- United States

- /

- Life Sciences

- /

- NYSE:QGEN

If You Had Bought QIAGEN (NYSE:QGEN) Stock Five Years Ago, You Could Pocket A 94% Gain Today

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. Buying under-rated businesses is one path to excess returns. For example, long term QIAGEN N.V. (NYSE:QGEN) shareholders have enjoyed a 94% share price rise over the last half decade, well in excess of the market return of around 47% (not including dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 27%.

Check out our latest analysis for QIAGEN

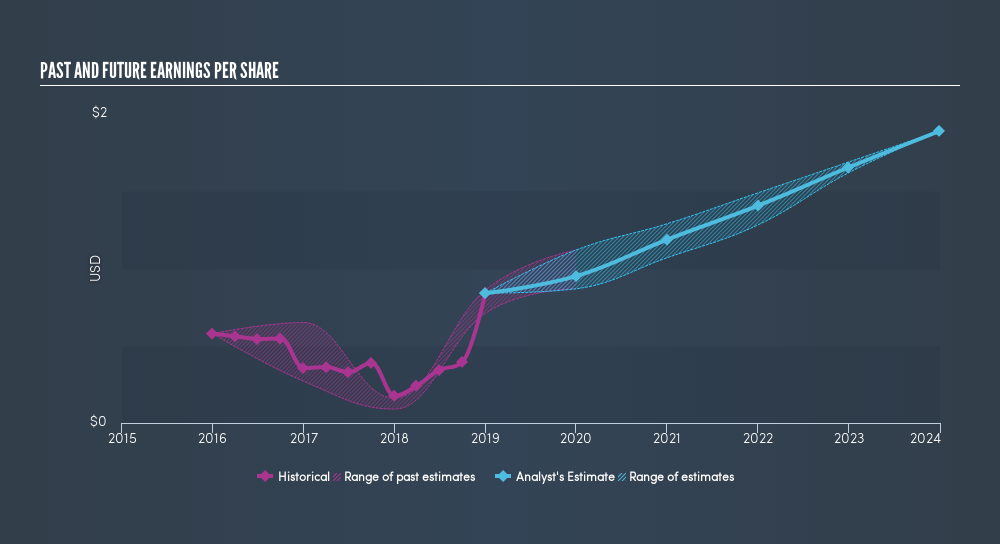

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, QIAGEN achieved compound earnings per share (EPS) growth of 22% per year. The EPS growth is more impressive than the yearly share price gain of 14% over the same period. So it seems the market isn't so enthusiastic about the stock these days.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on QIAGEN's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered QIAGEN's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that QIAGEN's TSR, at 102% is higher than its share price return of 94%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

We're pleased to report that QIAGEN shareholders have received a total shareholder return of 27% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 15% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. If you would like to research QIAGEN in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

For those who like to find winning investments this freelist of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:QGEN

Qiagen

Provides sample to insight solutions that transform biological samples into molecular insights in the Netherlands and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives