- United States

- /

- Pharma

- /

- NYSE:PFE

Pfizer (PFE) Valuation in Focus Following FDA Approval of Updated COVID-19 Vaccine

Reviewed by Simply Wall St

Pfizer (PFE) just landed a significant regulatory win. On August 27, the company and its partner BioNTech announced that the U.S. Food and Drug Administration approved their updated LP.8.1-adapted monovalent COVID-19 vaccine. This new version is cleared for adults aged 65 and over, as well as younger high-risk individuals, thanks to clinical data showing it provides stronger immune protection against multiple newer COVID strains. For investors wondering where this leaves Pfizer as COVID revenue stabilizes, this FDA nod keeps the company’s vaccine business in the spotlight and could open the door to more recurring demand in the higher-risk population.

Looking at the bigger picture, the news comes at an interesting moment for Pfizer’s stock. Over the past year, shares fell about 6%, but recent weeks have seen a bit of momentum with gains of 5% in the past month and almost 6% over the past 3 months. This turnaround follows a tough period marked by falling COVID product sales and challenges like major patent expirations looming from 2026 onward. However, Pfizer's expanded vaccine approvals and continued work in oncology suggest that new catalysts may be on deck as the company remakes its product lineup.

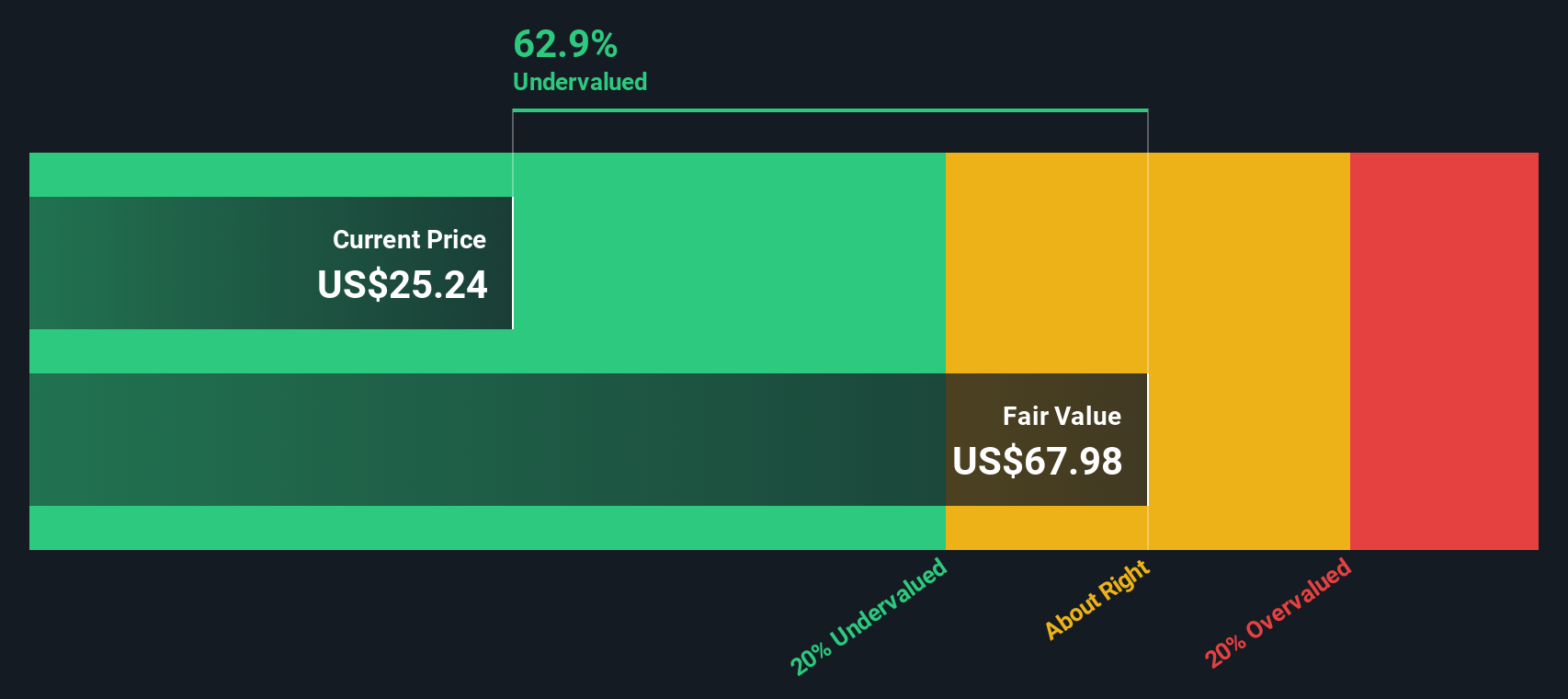

So, after this year’s mixed performance and fresh regulatory tailwinds, the real question is whether Pfizer is now trading at a bargain or if investors should be cautious about how much future growth is already built into the share price.

Most Popular Narrative: 19.1% Undervalued

According to a widely followed narrative, Pfizer’s current share price is seen as offering a solid discount to its fair value, reflecting optimism about the company's transition beyond Covid-related products.

I think that Pfizer has a strong pipeline. The acquisition of Seagen added many new oncology products that will continue to grow by 14%, partially offsetting the decline in sales of the Covid-19 vaccines. This should keep revenue flat, possibly growing in low to mid single digits in an optimistic scenario.

Curious how this fair value was calculated? The most bullish assumptions in this narrative point to operational margin strength and future product launches well above market expectations. What are the numbers behind this confidence? Discover which variables could supercharge Pfizer's valuation and why the growth forecast might surprise you.

Result: Fair Value of $30.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, still, stubbornly high debt levels and the possibility of a dividend cut could challenge the case for Pfizer’s undervaluation in the near term.

Find out about the key risks to this Pfizer narrative.Another View: DCF Backs Up the Bullish Case

Looking beyond sentiment and industry multiples, our SWS DCF model also points to Pfizer being undervalued. This supports the view that its current price could be a bargain. But does the future play out as forecast?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Pfizer Narrative

If you have a different perspective or want to dig deeper into the numbers, you can put your own story together in just a few minutes. Do it your way.

A great starting point for your Pfizer research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t limit yourself to just one company when there could be even greater opportunities waiting. Tap into tailored ideas that might perfectly fit your portfolio and give your investing strategy a sharp edge.

- Explore high-yield cash flow by checking out dividend-focused companies through our convenient option for dividend stocks with yields > 3%.

- Get exposure to fast-moving trends by uncovering promising contenders in artificial intelligence innovation, starting with AI penny stocks.

- Find potential bargains and spot stocks trading below their estimated worth with our in-depth guide to undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:PFE

Pfizer

Pfizer Inc. discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products in the United States and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)