- United States

- /

- Real Estate

- /

- NasdaqCM:RITR

US Market's Hidden Gems: 3 Small Caps with Strong Potential

Reviewed by Simply Wall St

The United States market has shown robust performance recently, rising 2.1% in the last week and 14% over the past year, with all sectors seeing gains. In such an environment, identifying small-cap stocks with strong potential can be particularly rewarding as these companies often offer unique growth opportunities that align well with anticipated earnings growth trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| West Bancorporation | 169.96% | -1.41% | -8.52% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Wilson Bank Holding | 0.00% | 7.88% | 8.09% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| Senstar Technologies | NA | -20.82% | 14.32% | ★★★★★★ |

| China SXT Pharmaceuticals | 64.25% | -29.05% | 10.33% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Reitar Logtech Holdings (RITR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Reitar Logtech Holdings Limited, with a market cap of $330.95 million, operates through its subsidiaries to offer construction management and engineering design services.

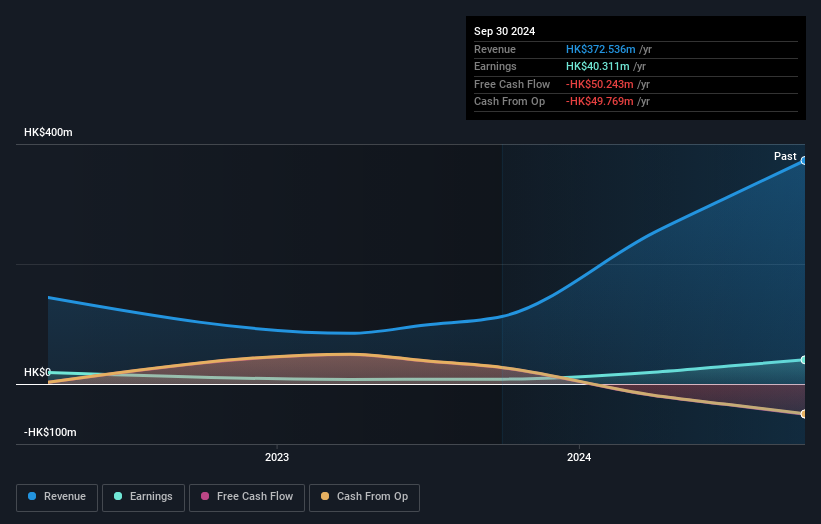

Operations: Reitar Logtech Holdings generates revenue primarily from construction and engineering services, amounting to HK$358.56 million. The company has a market capitalization of $330.95 million.

Reitar Logtech Holdings, a small-cap player in logistics technology, has shown impressive earnings growth of 398.7% over the past year, significantly outpacing the Real Estate industry's 25.8%. The company's interest payments are well covered with EBIT at 35.7 times coverage, and its net debt to equity ratio stands at a satisfactory 14.5%. Recent strategic moves include a non-binding MOU with Rich Harvest Agricultural Produce to integrate blockchain and smart cold chain technologies in agricultural supply chains and plans for acquisitions within smart logistics ecosystems. Despite these strengths, Reitar's share price has been highly volatile recently.

- Click to explore a detailed breakdown of our findings in Reitar Logtech Holdings' health report.

Assess Reitar Logtech Holdings' past performance with our detailed historical performance reports.

Yuanbao (YB)

Simply Wall St Value Rating: ★★★★★★

Overview: Yuanbao Inc. operates as an online insurance distribution and services company in the People’s Republic of China, with a market capitalization of approximately $1 billion.

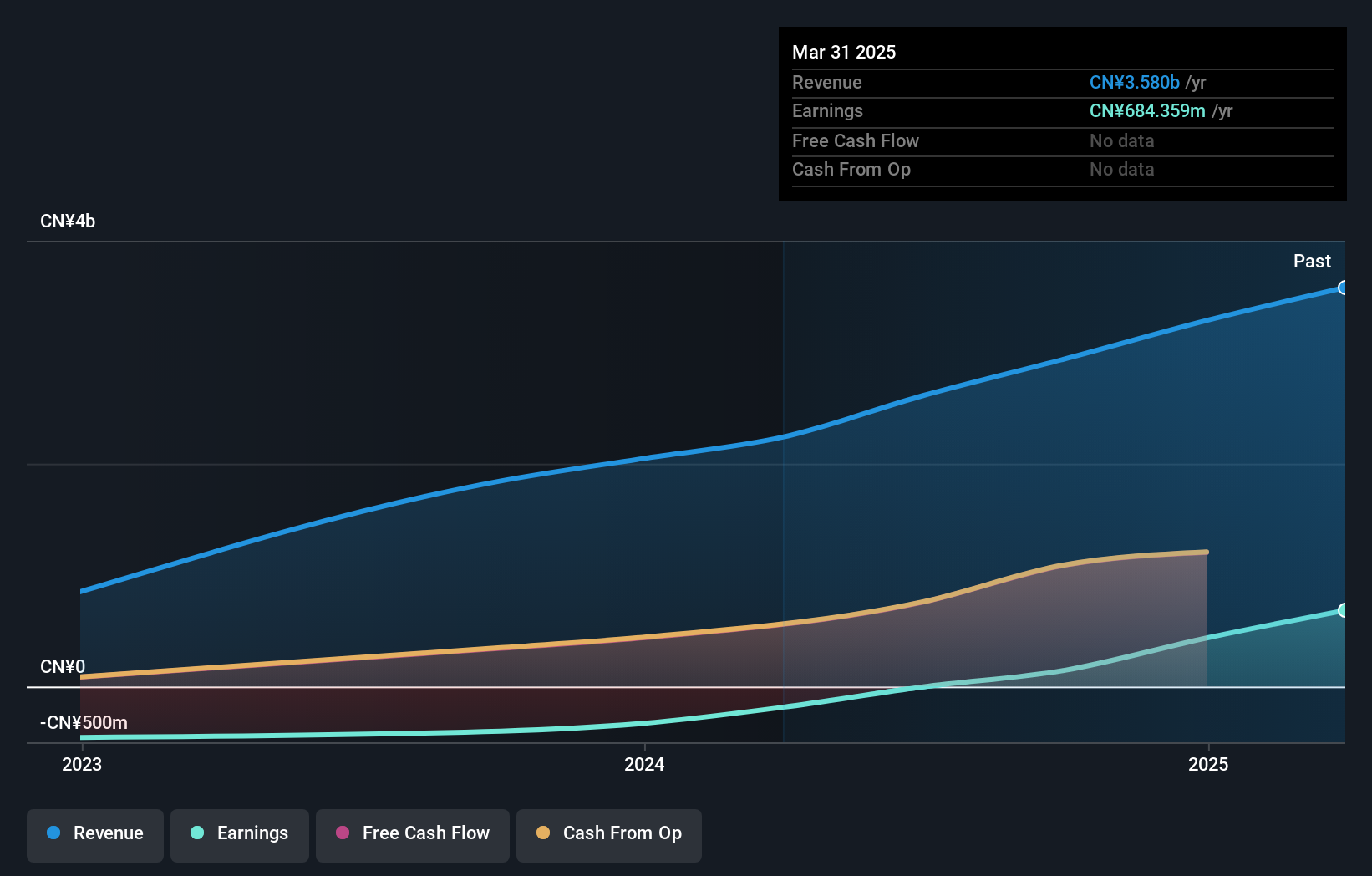

Operations: Yuanbao generates revenue primarily from its insurance brokers segment, which accounted for CN¥3.58 billion. The company's net profit margin was 12% during the last reported period.

Yuanbao, a rising player recently added to the NASDAQ Composite Index, is showcasing some impressive numbers. The company reported CNY 970 million in sales and a net income of CNY 295 million for Q1 2025, both significantly up from the previous year. Basic earnings per share jumped to CNY 17.88 from CNY 4.98, while diluted earnings per share rose to CNY 6.48 from CNY 2.94. With no debt on its books and trading at over three-quarters below estimated fair value, Yuanbao seems poised as an intriguing prospect following its recent $30 million IPO completion in April.

- Delve into the full analysis health report here for a deeper understanding of Yuanbao.

Gain insights into Yuanbao's historical performance by reviewing our past performance report.

REX American Resources (REX)

Simply Wall St Value Rating: ★★★★★★

Overview: REX American Resources Corporation, along with its subsidiaries, focuses on the production and sale of ethanol in the United States and has a market capitalization of approximately $868.90 million.

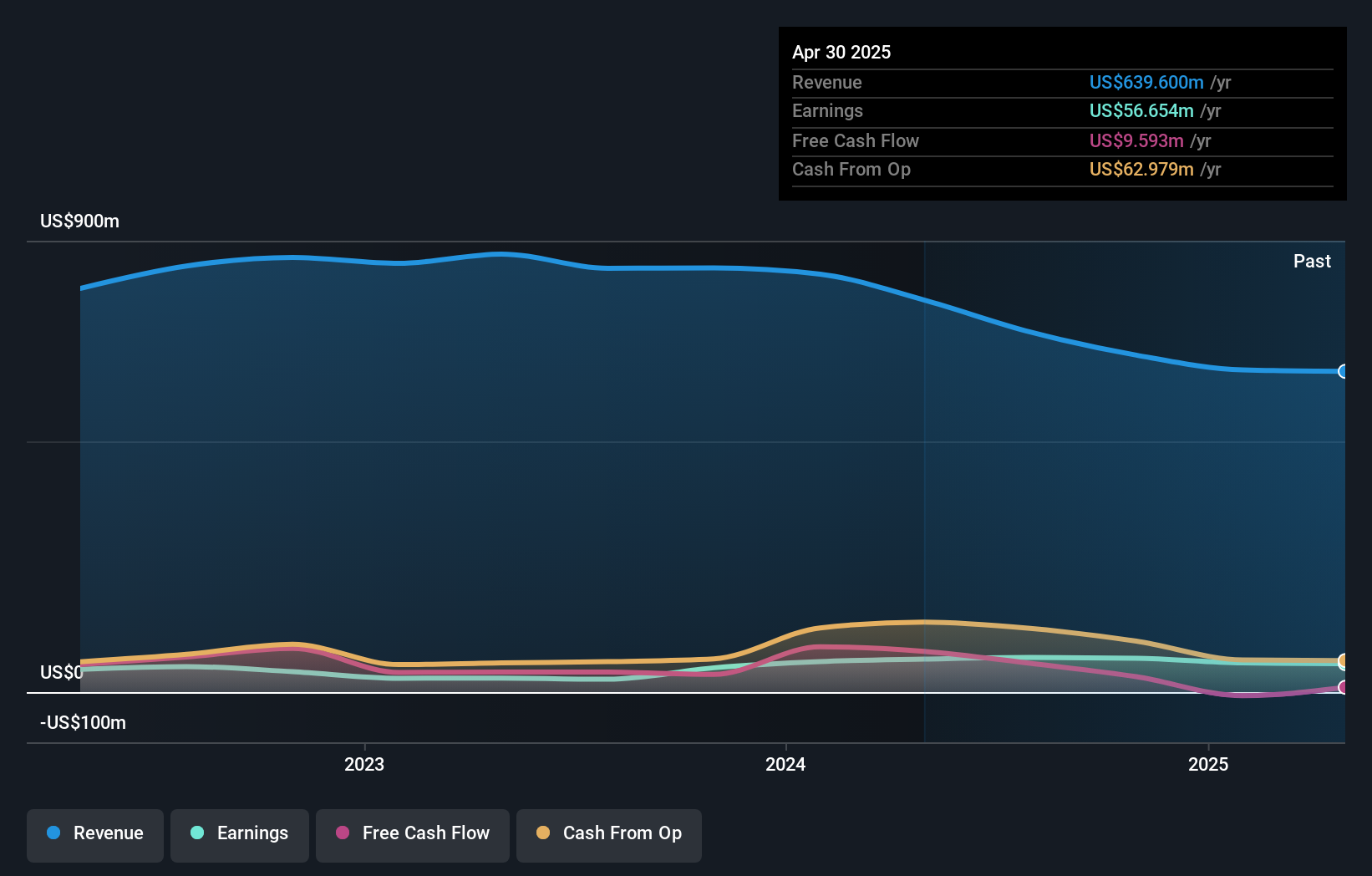

Operations: REX generates revenue primarily from the ethanol and by-products segment, amounting to $1.66 billion. The company reports a negative figure of -$1.02 billion related to unallocated equity method ethanol investment, which impacts its overall financial performance.

REX American Resources, a nimble player in the energy sector, is navigating some choppy waters with its recent removal from the Russell 2000 Dynamic Index. Despite a dip in earnings growth by 14% compared to an industry average of -9.7%, REX remains debt-free and boasts a favorable price-to-earnings ratio of 15.3x against the US market's 18.6x. The company's strategic share repurchase program has reduced shares by over 10%, potentially boosting EPS amid regulatory hurdles and cost pressures. With projected revenue growth and facility expansions on the horizon, REX's future seems cautiously optimistic yet demands vigilant oversight.

Make It Happen

- Navigate through the entire inventory of 281 US Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RITR

Reitar Logtech Holdings

Through its subsidiaries, provides construction management and engineering design services.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives