- United States

- /

- Life Sciences

- /

- NYSE:WAT

The Bull Case For Waters (WAT) Could Change Following Launch of Xevo CDMS for Mega-Mass Biomolecules

Reviewed by Sasha Jovanovic

- Earlier this week, Waters Corporation launched the Xevo Charge Detection Mass Spectrometer (CDMS), a system enabling direct, rapid measurement of mega-mass biomolecules critical for next-generation therapeutics by using up to 100-fold less sample than existing techniques.

- This innovation targets a key challenge in biotherapeutics development and may help accelerate the adoption of gene therapy and advanced modalities by research and biopharma sectors.

- We'll examine how the CDMS breakthrough in large biomolecule analysis could influence Waters' longer-term investment narrative and competitive outlook.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Waters Investment Narrative Recap

To be a Waters shareholder, you need confidence in sustained demand for advanced analytical instruments supporting pharma R&D, recurring revenues, and successful execution on large integrations like the pending BD acquisition. The Xevo CDMS launch is a meaningful innovation aligned with the push into fast-growing therapeutics, but in the short term, the largest catalyst and risk remain tied to the successful integration and realization of synergies from the BD deal, with the CDMS’s immediate financial impact likely limited given the scale of ongoing integration efforts.

Among recent company developments, Waters' raised earnings guidance in August stands out as highly relevant against the backdrop of ongoing product launches. This upward revision in earnings outlook supports the narrative of operational momentum, but the actual delivery of forecasted synergies from the BD acquisition, and the avoidance of integration pitfalls, will weigh more heavily on shareholder returns than any new single instrument introduction this year.

However, for investors, it is crucial to keep in mind that if BD integration stumbles and synergies materialize slower than planned, the earnings growth story could quickly shift in ways that...

Read the full narrative on Waters (it's free!)

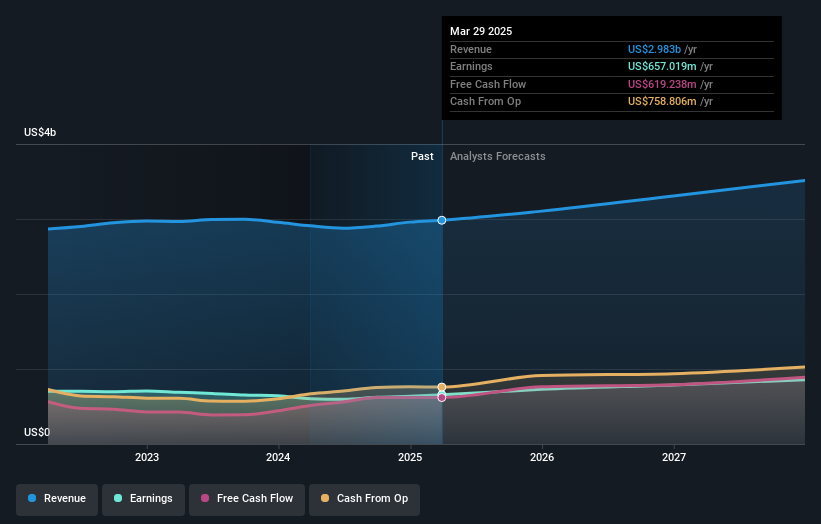

Waters' narrative projects $3.7 billion revenue and $946.3 million earnings by 2028. This requires 6.4% yearly revenue growth and a $284.9 million earnings increase from $661.4 million today.

Uncover how Waters' forecasts yield a $351.07 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community members estimate Waters' fair value between US$351 and US$388 per share. With results highly dependent on integration execution, you may want to compare these views to your own expectations for the business’s evolving risk profile.

Explore 2 other fair value estimates on Waters - why the stock might be worth just $351.07!

Build Your Own Waters Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Waters research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Waters research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Waters' overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waters might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WAT

Waters

Provides analytical workflow solutions in Asia, the Americas, and Europe.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives