- United States

- /

- Real Estate

- /

- NYSE:BEKE

KE Holdings (NYSE:BEKE) Sees 12% Price Increase Over Quarter Despite Net Income Drop

Reviewed by Simply Wall St

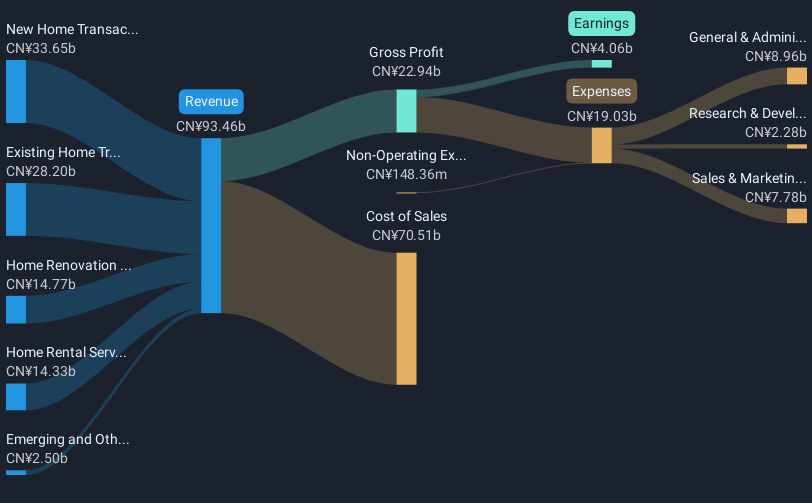

KE Holdings (NYSE:BEKE) recently announced its fourth quarter and full-year earnings for 2024, showing significant revenue growth of 54% year-over-year for the quarter, although net income declined by 15%. Additionally, the company implemented a share buyback program, repurchasing approximately 21 million shares in the last quarter, which may have impacted its total return. Meanwhile, the broader market saw tech stocks drive moderate gains in key indexes, recovering from recent declines. Despite a decrease in earnings, KE Holdings experienced a 12% price increase over the last quarter, suggesting investor confidence in its future prospects.

Buy, Hold or Sell KE Holdings? View our complete analysis and fair value estimate and you decide.

Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

Over the last three years, KE Holdings has delivered a total shareholder return of 75.55%, reflecting a significant appreciation in share value and dividends. This period saw strategic moves such as the implementation of share buyback programs which began in August 2022 and totaled 123.1 million shares repurchased by December 2024 for US$1.63 billion. These buybacks effectively reduced the share count, thus enhancing per-share earnings and potentially investor sentiment.

AI integration and market expansion were also key developments driving performance. The company focused on improving operational efficiency and customer experience through AI-driven strategies, leading to increased revenue and growth in its home-related services. KE Holdings also outperformed the US Real Estate industry, which returned 13.4% over the past year, emphasizing its solid standing despite the challenges in the Chinese real estate market. Additionally, increases in dividends, like the annual US$0.36 per share announced in March 2025, supported shareholder returns further.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade KE Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if KE Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BEKE

KE Holdings

Through its subsidiaries, engages in operating an integrated online and offline platform for housing transactions and services in the People's Republic of China.

Flawless balance sheet and fair value.