- United States

- /

- Real Estate

- /

- NasdaqGS:OPEN

Opendoor Technologies (OPEN) Stock Surges 636% Last Quarter

Reviewed by Simply Wall St

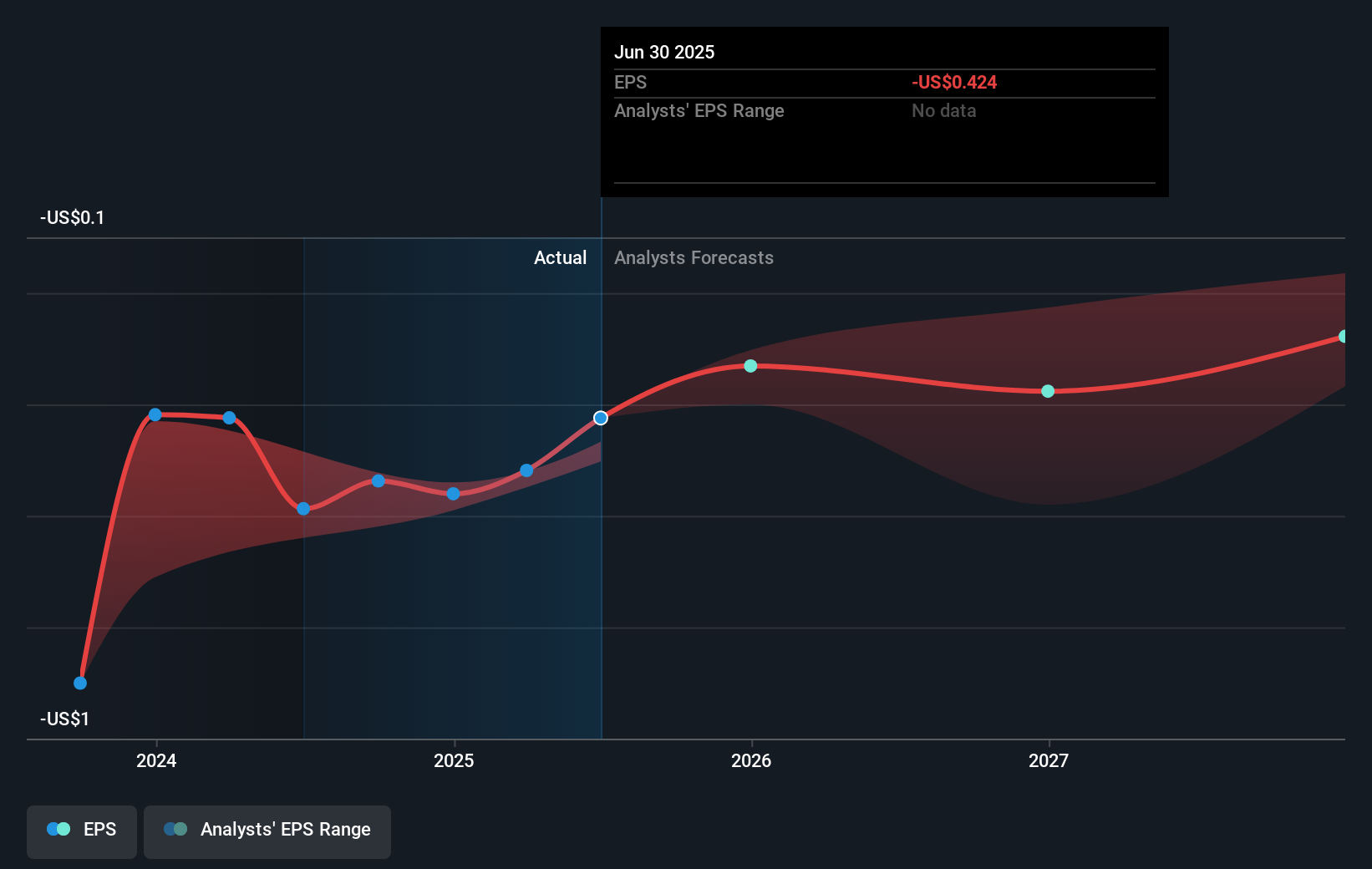

Opendoor Technologies (OPEN) has recently seen a significant share price increase of 636.01% over the last quarter, coupled with substantial executive changes as Shrisha Radhakrishna has taken on the role of interim President. The company's Q2 earnings improvement, marked by a reduction in net loss and positive revenue guidance for the upcoming quarter, reflects a strategic operational shift. Furthermore, Opendoor's introduction of the Cash Plus product aims to enhance the home-selling experience. These developments align with the broader market's enthusiasm, as potential rate cuts have spurred interest-sensitive stocks, reinforcing the company's recent robust performance.

We've spotted 2 weaknesses for Opendoor Technologies you should be aware of.

Recent developments for Opendoor Technologies bring both opportunities and risks for the company's future. The recent surge in share price is a remarkable market reaction, sparked by executive changes and positive earnings guidance. In the longer-term context, the total shareholder return, including share price and dividends, was 122.67% over the last year, highlighting a strong recovery. Over the past year, Opendoor outperformed both the US Real Estate industry, which returned 25%, and the broader US Market, which saw a 15.7% return. However, challenges such as macroeconomic pressures and inventory risks could impact future revenue and earnings.

The introduction of the Cash Plus product and improved Q2 earnings reflect possible positive shifts in Opendoor's operational strategy. These factors might enhance revenue projections and earnings forecasts, although risks remain given the competitive real estate market environment. Analysts anticipate that revenue will grow as the company expands its product offerings and optimizes its marketing strategies. Despite these potential upsides, the share price of US$5.01 remains substantially higher than the analyst consensus price target of US$1.39, signaling a premium valuation. This discrepancy indicates that while recent price movements reflect market enthusiasm, they might not align with the current analyst outlook or fair value assumptions based on forecasted financial performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPEN

Opendoor Technologies

Operates a digital platform for residential real estate transactions in the United States.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives