- United States

- /

- Life Sciences

- /

- NYSE:TMO

Is Thermo Fisher a Smart Play After 11% Rally and Positive Sector News?

Reviewed by Bailey Pemberton

Thinking about what to do with your Thermo Fisher Scientific stock? You are not alone. Investors have a lot of questions these days, and TMO's price action is adding to the mix. Over the last month, the stock has climbed a healthy 11.3%, a strong rebound after a slower start to the year. That said, gains are coming off a one-year dip of -10.5%, so there is still a sense the company may be shaking off some lingering pessimism. Recent sector-wide optimism in healthcare and a renewed focus on life sciences technology seem to be fueling investor confidence again. However, perceptions of risk are clearly shifting.

For longer-term holders, it's worth noting that Thermo Fisher has managed a positive 5.3% return over three years and an impressive 14.1% over five years. This suggests that short-term turbulence has not derailed the company’s growth story for patient investors. However, the real question now is whether these price moves have made the stock a bargain or if it is merely reflecting improved sentiment. On our six-point valuation scorecard, the company clocks in at a 3 out of 6, meaning it's undervalued on half of the key metrics we track and is right at the tipping point.

If you are trying to figure out whether to add, hold, or trim your position, a disciplined valuation analysis is essential. Next, we will break down how different valuation approaches apply to TMO. Stay tuned as a more comprehensive perspective on value is coming later in the article.

Approach 1: Thermo Fisher Scientific Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a business is worth today by projecting its future cash flows and discounting them back to their present value. This approach helps investors gauge whether the current share price fairly reflects the company’s potential to generate cash in the years ahead.

For Thermo Fisher Scientific, analysts expect Free Cash Flow (FCF) for the last twelve months to be around $6.0 Billion, with projections growing steadily over the coming decade. By 2029, FCF is forecast to reach $11.3 Billion. Extended estimates suggest FCF could surpass $15 Billion by 2035, drawing on both analyst inputs and extrapolated figures.

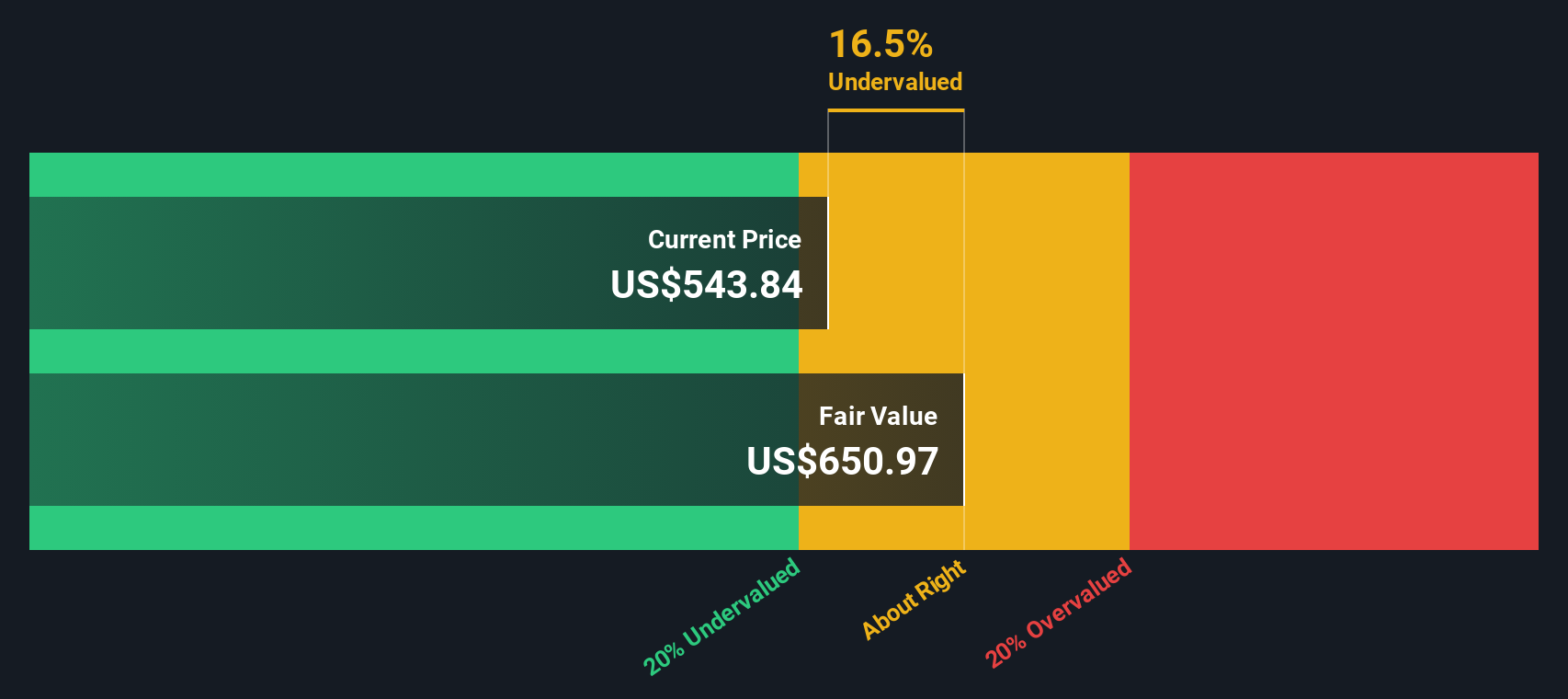

Using this method, Thermo Fisher’s intrinsic value is calculated at $652.42 per share in USD, applying a two-stage Free Cash Flow to Equity approach. This value is roughly 19.1% higher than the company’s recent share price, implying the stock is notably undervalued according to the model.

The DCF analysis points to meaningful upside and presents a strong case for potential value at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Thermo Fisher Scientific is undervalued by 19.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Thermo Fisher Scientific Price vs Earnings

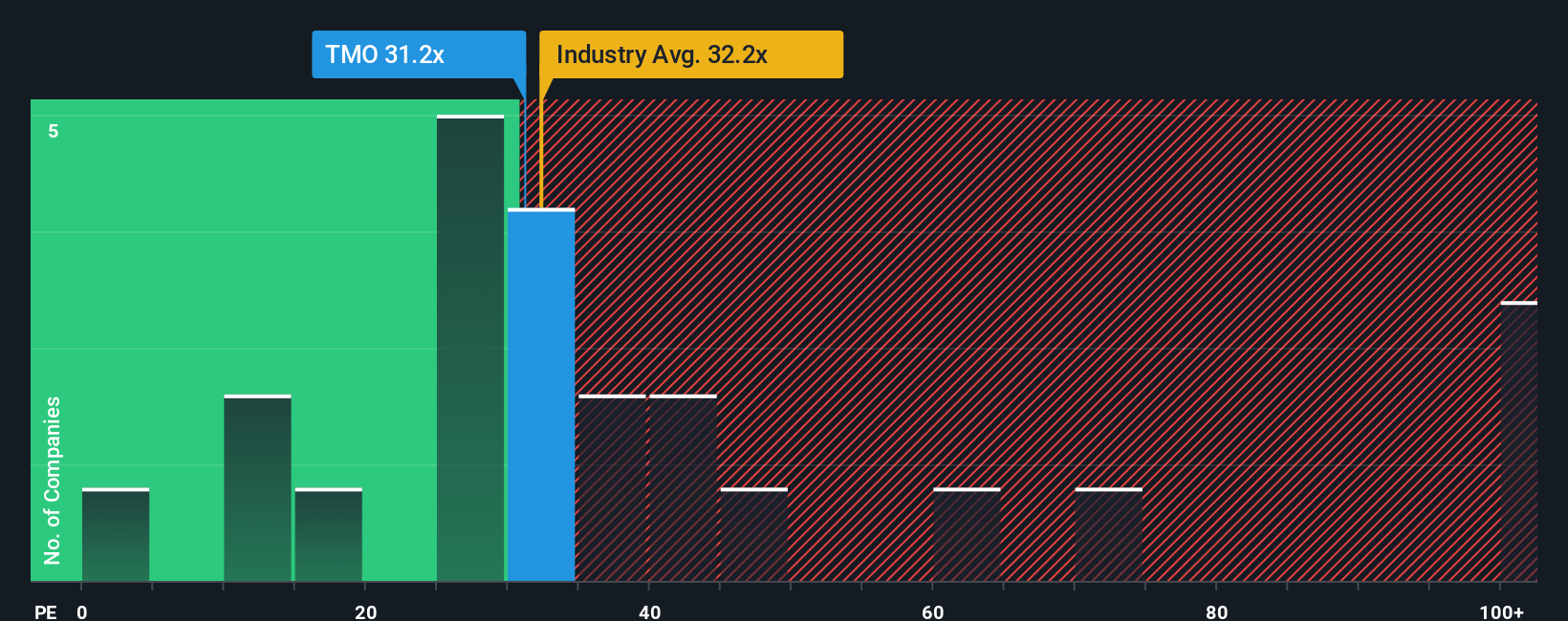

The Price-to-Earnings (PE) ratio is often the go-to metric for valuing established and profitable companies like Thermo Fisher Scientific. This ratio helps investors see how much they are paying for each dollar of current earnings, making it especially effective when a company generates consistent profits and has reliable growth prospects.

It is important to remember that what counts as a “normal” or “fair” PE ratio depends on future expectations and risks. Higher growth and stable profits typically justify a higher PE, while greater risk or slowing earnings can bring that number down. For Thermo Fisher, the current PE sits at 30.3x, below both the broader Life Sciences industry average of 32.5x and a peer group average of 34.0x. At first glance, that seems attractive, especially given Thermo Fisher’s global scale and strong margins.

However, benchmarks like peer and industry averages only reveal part of the story. That's where Simply Wall St’s “Fair Ratio” comes in, a comprehensive measure that factors in not just the company’s growth and profit margin, but also its unique risk profile, industry dynamics and market capitalization. This proprietary approach assigns Thermo Fisher a Fair Ratio of 27.18x, which is slightly lower than both its current PE and industry average. The fact that the current multiple is within just a few points of the Fair Ratio suggests the stock is priced about right based on its fundamentals, risks, and future earnings potential.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Thermo Fisher Scientific Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personalized story about what you believe matters most for a company, blending your views on its future revenue, profit margins, and risks into a unique forecast and fair value calculation. Narratives connect a company’s real-world journey to your financial expectations, giving real numbers and estimates a meaningful context behind your investment decisions.

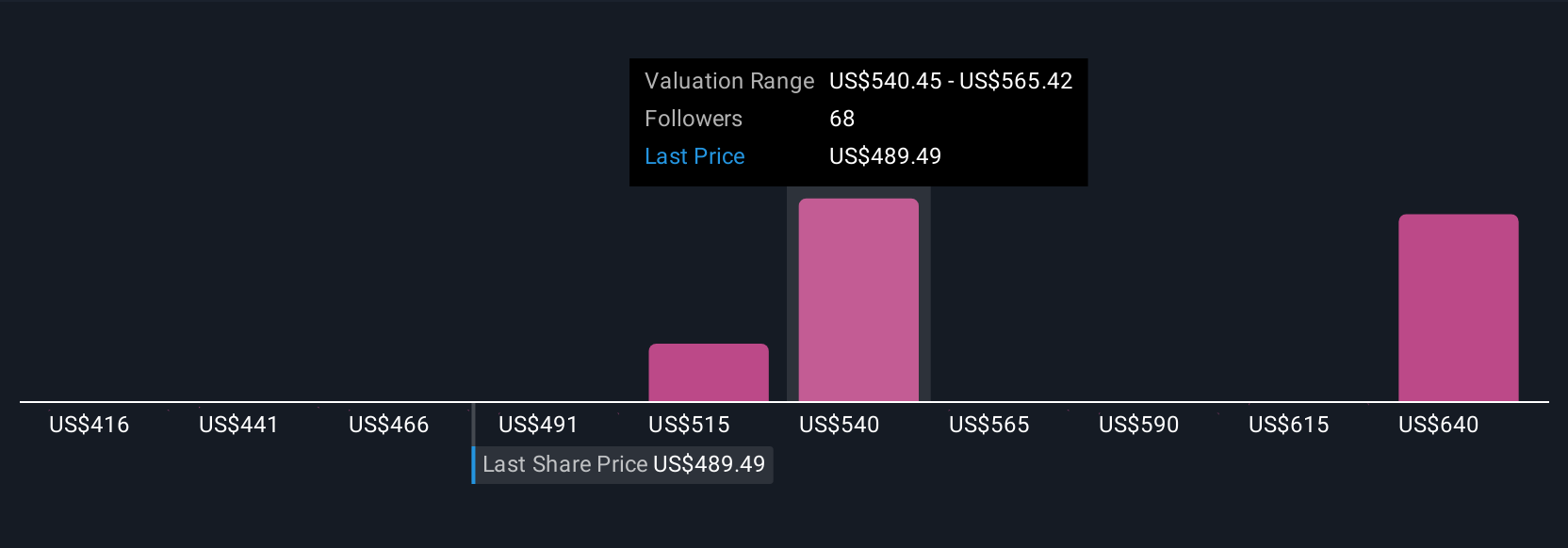

You do not need to be a finance expert to use Narratives. On Simply Wall St’s Community page, millions of investors use this tool to quickly build and share their own perspectives on where a company like Thermo Fisher Scientific is headed. Narratives simplify decision making by dynamically updating fair value estimates whenever new news or earnings data is released, so your outlook remains current.

This approach empowers you to compare your fair value with the latest market price and decide when to buy, hold, or sell with greater confidence. For example, using Thermo Fisher as a case study, some investors craft bullish Narratives, forecasting high revenue growth and margin gains, leading to a fair value above $767 per share. More cautious forecasters see risks ahead and arrive at a fair value closer to $490 per share. That flexibility means you can craft, test, and refine your investment story to match your own knowledge and convictions.

Do you think there's more to the story for Thermo Fisher Scientific? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thermo Fisher Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TMO

Thermo Fisher Scientific

Provides life sciences solutions, analytical instruments, specialty diagnostics, and laboratory products and biopharma services in the North America, Europe, Asia-Pacific, and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives