- United States

- /

- Real Estate

- /

- NasdaqGM:EXPI

The five-year returns have been splendid for eXp World Holdings (NASDAQ:EXPI) shareholders despite underlying losses increasing

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But on a lighter note, a good company can see its share price rise well over 100%. For instance, the price of eXp World Holdings, Inc. (NASDAQ:EXPI) stock is up an impressive 178% over the last five years. In the last week the share price is up 3.9%.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

See our latest analysis for eXp World Holdings

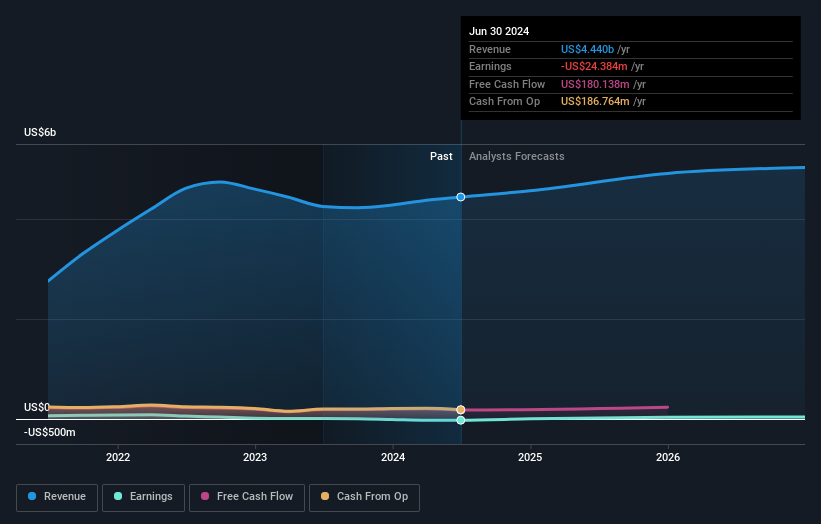

Given that eXp World Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

For the last half decade, eXp World Holdings can boast revenue growth at a rate of 30% per year. That's well above most pre-profit companies. Meanwhile, its share price performance certainly reflects the strong growth, given the share price grew at 23% per year, compound, during the period. So it seems likely that buyers have paid attention to the strong revenue growth. eXp World Holdings seems like a high growth stock - so growth investors might want to add it to their watchlist.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of eXp World Holdings, it has a TSR of 189% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market gained around 32% in the last year, eXp World Holdings shareholders lost 4.3% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 24% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand eXp World Holdings better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for eXp World Holdings you should know about.

Of course eXp World Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:EXPI

eXp World Holdings

Provides cloud-based real estate brokerage services for residential homeowners and homebuyers.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives