- United States

- /

- Real Estate

- /

- NasdaqGS:CSGP

Evaluating CoStar Group (CSGP) Valuation Following Standout Earnings and Sustained Double-Digit Growth

Reviewed by Simply Wall St

Most Popular Narrative: 10.6% Undervalued

According to the most widely followed narrative, CoStar Group shares trade at a discount to their estimated fair value. This suggests material upside based on future growth expectations and profitability improvements.

The integration of AI-driven features, Matterport's 3D technology, and advanced analytics across platforms is increasing user engagement. This enables higher-value product offerings and upsells and improves client retention, which positions the company for elevated margins and increased net income over time.

Curious how cutting-edge technology and ambitious market expansion combine to back up a double-digit growth forecast? Some of the numbers underlying this bullish projection would surprise even seasoned real estate investors. See how much of CoStar's future value hinges on a bold call about profit margins and revenue scale.

Result: Fair Value of $97.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, as CoStar ramps up investments in residential real estate, rising costs or slower than expected adoption could pressure margins and test bullish forecasts.

Find out about the key risks to this CoStar Group narrative.Another View: What Multiples Tell Us

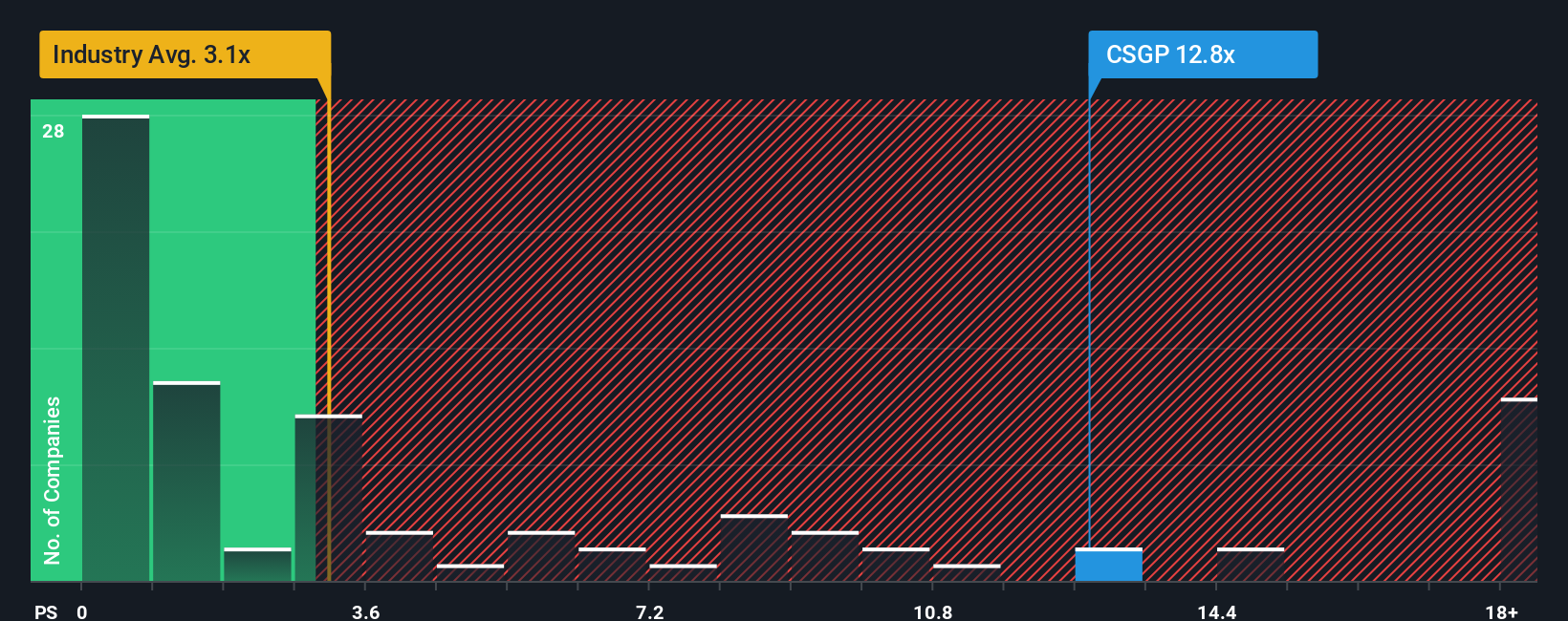

While the growth narrative paints an undervalued picture, a look through the lens of the price-to-sales ratio gives a different impression. By this method, CoStar appears far pricier than other real estate stocks. This raises the question: is growth alone enough to justify the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CoStar Group Narrative

If you see things differently, or want to dive into the numbers on your own, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your CoStar Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take action now and secure your spot ahead of the crowd. The smartest investors expand their opportunities by looking beyond the obvious. Make sure you're not missing out on tomorrow's top stocks.

- Spot undervalued gems and tap into the next big wave of returns by using our powerful undervalued stocks based on cash flows.

- Benefit from the AI revolution and see which next-generation companies are making headlines with our dynamic AI penny stocks.

- Collect high-yield dividends that beat the average and add steady income streams with our exclusive dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSGP

CoStar Group

Provides information, analytics, and online marketplace services in the United States, Canada, Europe, the Asia Pacific, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives