- United States

- /

- Life Sciences

- /

- NYSE:WST

West Pharmaceutical Services (WST): Evaluating Valuation as Earnings Approach and Automation Plans Spark Optimism

Reviewed by Kshitija Bhandaru

West Pharmaceutical Services (WST) is seeing increased attention from investors ahead of its third-quarter results. The focus is on easing inventory issues, expanding in GLP-1 products, and automation plans that are expected to improve efficiency.

See our latest analysis for West Pharmaceutical Services.

Shares of West Pharmaceutical Services have been climbing steadily over the past quarter, with an 18.4% share price return in the last 90 days. This hints at some renewed momentum, even as the year-to-date share price is still down about 20% and the one-year total shareholder return sits at minus 11%. Long-term performance has been choppy, but the recent upturn suggests optimism is building around the company’s automation plans and GLP-1 market exposure.

If you're interested in discovering more growth stocks that are catching market attention, now is the perfect moment to check out See the full list for free.

With shares rebounding but the company still trading below analyst price targets, the big question is whether West Pharmaceutical Services remains undervalued or if the promise of automation and GLP-1 growth is already priced in. Could there be a real buying opportunity, or has the market looked ahead?

Most Popular Narrative: 17.3% Undervalued

With West Pharmaceutical Services closing at $261.77, the latest and most popular narrative points to a fair value of $316.36. This significant gap has caught the eye of the market. The setup: big changes in automation and the surging GLP-1 market could be game changers for the company’s long-term outlook.

*The introduction of an automated line for HVP delivery devices later in 2025 to early 2026 is expected to improve margins by driving operational efficiencies and scale, enhancing net margins. The increase in demand and the transition to higher-margin HVP components, supported by approximately 340 Annex 1 projects, is likely to positively impact both revenue and net margins due to a favorable mix shift.*

Want to know what is fueling this bullish view? The foundation of this narrative rests on some bold revenue and profit projections, layered with an aggressive outlook on margin expansion. Ever wondered what it takes for a company in this sector to justify a premium valuation usually reserved for technology disruptors? You’ll only find those eye-opening numbers by diving into the full narrative.

Result: Fair Value of $316.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in customer demand or unexpected tariff impacts could challenge West Pharmaceutical Services' optimistic margin projections and could add volatility to future growth.

Find out about the key risks to this West Pharmaceutical Services narrative.

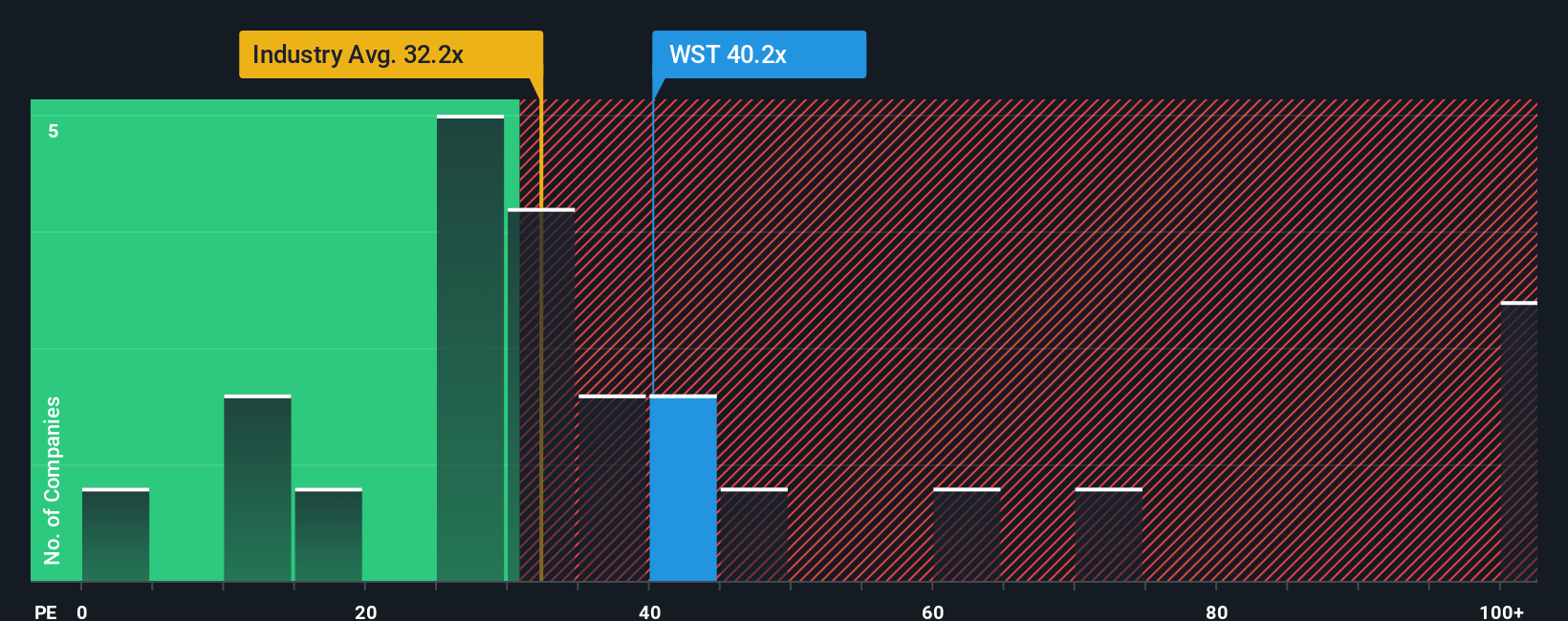

Another View: How Price Ratios Stack Up

While analyst consensus suggests West Pharmaceutical Services is undervalued, the market's favored price-to-earnings ratio tells a different story. WST’s ratio stands at 38.6x, considerably higher than the US Life Sciences industry average of 31.7x, the peer average of 22.7x, and the fair ratio of 25.3x. This gap implies investors may be pricing in significant future growth and sets a higher bar for the company to deliver. Does this premium leave room for upside, or does it elevate the risk if expectations are missed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own West Pharmaceutical Services Narrative

If you'd rather forge your own perspective or want to dig deeper into the numbers, you can use the same data to shape your own story in just a few minutes with Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding West Pharmaceutical Services.

Looking for more investment ideas?

Don't limit your strategy to a single stock when fresh opportunities are just a click away. Catch the trends real investors are acting on now.

- Tap into the hottest trends by tracking these 24 AI penny stocks that are shaping the future of artificial intelligence across tech and industry.

- Lock in potential passive income by checking out these 19 dividend stocks with yields > 3% with proven yields above 3% and strong track records.

- Seize tomorrow’s potential by uncovering these 79 cryptocurrency and blockchain stocks that are pushing the boundaries of blockchain and digital finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if West Pharmaceutical Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WST

West Pharmaceutical Services

Designs, manufactures, and sells containment and delivery systems for injectable drugs and healthcare products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives