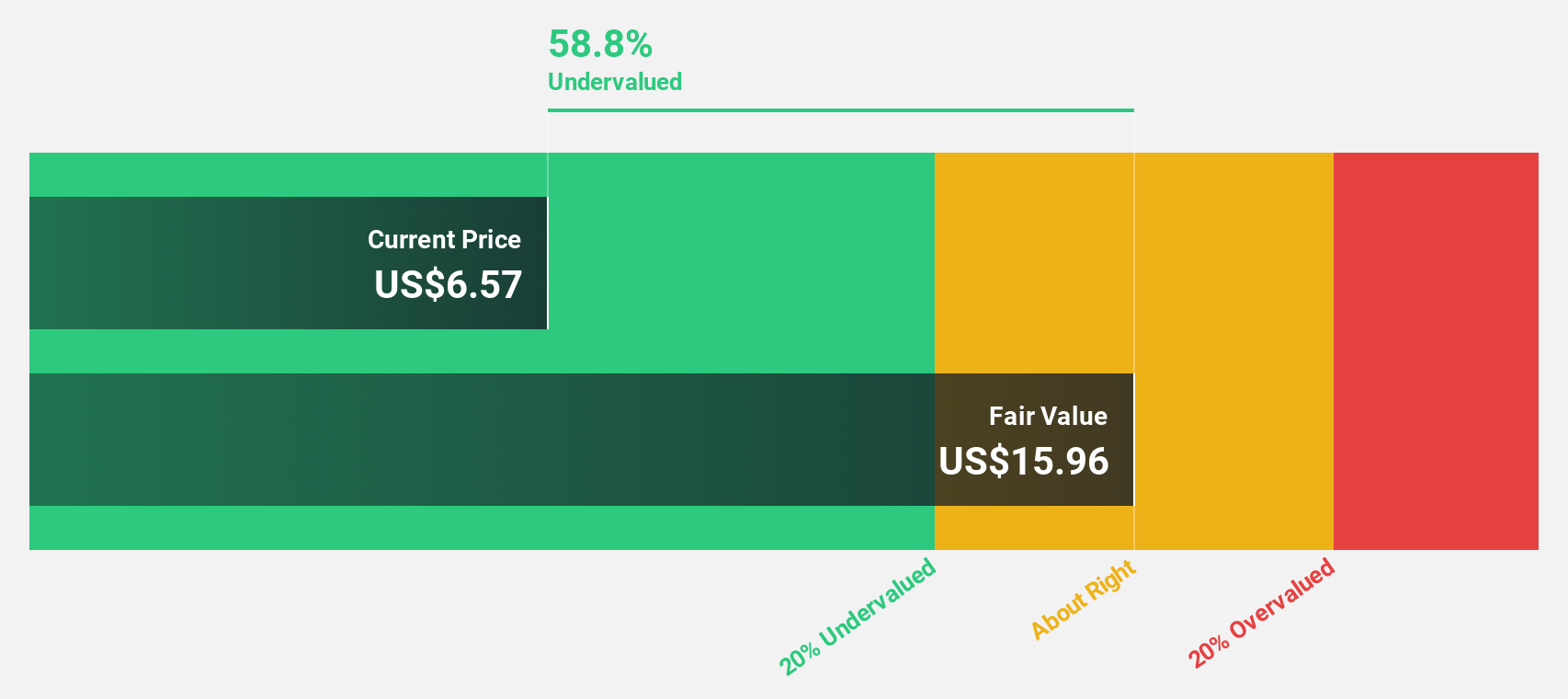

Estimated Discount To Fair Value: 17.5%

Compass is trading at US$7.83, below its fair value estimate of US$9.49, suggesting it is undervalued based on cash flows. Despite a net loss of US$154.4 million for 2024, this was an improvement from the previous year's loss of US$321.3 million, and earnings are forecast to grow significantly over the next three years. Recent M&A discussions could enhance market position amid slow home sales, while Compass One aims to streamline real estate transactions.

- The analysis detailed in our Compass growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Compass stock in this financial health report.

Taking Advantage

- Investigate our full lineup of 179 Undervalued US Stocks Based On Cash Flows right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Waystar Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Waystar Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WAY

Waystar Holding

Develops a cloud-based software solution for healthcare payments.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives