- United States

- /

- Software

- /

- NasdaqGS:INTU

3 US Stocks That May Be Trading Below Their Estimated Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market reaches record highs, with the S&P 500 and Dow Jones Industrial Average posting their largest monthly gains of 2024, investors are increasingly interested in identifying stocks that may be trading below their intrinsic value. In this environment of optimism and heightened valuations, discerning a stock's true worth involves assessing its fundamentals against current market conditions to uncover potential opportunities for long-term growth.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| NBT Bancorp (NasdaqGS:NBTB) | $50.12 | $99.93 | 49.8% |

| UMB Financial (NasdaqGS:UMBF) | $125.49 | $243.56 | 48.5% |

| West Bancorporation (NasdaqGS:WTBA) | $23.87 | $46.83 | 49% |

| Business First Bancshares (NasdaqGS:BFST) | $28.50 | $55.00 | 48.2% |

| Five Star Bancorp (NasdaqGS:FSBC) | $32.95 | $63.89 | 48.4% |

| Advanced Energy Industries (NasdaqGS:AEIS) | $115.04 | $219.53 | 47.6% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.40 | $30.26 | 49.1% |

| Snap (NYSE:SNAP) | $11.81 | $22.80 | 48.2% |

| Progress Software (NasdaqGS:PRGS) | $68.41 | $132.04 | 48.2% |

| Hesai Group (NasdaqGS:HSAI) | $8.18 | $16.30 | 49.8% |

Let's take a closer look at a couple of our picks from the screened companies.

Intuit (NasdaqGS:INTU)

Overview: Intuit Inc. offers financial management, compliance, and marketing products and services in the United States with a market cap of approximately $179.71 billion.

Operations: The company's revenue segments include Pro-Tax at $596 million, Consumer at $4.43 billion, Credit Karma at $1.83 billion, and Global Business Solutions at $9.73 billion.

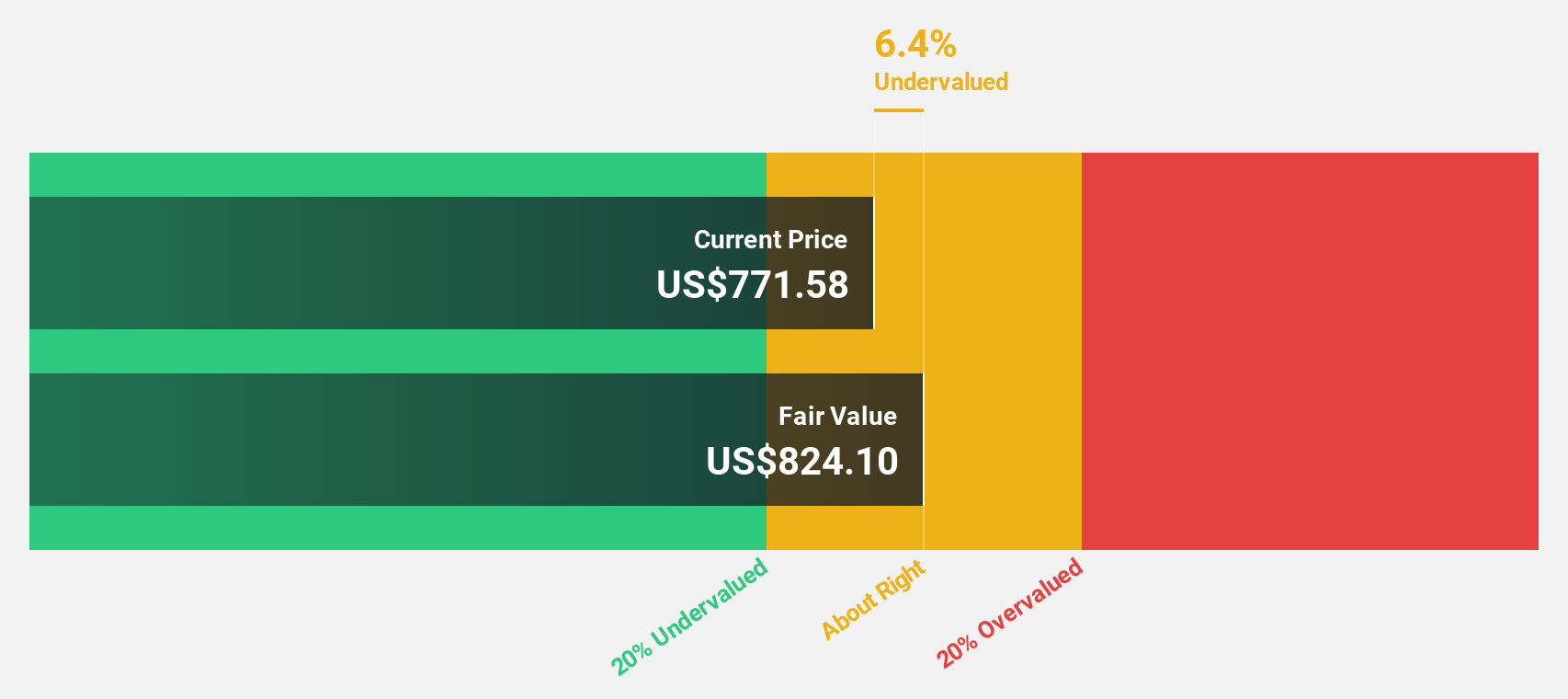

Estimated Discount To Fair Value: 30.6%

Intuit is trading at US$641.73, which is 30.6% below its estimated fair value of US$924.75, indicating potential undervaluation based on cash flows. The company's revenue for the first quarter was US$3.28 billion, up from US$2.98 billion a year ago, though net income decreased to US$197 million from US$241 million. Intuit's earnings are forecasted to grow annually by 17.4%, outpacing the broader U.S market growth rate of 15.4%.

- In light of our recent growth report, it seems possible that Intuit's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Intuit's balance sheet health report.

KE Holdings (NYSE:BEKE)

Overview: KE Holdings Inc. operates an integrated online and offline platform for housing transactions and services in China, with a market cap of approximately $22.79 billion.

Operations: The company's revenue segments include CN¥28.15 billion from New Home Transaction Services, CN¥25.33 billion from Existing Home Transaction Services, CN¥14.30 billion from Home Renovation and Furnishing, and CN¥8.91 billion from Emerging and Other Services (excluding Home Renovation and Furnishing).

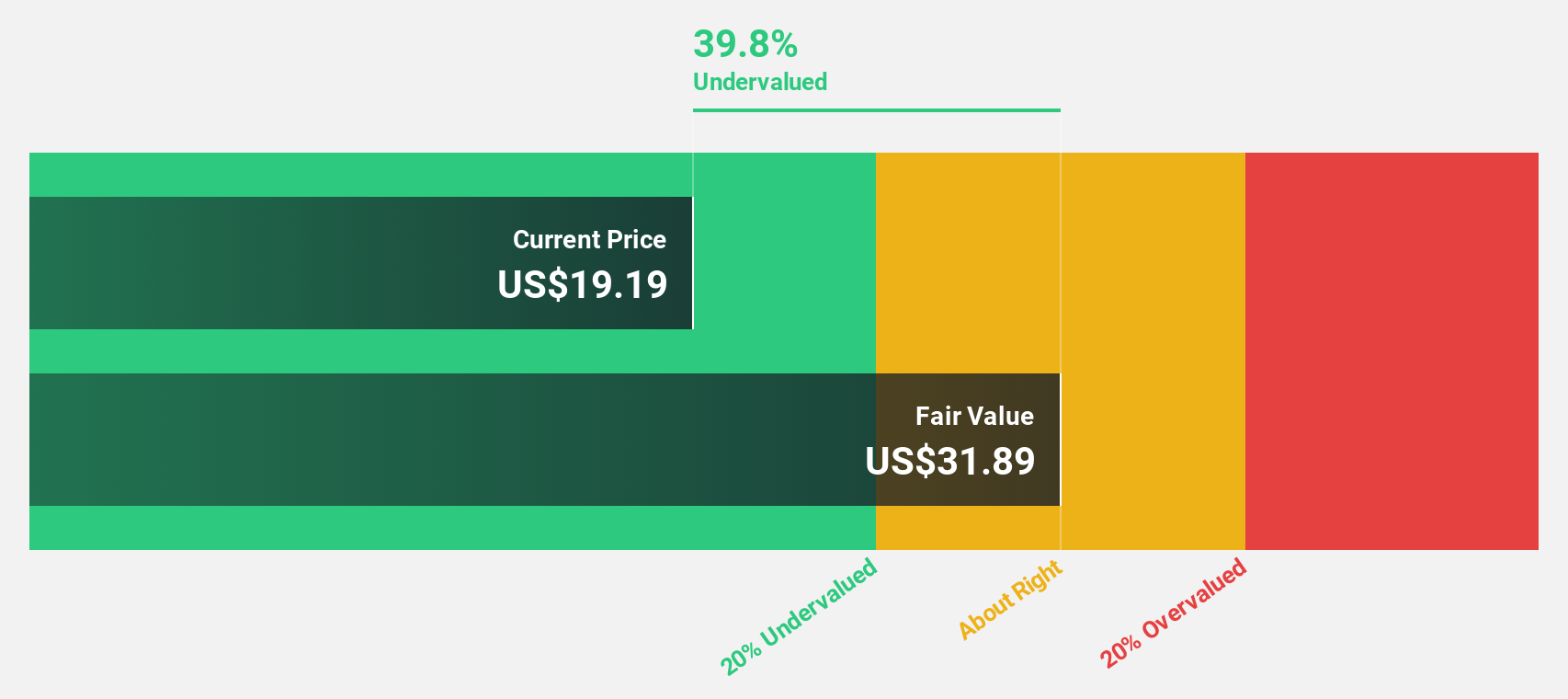

Estimated Discount To Fair Value: 31.7%

KE Holdings, trading at $18.85, is valued 31.7% below its estimated fair value of $27.59, suggesting it may be undervalued based on cash flows. Despite a volatile share price and declining profit margins from 7.5% to 5%, revenue grew significantly in the third quarter to CNY 22,584.65 million from CNY 17,810.71 million a year ago. The company completed a substantial buyback program worth $1,493.4 million for over 102 million shares.

- According our earnings growth report, there's an indication that KE Holdings might be ready to expand.

- Dive into the specifics of KE Holdings here with our thorough financial health report.

Fidelity National Information Services (NYSE:FIS)

Overview: Fidelity National Information Services, Inc. (NYSE:FIS) is a leading provider of technology solutions for merchants, banks, and capital markets firms globally with a market cap of approximately $45.92 billion.

Operations: The company's revenue segments include Banking Solutions at $6.86 billion and Capital Market Solutions at $2.91 billion.

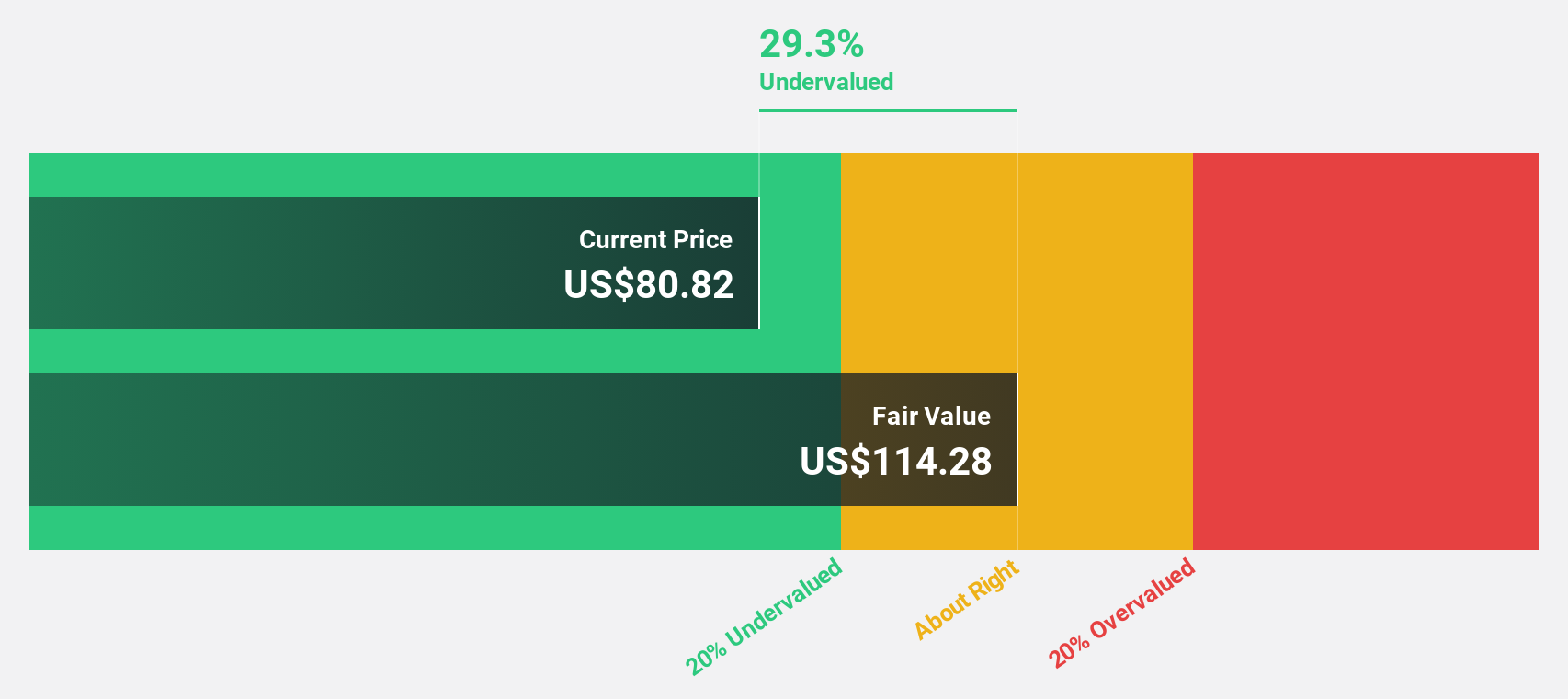

Estimated Discount To Fair Value: 23.7%

Fidelity National Information Services is trading at US$85.3, over 23% below its estimated fair value of US$111.74, highlighting potential undervaluation based on cash flows. Despite slower revenue growth forecasts compared to the market and a high debt level, earnings are projected to grow significantly at 24.9% annually. Recent third-quarter results showed a shift from a net loss to a net income of US$224 million, although large one-off items affected financials.

- Our expertly prepared growth report on Fidelity National Information Services implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Fidelity National Information Services' balance sheet by reading our health report here.

Next Steps

- Click this link to deep-dive into the 185 companies within our Undervalued US Stocks Based On Cash Flows screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTU

Intuit

Provides financial management, compliance, and marketing products and services in the United States.

Excellent balance sheet with reasonable growth potential.