- United States

- /

- Pharma

- /

- NYSE:PFE

Is Pfizer’s Latest Drug Pricing Deal a Turning Point for 2025 Valuation?

Reviewed by Bailey Pemberton

Thinking about what to do with your Pfizer stock right now? You are not alone. The mood around this household pharmaceutical giant keeps shifting, and 2025 is proving no different. Pfizer’s share price has been a bit of a rollercoaster lately. Down 6.4% in just the past week, but up 3.6% over the last month, it is clear the market is still parsing out the implications of the latest headlines.

If you look back farther, Pfizer’s journey has been far from smooth. Year-to-date, the stock is off by 7.1%, and over the past year, it has lost 9.0%. The longer-term view shows even more pain, with a 3-year drop of 33.2% and a 5-year dip of 12.5%. So, what is driving all this volatility? Some of it comes down to uncertainty swirling around pricing power and policy. Recent news has highlighted fresh drug pricing negotiations and shifting regulatory conversations, with Pfizer executives making last-minute deals with the White House and the administration dialing back some tougher stances, such as excluding generics from pharma tariffs. These developments hint at both risks and new opportunities ahead for Pfizer and its investors.

But the real question for investors is: does Pfizer deserve a spot in your portfolio at these prices? Stripping away the noise, Pfizer scores a 5 out of 6 on our undervaluation checklist, suggesting it is trading below its intrinsic worth on most major metrics. Next, we will dig into the valuation techniques behind that score. Then we will explore an even smarter way to value the company before making any big moves.

Why Pfizer is lagging behind its peers

Approach 1: Pfizer Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a powerful tool for valuing a company. It works by forecasting Pfizer’s future cash flows, then discounting them to today’s dollars to estimate the intrinsic worth of the business. This approach removes short-term market noise and focuses on the company’s real earning power over time.

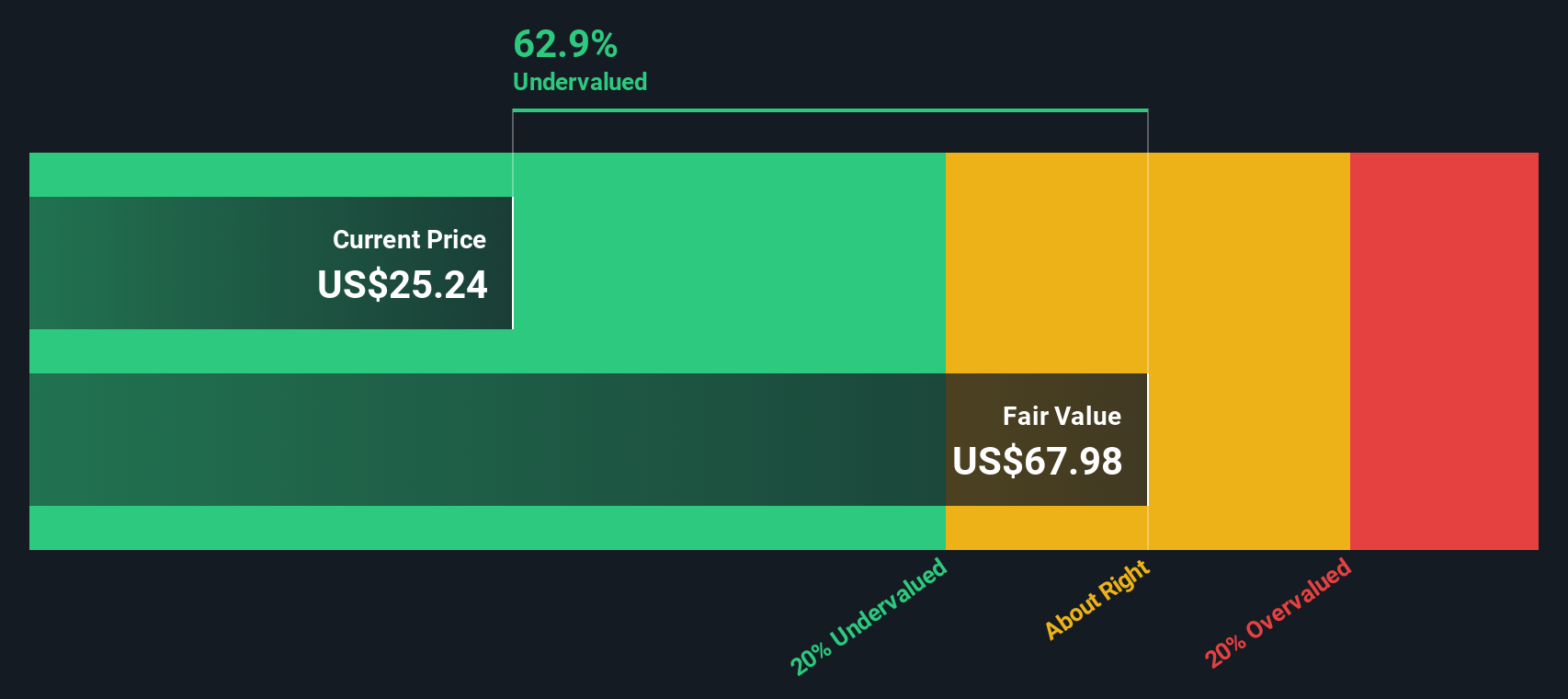

Looking at Pfizer’s numbers, the company generated $12.03 billion in free cash flow (FCF) over the last twelve months. Analysts project solid growth in the years ahead, with free cash flow expected to reach $16.85 billion by 2029. Although analyst coverage tapers off after five years, Simply Wall St extrapolates cash flows out to a full decade to provide a broader valuation picture. Each year’s projection is discounted back to reflect the value in today’s terms.

After adding up all these discounted cash flows, the DCF model estimates Pfizer’s intrinsic value at $67.98 per share. With the stock currently trading at a 63.6% discount to this estimated value, the analysis suggests Pfizer is significantly undervalued at the moment.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Pfizer is undervalued by 63.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Pfizer Price vs Earnings

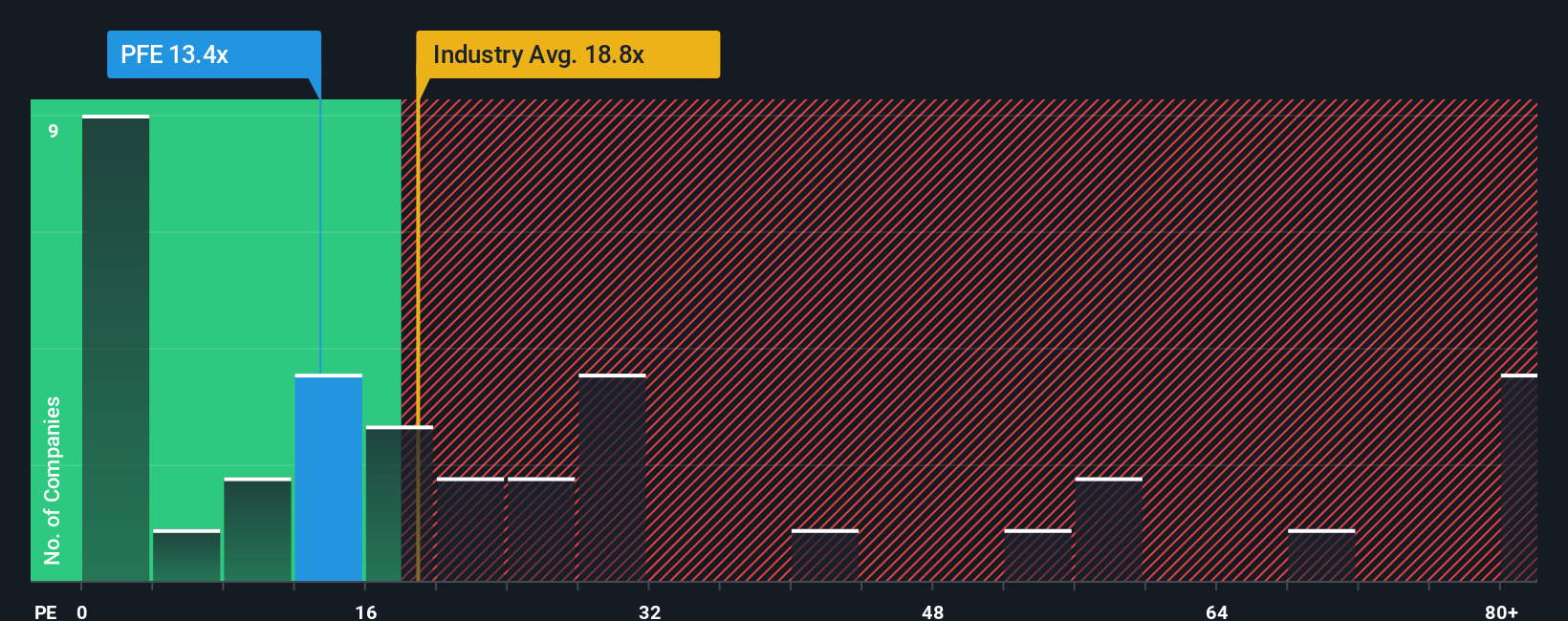

For profitable companies like Pfizer, the Price-to-Earnings (PE) ratio is one of the most popular and effective ways to assess valuation. Because it directly compares the share price to the company’s earnings, it gives investors a quick snapshot of how much they are paying for each dollar of profit. This makes the PE ratio especially relevant when the company has a history of consistent profitability and transparent earnings.

However, what counts as a “normal” or “fair” PE ratio can vary based on expectations for growth and the level of risk involved. Typically, higher expected growth or lower perceived risk justifies a higher PE ratio. In contrast, riskier or slower-growing companies tend to deserve lower multiples.

Currently, Pfizer trades at a PE ratio of 13.1x. That is notably below both the industry average of 17.9x and the average for its closest peers at 18.8x. This difference might suggest the stock is undervalued by those simple comparisons, but we can go one step further.

Simply Wall St’s proprietary “Fair Ratio” blends in a broader set of factors, including Pfizer’s earnings growth prospects, profit margins, risk factors, industry dynamics, and market capitalization. This approach creates a more nuanced benchmark than just comparing against the industry average or peers. Pfizer’s fair PE ratio is calculated at 22.2x, indicating that, given its current fundamentals and outlook, the market could reasonably value Pfizer at a much higher multiple than where it trades today.

With Pfizer’s current PE sitting well below the fair ratio, the numbers point to the stock being undervalued on this metric as well.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Pfizer Narrative

Earlier, we mentioned an even better way to understand valuation, so let us introduce you to Narratives, an accessible tool that lets you personalize your investment view by connecting Pfizer’s real-world story, its financial forecasts, and what you believe is a fair value.

A Narrative is essentially your perspective on a company, backed by your own set of forecasts for future revenues, earnings, and margins. These forecasts help you build a story of what’s possible for Pfizer, right on Simply Wall St’s Community page.

Instead of relying solely on headline numbers, Narratives allow investors to link their views on the future, such as believing in breakthrough oncology pipelines, fearing regulatory headwinds, or expecting operational turnaround, to concrete financial projections and a clear calculation of fair value.

This approach helps you decide when to buy or sell by comparing your Narrative’s fair value to the current market price. Because Narratives are constantly updated as new news or earnings arrive, your outlook stays relevant without the guesswork.

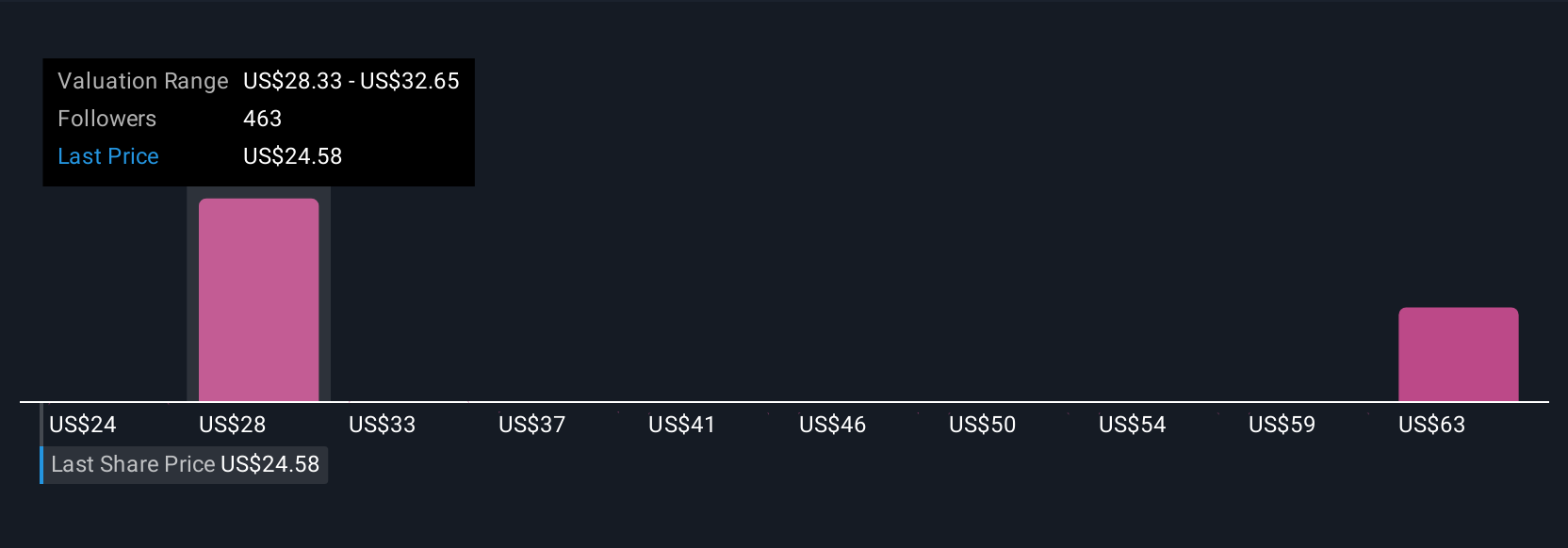

For example, some investors see Pfizer’s fair value as high as $36.00 if they are confident in robust oncology growth and margin expansion. Others anticipate a more cautious outlook and set fair value closer to $24.00 based on anticipated revenue declines and regulatory pressure.

For Pfizer, here are previews of two leading Pfizer Narratives:

- 🐂 Pfizer Bull Case

Fair Value: $28.86

Current discount: 14.3%

Expected Revenue Growth: -2.2%

- Expansion in oncology and biologics, supported by digitalization and emerging markets, is considered a driver for long-term growth and resilience.

- Strategic deals and pipeline launches help mitigate patent expirations and diversify revenue streams.

- Analysts expect rising profit margins and steady earnings growth, with fair value notably above the current share price.

- 🐻 Pfizer Bear Case

Fair Value: $24.00

Current premium: 3.0%

Expected Revenue Growth: -4.2%

- Ongoing regulatory reforms, drug pricing negotiations, and looming patent expirations are expected to squeeze Pfizer's profits and limit growth.

- There is a risk that new products and acquisitions will not fully offset revenue lost to generic competition and exclusivity losses.

- Consensus suggests that the current share price is close to or slightly above fair value, reflecting a more cautious outlook on earnings stability.

Do you think there's more to the story for Pfizer? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFE

Pfizer

Pfizer Inc. discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products in the United States and internationally.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives