- United States

- /

- Life Sciences

- /

- NYSE:RVTY

Is Revvity’s Latest 10% Rally a Signal for Reassessment in 2025?

Reviewed by Bailey Pemberton

Deciding what to do with Revvity stock right now? You are not alone. Investors are taking a fresh look at the company this week, especially after a sharp 10.9% rise in just the past seven days. That quick bounce stands out against a challenging year, as Revvity has lost 16.6% year to date and is down more than 23% over the last twelve months. A longer lens reveals an even steeper slide, with the stock trailing by 22.5% over three years and 26.4% over five years. Lately, investors seem to be reassessing risk and opportunity for Revvity, possibly triggered by shifts in the broader market or renewed confidence in the sector.

Here is the headline detail: Revvity currently scores a 4 out of 6 on our valuation scorecard, meaning it appears undervalued against four of the six main checks we use. That gives us a hint that there could be value overlooked by the market, despite the rollercoaster ride in share price. But a score is just the start. Let’s dig into what these valuation measures actually show, and why a practical, real-world approach to value may matter even more than the numbers suggest.

Why Revvity is lagging behind its peers

Approach 1: Revvity Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future free cash flows and then discounting those amounts back to today’s dollars. This approach helps investors focus on a business’s true earning power, rather than just short-term price swings.

For Revvity, current Free Cash Flow stands at $503 million. Analysts project steady increases, with cash flows expected to reach $756 million in 2028. Beyond that, additional forecasts are extrapolated, bringing the estimated Free Cash Flow to just over $1 billion by 2035. All projections are expressed in US dollars, in line with the listing currency.

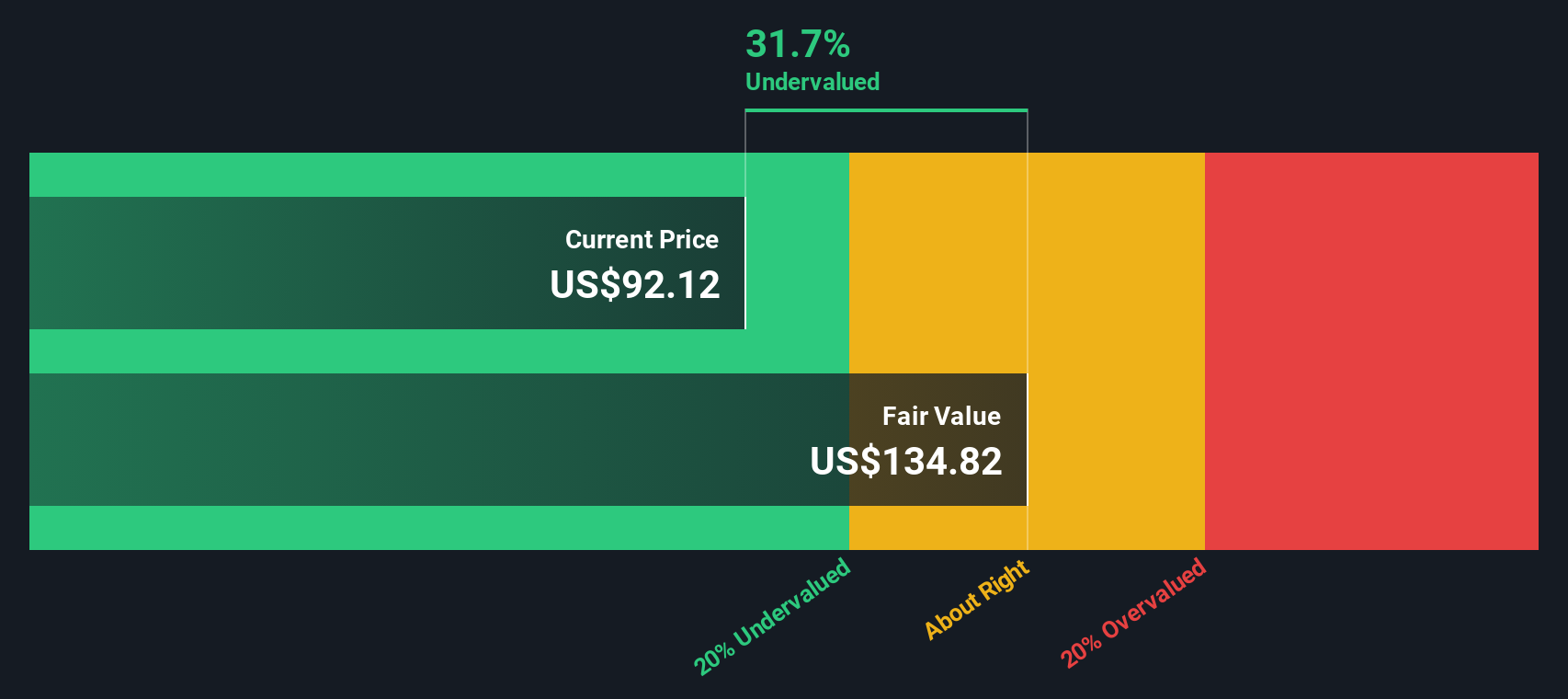

Using this model, Revvity’s fair value is calculated at $136.50 per share. Compared to the current price, the DCF analysis indicates the stock is trading at a 31.6% discount. In other words, the intrinsic value is substantially above where shares change hands now. This suggests significant upside if the projections are realized and market sentiment changes.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Revvity is undervalued by 31.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Revvity Price vs Earnings (PE Ratio)

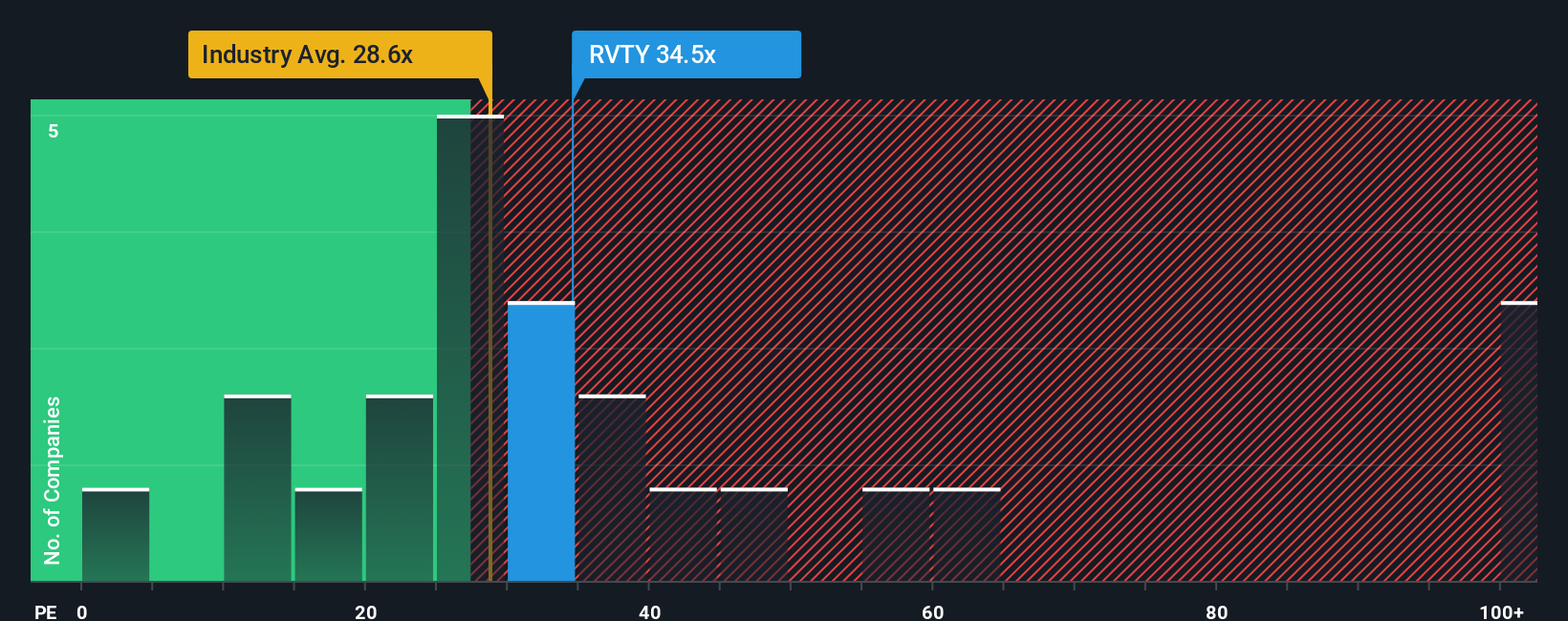

The price-to-earnings (PE) ratio is the go-to valuation metric for profitable companies like Revvity, as it reflects how much investors are willing to pay for each dollar of earnings. For investors, the PE ratio balances expectations for growth against the risks and stability of a company’s future profits. A higher ratio often means the market expects faster growth or lower risk, while a lower ratio can indicate lower expectations or more risk.

Revvity’s current PE ratio stands at 38.9x. That is higher than the Life Sciences industry average of 32.7x, but below the peer group’s average of 49.7x. These comparisons can be useful, but they may not tell the full story since they do not account for the company’s unique profile or risk factors.

Enter the “Fair Ratio,” Simply Wall St’s proprietary benchmark that estimates what a company’s PE ratio ought to be, factoring in earnings growth, profit margins, risk profile, industry conditions, and market cap. For Revvity, the Fair Ratio is 23.7x. This more tailored approach often gives a sharper view than broad peer or industry comparisons, as it is built around the company’s specific strengths and challenges, not just a generic group average.

With Revvity’s actual PE ratio notably above the Fair Ratio, the analysis suggests the shares are overvalued at current levels relative to their fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Revvity Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your unique story and perspective about a company, blending your view on its business, such as expected revenue growth, profit margins, and future risks, with a financial forecast and an estimate of fair value.

Narratives empower investors by directly linking a company's story to the numbers behind its valuation, making every forecast meaningful and grounded in real assumptions. This tool is accessible to everyone on Simply Wall St’s Community page, home to millions of investors building, sharing, and updating their perspectives dynamically as new information and earnings come in.

With Narratives, you can easily see how your beliefs about Revvity translate into a fair value and compare that directly to today’s market price, helping you decide whether it is a buy, hold, or sell for your portfolio. For example, one investor may believe in aggressive digital transformation and recurring revenues and set a Narrative price target as high as $162, while a more skeptical user, wary of regulatory and end-market challenges, might estimate fair value closer to $100.

Do you think there's more to the story for Revvity? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RVTY

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives