- United States

- /

- Life Sciences

- /

- NYSE:QGEN

How Investors Are Reacting To Qiagen (QGEN) Return to Profitability and Upgraded 2025 Sales Outlook

Reviewed by Simply Wall St

- Qiagen N.V. recently reported its second quarter 2025 results, posting sales of US$533.54 million and a net income of US$96.25 million after a loss in the prior year, while also raising its full-year net sales outlook to 4%-5% CER growth.

- This turnaround from a previous net loss and the upward revision of sales guidance highlight strengthened business performance and improved optimism for the rest of the year.

- With the company returning to profitability and boosting its sales outlook, we'll explore what this means for Qiagen's broader investment narrative.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 27 companies in the world exploring or producing it. Find the list for free.

Qiagen Investment Narrative Recap

To be a Qiagen shareholder, you need to believe in the long-term growth of molecular diagnostics and the company's ability to capture market share with recurring consumables and innovation, despite industry headwinds. The recent return to profitability and the raised sales outlook may strengthen short-term confidence, but macro volatility and research sector budgets remain the key risk and near-term catalyst respectively, neither is fundamentally changed by the latest earnings beat.

The most relevant announcement to recent results is the full-year 2025 guidance raise to 4%-5% CER sales growth. This update reflects management's improved outlook, likely connected to ongoing adoption of high-growth product lines like QIAstat-Dx, which continues to be a major catalyst for margin and revenue expansion.

However, investors should also keep in mind the persistent margin risk from currency swings, as even strong earnings can be quickly offset if ...

Read the full narrative on Qiagen (it's free!)

Qiagen's projections anticipate $2.5 billion in revenue and $566.6 million in earnings by 2028. Achieving this forecast would require a 6.8% annual revenue growth and an increase in earnings of $193.2 million from the current $373.4 million.

Uncover how Qiagen's forecasts yield a $50.58 fair value, a 3% upside to its current price.

Exploring Other Perspectives

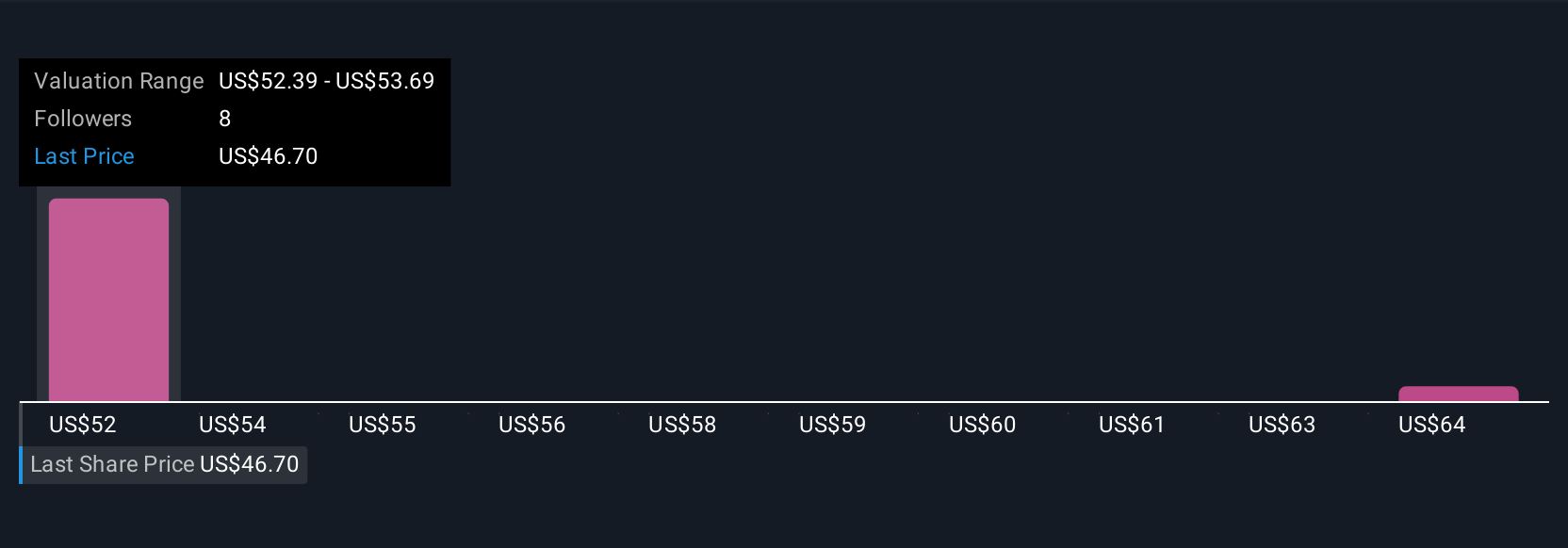

Simply Wall St Community members express fair value estimates for Qiagen between US$50.58 and US$65.86, highlighting differing outlooks from just 2 perspectives. While several see opportunity in product-driven growth, ongoing competition and cost pressures could shape future performance. Review multiple viewpoints to inform your own stance.

Explore 2 other fair value estimates on Qiagen - why the stock might be worth just $50.58!

Build Your Own Qiagen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Qiagen research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Qiagen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Qiagen's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qiagen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QGEN

Qiagen

Provides sample to insight solutions that transform biological samples into molecular insights in the Netherlands and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives