- United States

- /

- Real Estate

- /

- NasdaqGS:NMRK

What Newmark Group (NMRK)'s Mountain West Alliance Means for Shareholders

Reviewed by Simply Wall St

- Earlier this month, Mountain West Commercial Real Estate announced a new alliance with Newmark Group, expanding Newmark's presence across Utah, Idaho, Wyoming, Montana, and Nevada under the Newmark Mountain West brand.

- This partnership combines deep regional expertise and a large transaction track record with the global capabilities of Newmark, positioning the team to handle complex deals across multiple states and sectors.

- We'll explore how adding nearly 200 local specialists and significant transaction history in high-growth Western markets impacts Newmark's broader investment thesis.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Newmark Group Investment Narrative Recap

Owning shares in Newmark Group requires confidence that the company can turn regional expansion, talent acquisition, and a growing transaction pipeline into sustainable revenue and earnings growth, even while absorbing costs and integration challenges. The Mountain West alliance expands Newmark’s Western footprint and brings nearly 200 specialists into the fold, but the move does not materially shift the short-term focus, current revenue growth remains tightly tied to maintaining investor confidence in execution and cost control, while integration risk is now even more pronounced.

Of recent announcements, Newmark's July decision to raise its 2025 revenue guidance to US$3.05 billion to US$3.25 billion is most impactful alongside Mountain West, as it underscores expectations for further top-line acceleration. However, this optimism hinges on the company's ability to successfully execute integration of new markets and talent, a challenge heightened by its broader global ambitions and prior aggressive expansion efforts.

By contrast, investors should be mindful of how expanded talent rosters and onboarding costs from these regional alliances could affect margins if projected efficiencies take longer than anticipated...

Read the full narrative on Newmark Group (it's free!)

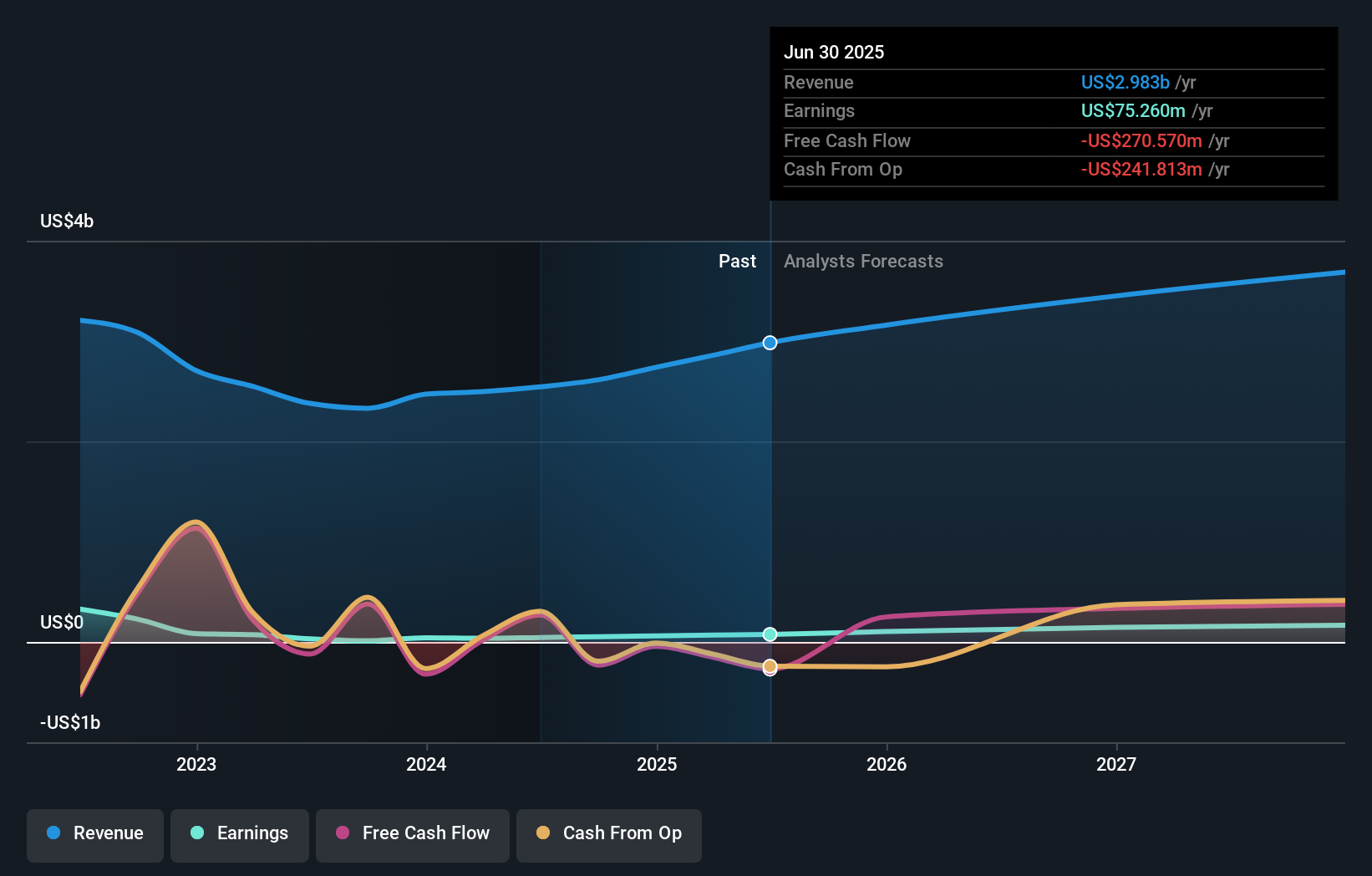

Newmark Group's outlook anticipates $3.8 billion in revenue and $201.7 million in earnings by 2028. This is based on an expected annual revenue growth rate of 8.2% and an increase in earnings of $126.4 million from current earnings of $75.3 million.

Uncover how Newmark Group's forecasts yield a $18.45 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have fair value estimates for Newmark Group ranging from US$11.81 to US$18.45, reflecting just two user perspectives before recent expansion news. While some forecast robust profit growth, the risk of margin pressure from integration and hiring efforts remains a critical consideration for future performance. Explore the full spectrum of their views for more insights.

Explore 2 other fair value estimates on Newmark Group - why the stock might be worth 32% less than the current price!

Build Your Own Newmark Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Newmark Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Newmark Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Newmark Group's overall financial health at a glance.

No Opportunity In Newmark Group?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newmark Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NMRK

Newmark Group

Provides commercial real estate services in the United States, the United Kingdom, and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives