- United States

- /

- Banks

- /

- NYSE:LOB

Undiscovered Gems In The US Three Promising Stocks To Watch

Reviewed by Simply Wall St

The United States market has seen a flat performance over the past week but has experienced a significant 25% increase over the past year, with earnings expected to grow by 15% annually. In this context, identifying promising stocks involves looking for companies with strong fundamentals and growth potential that may not yet be fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.65% | 11.17% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Reitar Logtech Holdings | 30.23% | 231.46% | 41.38% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Reitar Logtech Holdings (NasdaqCM:RITR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Reitar Logtech Holdings Limited, with a market cap of $257.27 million, operates through its subsidiaries to offer construction management and engineering design services.

Operations: Reitar Logtech Holdings generates revenue primarily from construction management and engineering design services. The company's financial performance is highlighted by a net profit margin of 12%, reflecting its efficiency in converting revenue into actual profit.

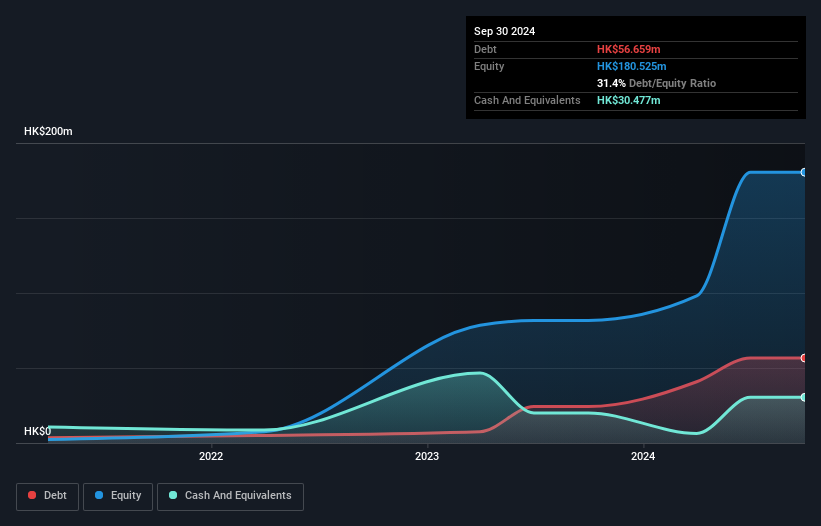

Reitar Logtech Holdings, a smaller player in the market, has shown impressive earnings growth of 398.7% over the past year, significantly outpacing the Real Estate industry average of -1.4%. The company's net debt to equity ratio stands at a satisfactory 13.3%, indicating reasonable leverage management. However, its share price has been highly volatile recently. For the half-year ending September 2024, Reitar reported sales of HKD 194.22 million and net income of HKD 24.39 million, both substantially higher than last year's figures of HKD 73.66 million and HKD 3.84 million respectively, suggesting robust operational performance despite challenges with free cash flow positivity.

- Take a closer look at Reitar Logtech Holdings' potential here in our health report.

Gain insights into Reitar Logtech Holdings' past trends and performance with our Past report.

Global Ship Lease (NYSE:GSL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Global Ship Lease, Inc. is a company that owns and charters containerships under fixed-rate agreements to container shipping companies globally, with a market capitalization of approximately $748.14 million.

Operations: GSL generates revenue primarily from owning and chartering containerships, with transportation shipping contributing $701.48 million. The company's financial performance is characterized by its net profit margin trends, which reflect the profitability of its fixed-rate charter agreements.

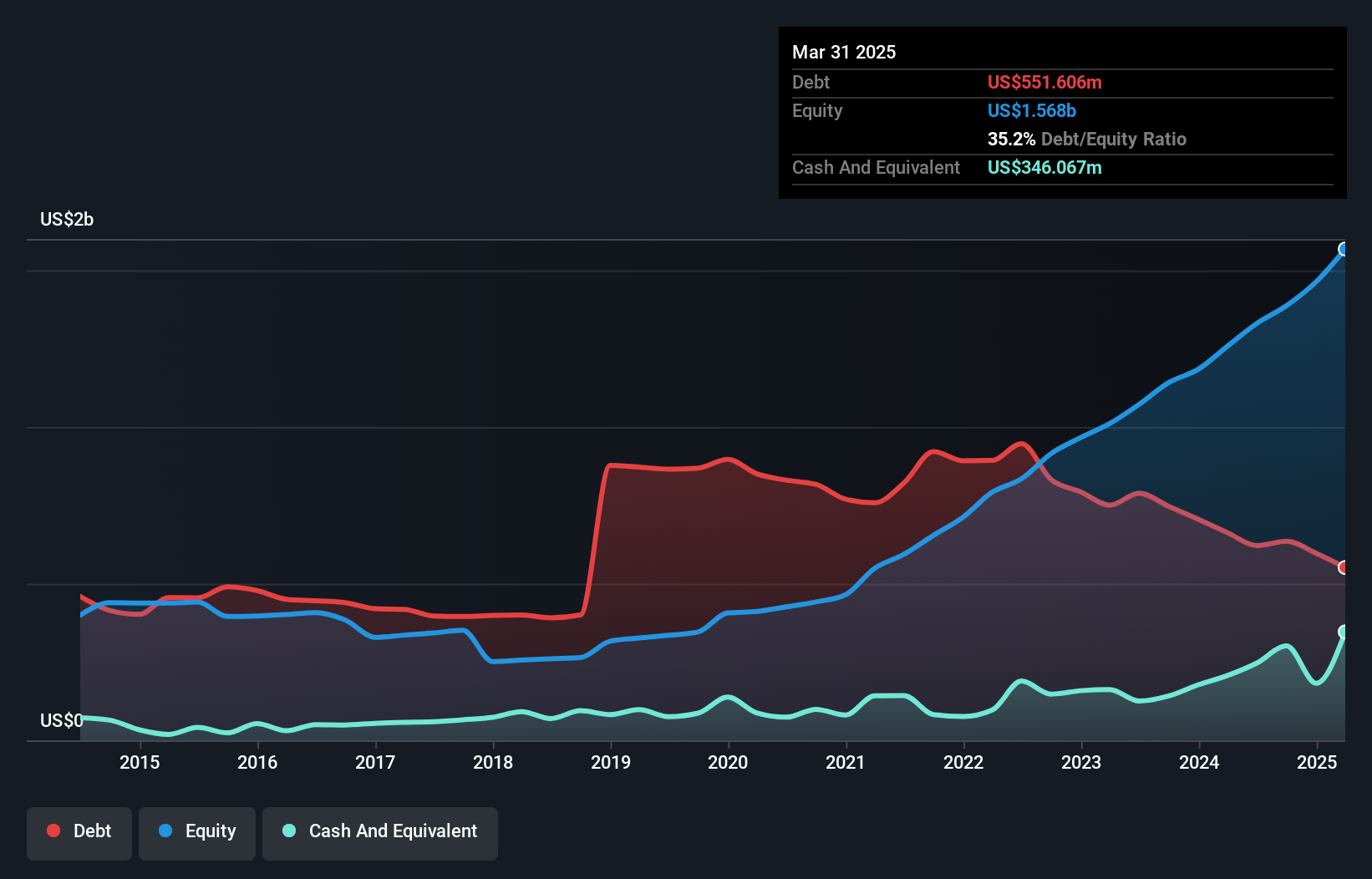

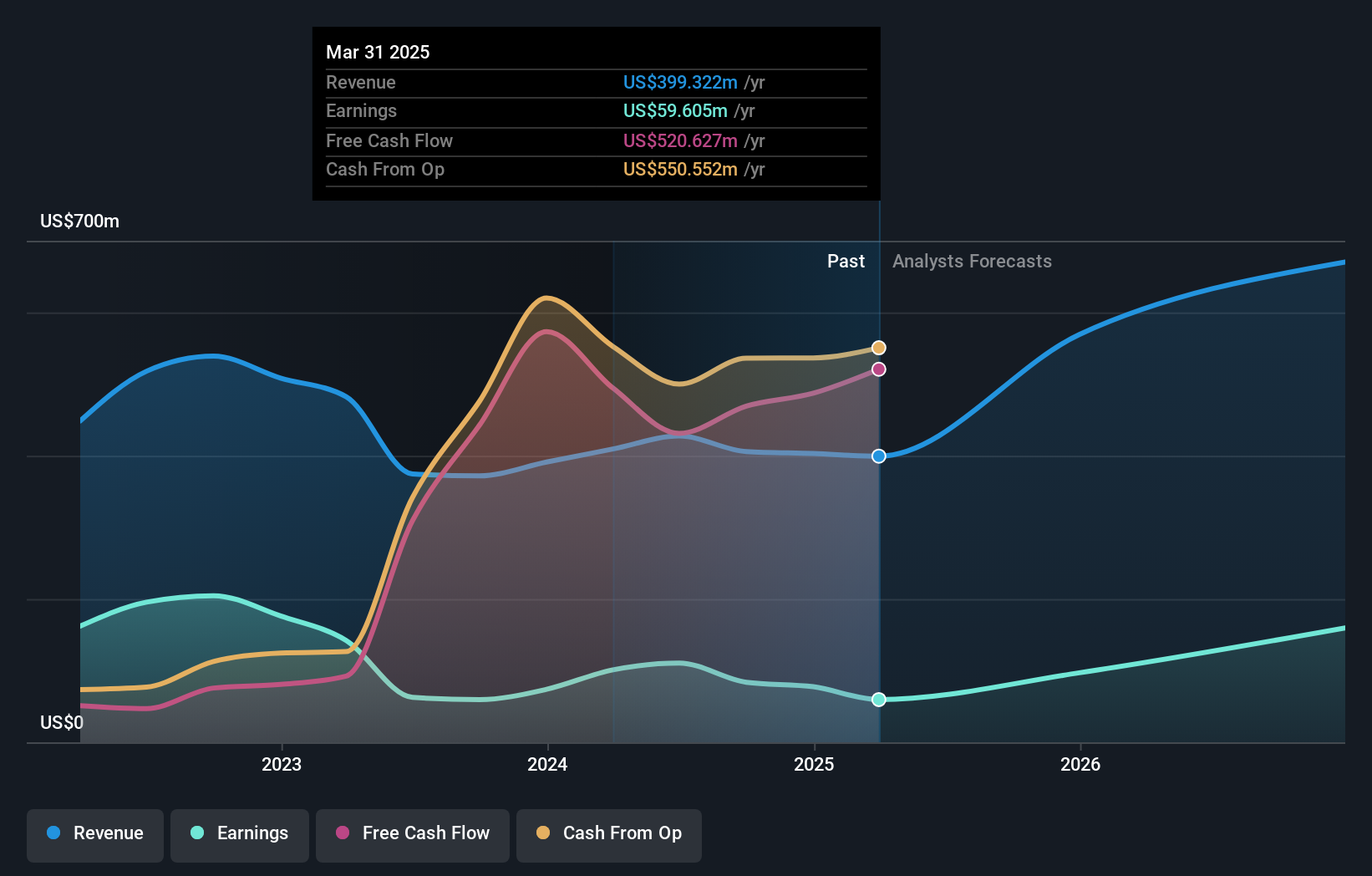

Global Ship Lease, a notable player in the shipping industry, shows promise with its strategic moves and financial metrics. The company has successfully reduced its debt to equity ratio from 251% to 46% over five years, indicating improved financial health. Earnings have grown at an impressive rate of 49% annually over the same period, although recent growth of 5% fell short compared to the industry's robust 27%. With a satisfactory net debt to equity ratio of 24%, GSL remains financially sound. Recent expansions include acquiring four high-reefer containerships for $274 million, potentially generating up to $184 million in EBITDA if charter options are exercised fully.

Live Oak Bancshares (NYSE:LOB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Live Oak Bancshares, Inc. is a bank holding company for Live Oak Banking Company, offering a range of banking products and services across the United States with a market cap of $1.61 billion.

Operations: Live Oak Bancshares generates revenue primarily through its banking products and services. The company's financial performance is reflected in its market capitalization of $1.61 billion.

Live Oak Bancshares, with assets of US$12.9 billion and equity of US$1 billion, is an intriguing player in the financial sector. The company has total deposits of US$11.8 billion and loans totaling US$10.1 billion, but faces a high level of bad loans at 3.6%. Despite this challenge, Live Oak's earnings growth over the past year outpaced the industry average by 4.8%, showcasing its robust performance in a tough market environment. Trading at 42% below estimated fair value suggests potential upside for investors willing to navigate its risks like significant insider selling and insufficient loan loss allowances (45%).

Next Steps

- Take a closer look at our US Undiscovered Gems With Strong Fundamentals list of 274 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOB

Live Oak Bancshares

Operates as the bank holding company for Live Oak Banking Company that provides various banking products and services in the United States.

High growth potential and good value.

Market Insights

Community Narratives