- United States

- /

- Pharma

- /

- NYSE:PFE

Pfizer (NYSE:PFE) Showcases New Cancer Treatment Study And Reports Prostate Cancer Drug Success

Reviewed by Simply Wall St

Pfizer (NYSE:PFE) recently presented groundbreaking findings in cancer research, particularly the first-in-human Phase 1 clinical study of the innovative MesoC2 drug at the ASCO Annual Meeting, and announced five-year beneficial survival results for XTANDI combined with ADT therapy. Despite these significant developments, the company's shares rose 2%, in line with broader market movements which showed resilience despite trade tensions revived by President Trump's tariff threats. Given the market's overall downward trend, Pfizer's performance reflects stability within the pharmaceuticals sector, buoyed by its ongoing advancements and strategic collaborations, including recent partnerships and licensing agreements.

We've identified 3 weaknesses for Pfizer that you should be aware of.

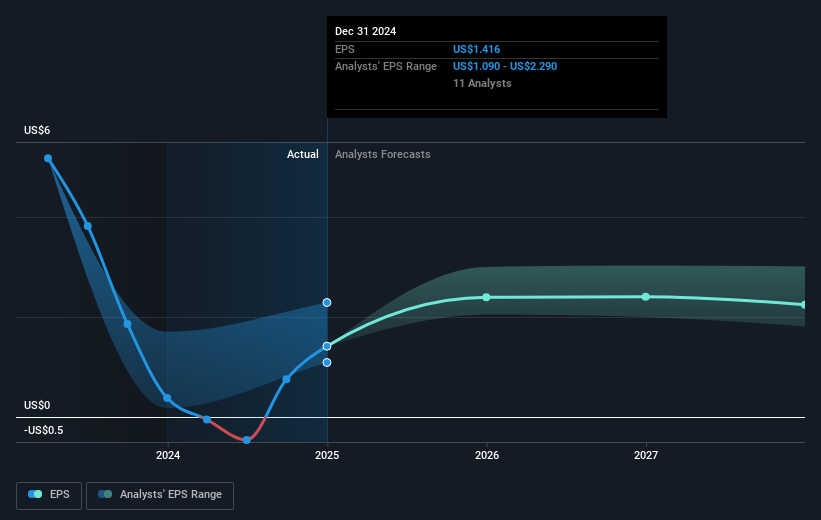

Pfizer’s recent announcements on cancer research advancements and significant survival results for XTANDI, while contributing positively to short-term share price movement, present a mixed impact on the company’s financial outlook. Despite promising developments on the oncology front, Pfizer shares have seen a total return of 14.32% decline over the past year when including both share price and dividends, which places its performance behind that of the US Pharmaceuticals industry over the same period.

The company's revenue and earnings forecasts are influenced by these announcements. Advancements in drug development can potentially boost revenue streams, yet increased competition and declining sales from key products pose substantial challenges. Market expectations may already account for some of these pressures, as reflected in the current trading dynamics.

At present, the analyst consensus gives Pfizer a fair value price target of US$29.50, with the company's current share price sitting at a discount compared to this target, suggesting some upside potential assuming positive catalysts play out effectively. Going forward, maintaining or surpassing this forecast depends heavily on the sustained success of new drug approvals and market expansion efforts, while managing expenses and operational efficiencies.

Understand Pfizer's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Pfizer, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFE

Pfizer

Pfizer Inc. discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products in the United States and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives