- United States

- /

- Pharma

- /

- NYSE:ZTS

Zoetis (NYSE:ZTS) Declares US$0.50 Dividend Per Share For Q3 2025

Reviewed by Simply Wall St

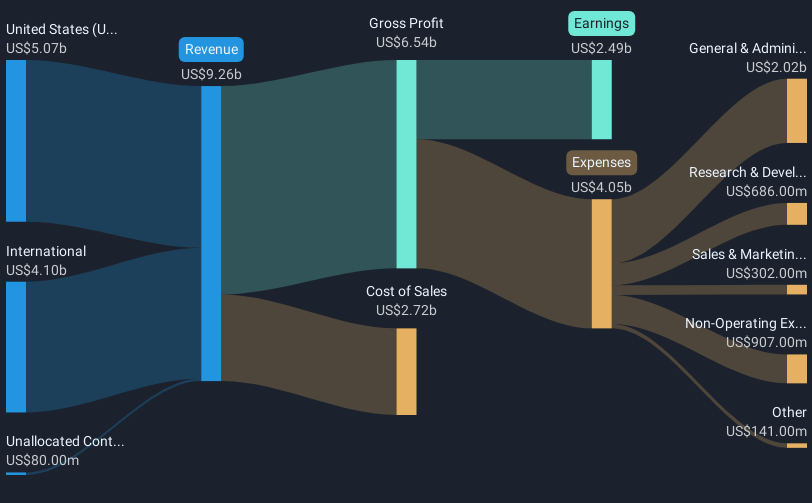

Zoetis (NYSE:ZTS) recently affirmed a dividend of $0.50 per share for the third quarter of 2025, reflecting positive sentiment among investors. This announcement followed the company's solid earnings report, which showcased an increase in sales to $2,220 million and net income of $631 million. These developments coincided with a general uptick in major stock indices, as markets rebounded after a sell-off. In this context, Zoetis's 10% share price increase over the past month aligns with broader market trends, with its robust financial performance likely reinforcing investor confidence amid generally rising indexes.

Zoetis has 1 possible red flag we think you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent dividend announcement and earnings results have a significant impact on Zoetis's narrative. With revenue at US$9.29 billion and earnings at US$2.52 billion, the company's strategic initiatives in the Companion Animal segment, particularly through product innovation and medical education, are beginning to yield results. These developments bolster confidence in the company's capacity to achieve its projected revenue and earnings targets. The positive market sentiment could enhance Zoetis's valuation prospects and align them more closely with the consensus price target of approximately US$195.49, suggesting a potential price increase from the current level.

Over the past five years, Zoetis's total shareholder return, including share price appreciation and dividends, was 23.97%. In the past year, Zoetis's returns underperformed the broader US market, which saw an increase of 9.1%. Despite this relative underperformance, Zoetis outperformed the US Pharmaceuticals industry, which faced a decline, showcasing the company's resilience in a challenging sector. As the company continues to focus on expanding its product offerings and improving margins, these efforts could positively influence future revenue and earning forecasts, further supporting its share price trajectory towards the target valuation.

Get an in-depth perspective on Zoetis' performance by reading our balance sheet health report here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Zoetis, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zoetis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZTS

Zoetis

Engages in the discovery, development, manufacture, and commercialization of animal health medicines, vaccines, diagnostic products and services, biodevices, genetic tests, and precision animal health products in the United States and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives